-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Long Duration Funds

A fixed-income investment avenue with a potential to generate Income over long term debt investors!

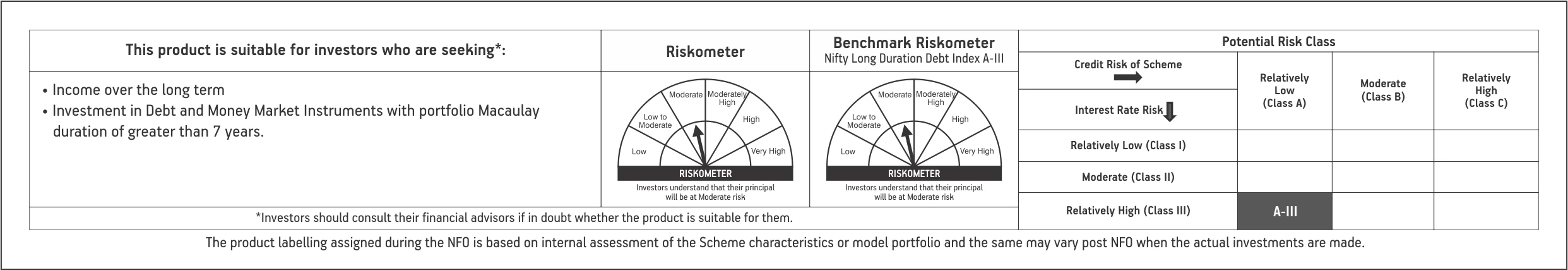

• Market seems to be well-positioned for long-term debt investors

The yield on the long-term G-sec and AAA-rated securities are at reasonable levels which can create an opportunity for long-term debt investors to look at investment in long duration funds.• Long Duration Fund - An investment avenue for long-term debt investors

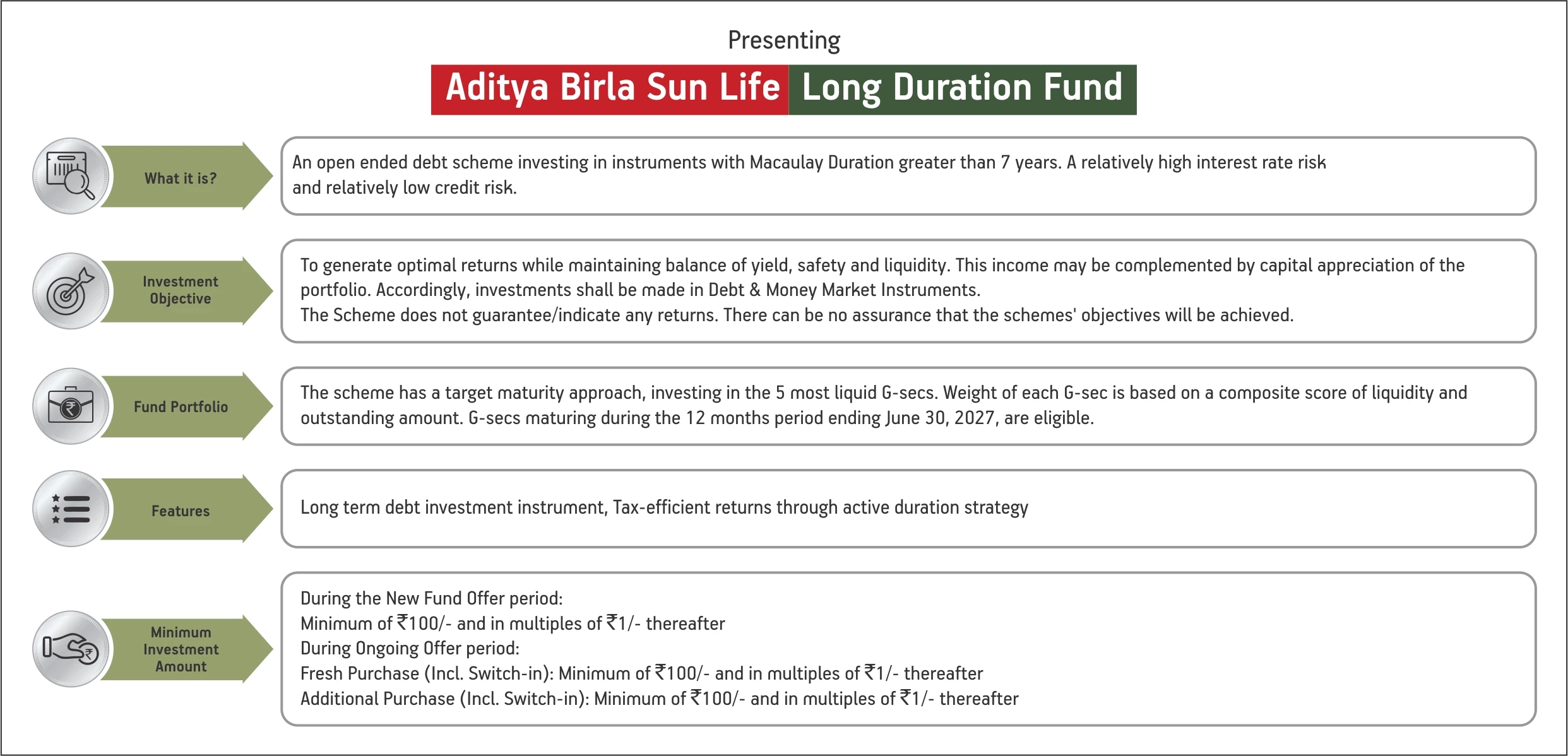

An open-ended debt mutual fund scheme that invests in instruments with Macaulay duration greater than 7 years.• One product, multiple features!

A high-quality portfolio with active duration management strategy. Tax efficient returns. Being open ended, this fund has no lock-in period and is highly liquid.

How is the portfolio of Aditya Birla Sun Life Long Duration Fund constituted?

• The fund will look to build a high-quality portfolio that includes sovereign G-Secs, State Development Loans, AAA rated Corporate or PSU bonds

- • Its portfolio strategy is modelled around core allocation, tactical allocation, and active duration management

o Core allocation – presently allocate between 14-year G-secs and 10-year SDLs

o Tactical allocation – increase allocation to 10-year SDLs and AAA bonds when spreads increase or are expected to reduce; to seek optimum returns

o Active duration management – basis interest rate scenario the fund shall alter portfolio duration between 7 to 15 years; managing duration risks

Why one can invest in Aditya Birla Sun Life Long Duration Fund?

- High-Quality Long-term portfolioGives investors access to a diversified portfolio of sovereign G-secs, SDLs and high-quality AAA rated bonds with long duration. Can be considered as one of the investment avenues for your long-term goals.

-Current market situation can be conducive for long duration funds

Long tenor yields are higher by ~90 bps v/s pre-covid levels and term spreads are at an elevated level which is capturing aggressive future rate hike actions by RBI#.

#Source –Reuters Eikon, Bloomberg, ABSLAMC Research; Data as on July 15, 2022.

-Portfolio strategy that aims looks to optimise investor returns

The fund will seek to take benefit of the term spreads, managing tactical allocation between G-Sec, SDL and AAA Corporate bonds basis their spreads and actively modulate duration with an aim to seek optimum risk-adjusted returns for investors.

-Tax Efficient returns

Investments held for more than 3 years qualify for long term capital gain(LTCG) taxability on redemption. LTCG are taxed at 20% after giving the benefit of indexation.

-Low minimums and with high liquidity

Investors can invest with as little as Rs. 100/- and in multiples of Re. 1/- thereafter. Being an open ended fund, there is no lock-in nor any exit load; giving high liquidity to investors.

Aditya Birla Sun Life Long Duration Fund

Download

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000