-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

Does Your Portfolio Have The features of Three? / What Can Combine Diversity with Volatility to Create Opportunity?

Two is company, three is a team. Three friends that are different and unique in their own way but when together, they support each other through ups and downs. What if you could get the partnership of three such friends in your investments as well?

Imagine the dynamic combination of equity, debt, and commodities. Together, these 3 friends can help your investment get the diversity it needs for long term growth.

The 3-in-1 Investment Fund

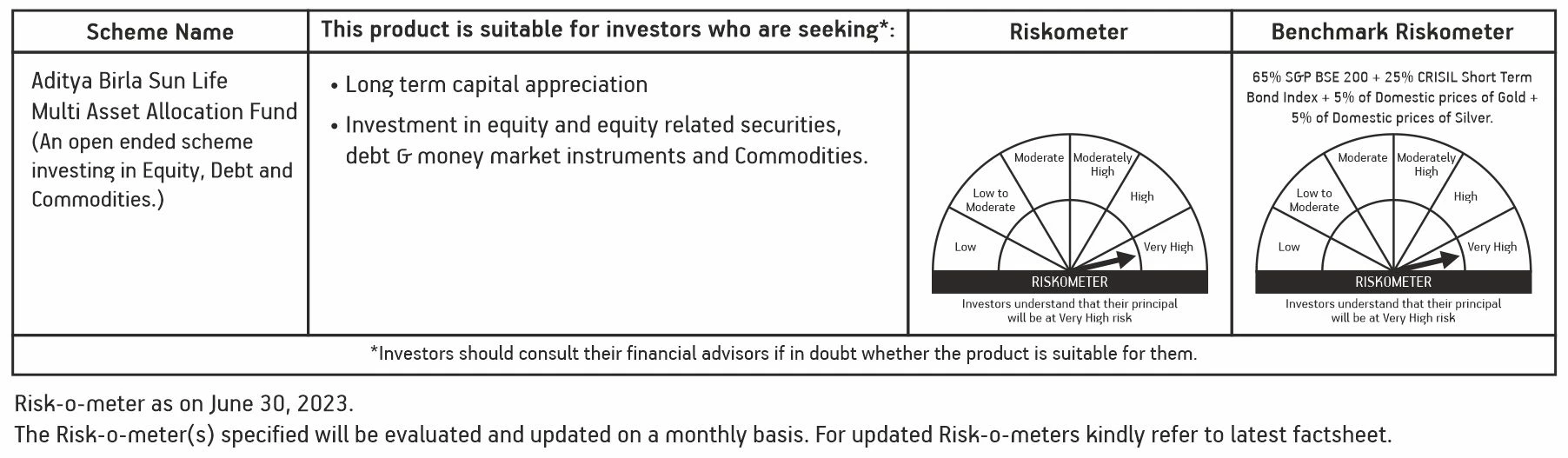

Aditya Birla Sun Life Multi Asset Allocation Fund is an open ended scheme investing in Equity, Debt and Commodities. The fund is an optimum mix of three asset classes, with an aim to generate long term returns.

How does Aditya Birla Sun Life Multi Asset Allocation Fund work?

Aditya Birla Sun Life Multi Asset Allocation Fund works on the premise that different asset classes have distinct features and perform differently in different market cycles. The fund is diversified across asset classes (primarily equity, debt, and commodities) to capitalise on the unique benefits of each asset class:

• Invests 65-80% in Equity & Equity related instruments

• Invests 10-25% in Debt and Money Market Instruments.

• Invests 10-25% in Commodities like Gold and Gold related instruments, Silver and Silver related instruments.

How Does Aditya Birla Sun Life Multi Asset Allocation Fund Add Value?

Balances risk and reward:

Having too much exposure to equity or debt could create an imbalance in portfolio returns and financial goals. This fund diversifies across 3 asset classes with an aim to reduce downside risk while tapping market growth.

Strategic portfolio adjustments:

Considering the varying performance of different asset classes during market cycles, it strategically allocates funds across each asset class to take advantage of top performers.

Keeps investing disciplined

By eliminating the ‘emotion’ factor from investing decisions, this fund keeps you disciplined and helps you stay on track with your financial goals.

Why Invest in Aditya Birla Sun Life Multi Asset Allocation Fund?

Long Term Wealth Creation:

Aims to provide long term returns, giving your portfolio the potential of building wealth over the long term.

Multi-Asset Diversification Benefit:

Provides access to a diversified and balanced portfolio with representation across asset classes.

Professional Fund Management:

Professional fund management with periodic rebalancing and an active management style may enhance long-term growth potential.

Tax Efficiency:

With a minimum 65% equity exposure, it optimizes tax efficiency by benefiting from favourable tax rates applicable to equities.

Who can invest?

• Long-term equity Investors with an Investment horizon of 3 years and above.

• Investors looking for long-term capital appreciation with a volatility management strategy.

• Investors looking to build a diversified portfolio of instruments across asset classes of equity, debt, and commodities.

• Investors looking to rely on professional fund manager expertise to meet their asset allocation needs.

Give your investments the advantage of three! With Aditya Birla Sun Life Multi Asset Allocation Fund

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000