-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

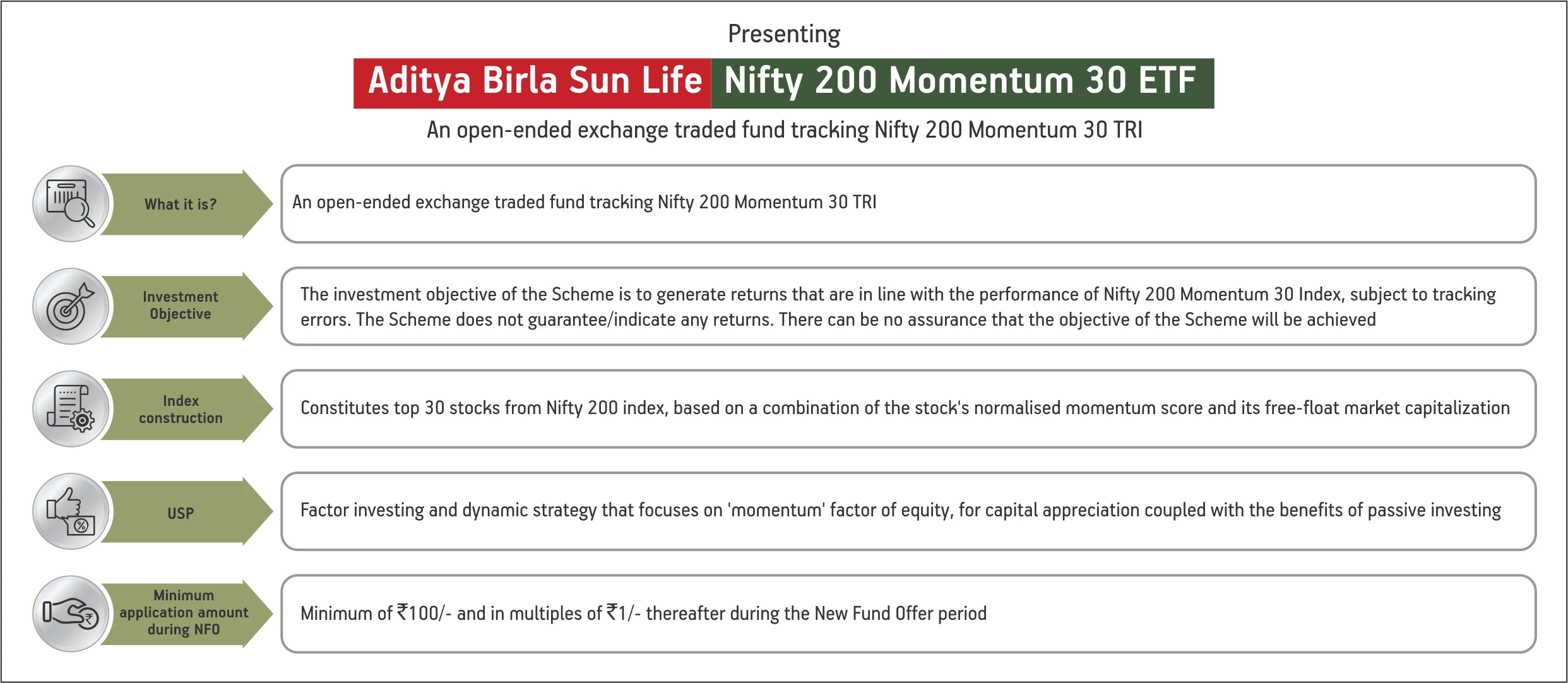

Ride the “Momentum” of Factor Investing!

• Buying the winners

As an equity investor, you look for high performers. Strong stocks that begin to rise and perform well can continue to do so, at least in the near term. Probably, due to the snowball effect – the further it rolls the bigger it becomes!• The ‘go with the flow’ strategy!

Momentum based factor investing can help identify such stocks based on their recent price performance trends – generally over 6 months or 1 year time frame. Making it is essentially a dynamic investing strategy.• Factor investing – best of both worlds: active and passive investing

Factor investing combines the best of both - looks to outperform traditional market cap weighted indices, while maintaining the low costs and transparency of passive investing.

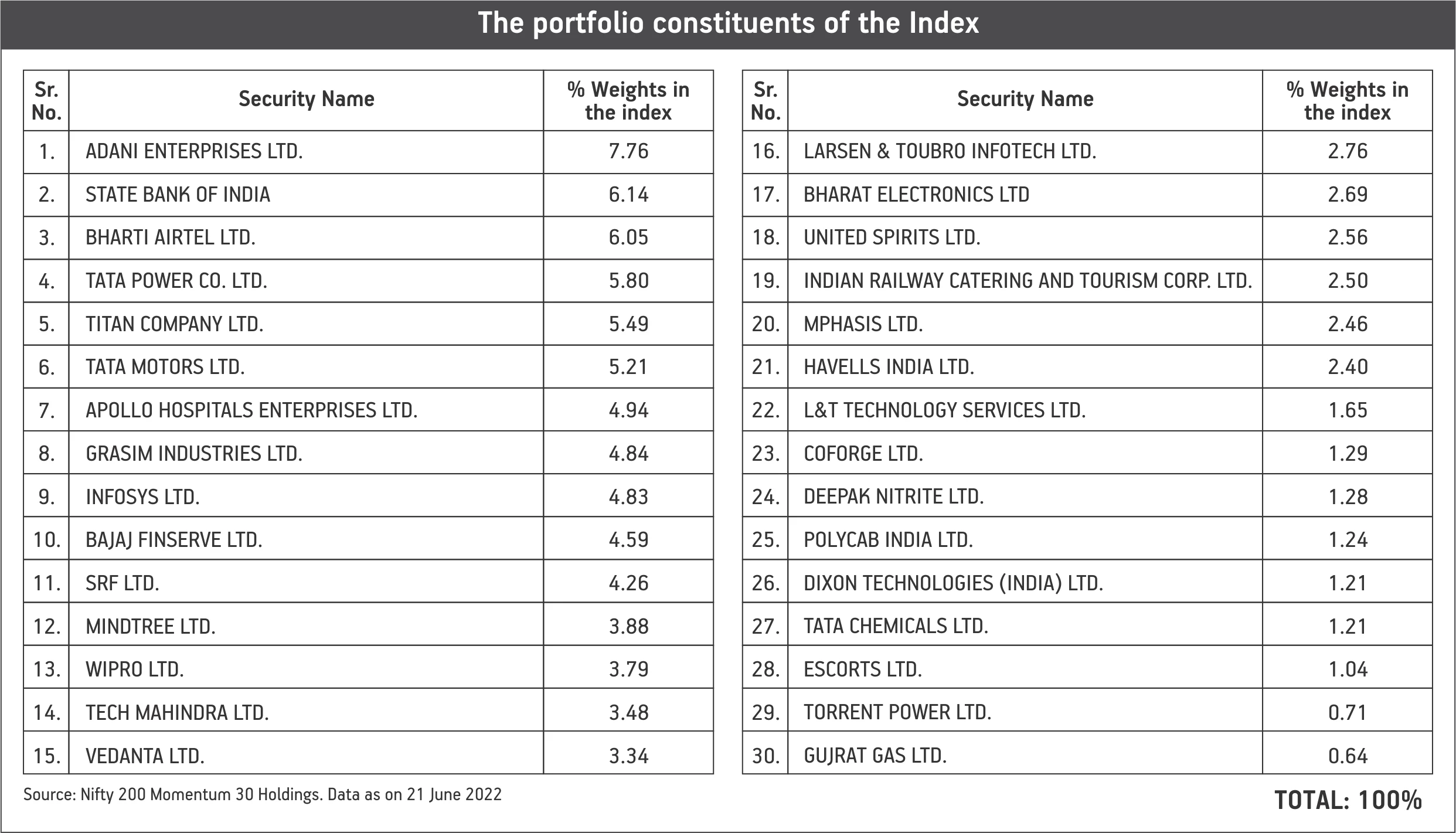

How is the Nifty 200 Momentum 30 Index constituted?

• The index comprises of the top 30 stocks from the parent NIFTY 200 Index, that are performing consistently over the 6-month/12-month time frame (‘normalised momentum’ scores)

- • Weightage of each stock in the index is derived by multiplying the free float market cap with the normalised momentum score of that stock.

- • Each stock in the index is capped at the lower of 5% or 5 times the weight of the stock in the index based only on free float market capitalization.

• The index is rebalanced semi-annually.

Source: https://www.niftyindices.com/indices/equity/strategy-indices/nifty200-momentum-30

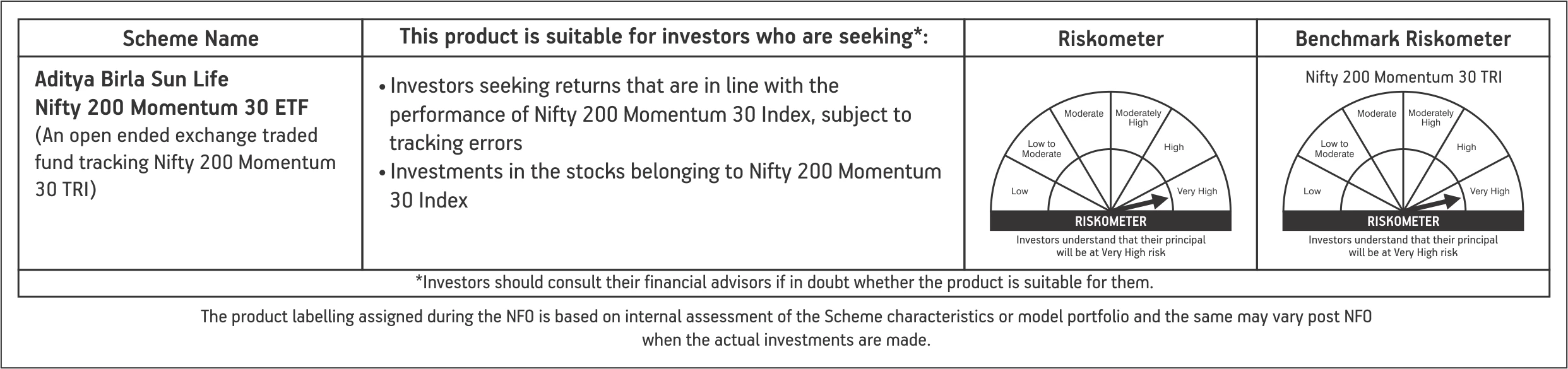

Aditya Birla Sun Life NIFTY 200 Momentum 30 ETF

Download

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000