-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Up the ‘quality’ of your equity portfolio – through smart factor investing!

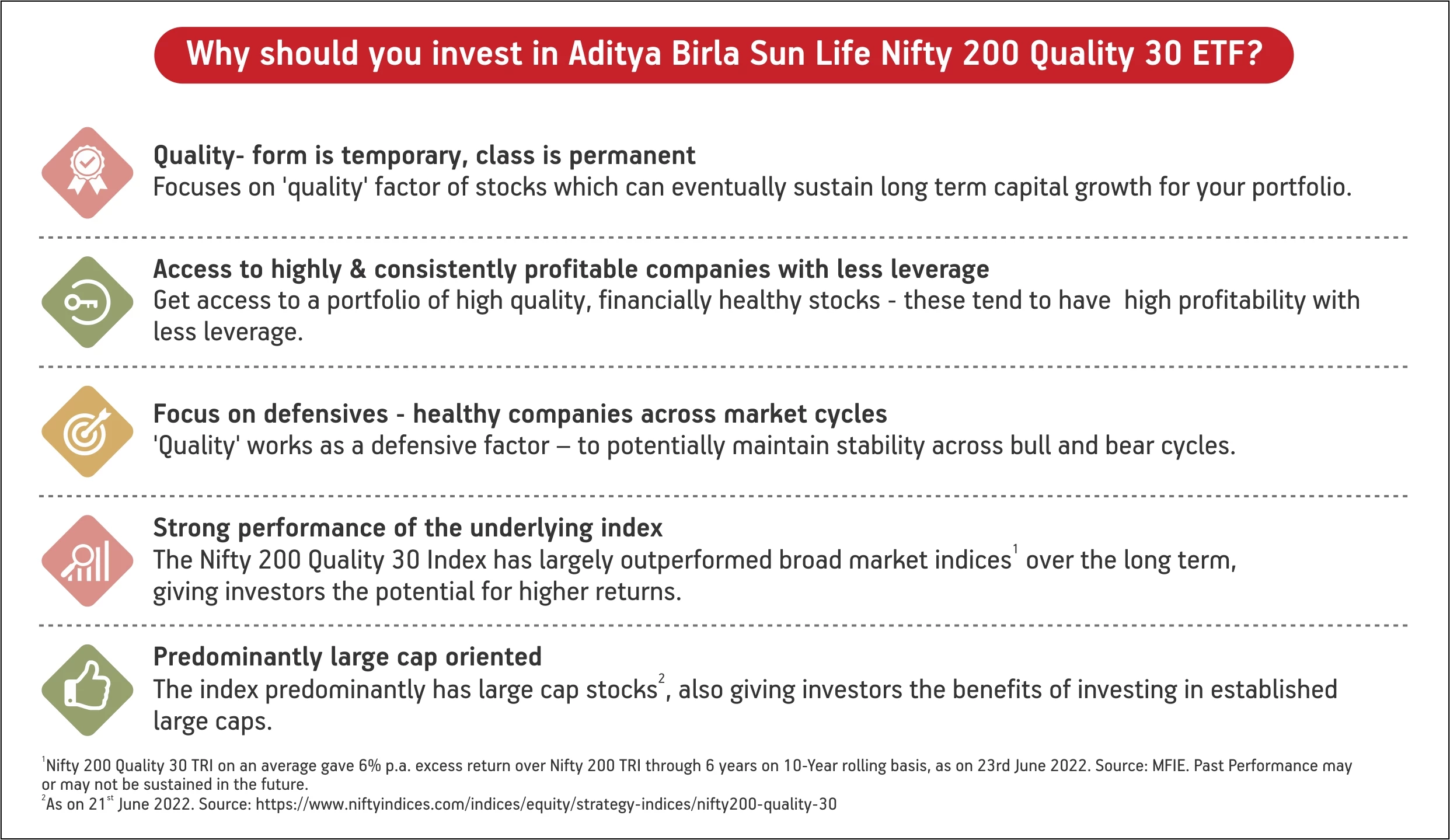

• Factor investing – the new mantra for equity investing success

Equity investors are flocking to factor investing. The new age ‘smart investing’ strategy is gaining considerable popularity.• Targeting the fundamentals that drive performance

Factor investing - an investing strategy recognises that there are certain ‘factors’ or attributes that drive performance of stocks; and builds a portfolio targeting these ‘factors’.• Factor investing – best of both worlds: active and passive investing

Factor investing combines the best of both - seeks to outperform traditional market cap weighted indices, while maintaining the low costs and transparency of passive investing. Factor investing tracks indices that are modelled on specific, well researched and quantifiable stock characteristics.• The ‘Quality’ factor – form is temporary, class is permanent!

Quality can be considered both a sustenance and success factor for stocks, especially in the long run. Factor investing basis ‘quality’ involves focusing on quality attributes of stocks to guide portfolio decisions. Quality metrics are financial attributes that gauge profitability and solvency of a company – namely RoE, EPS growth and financial leverage.

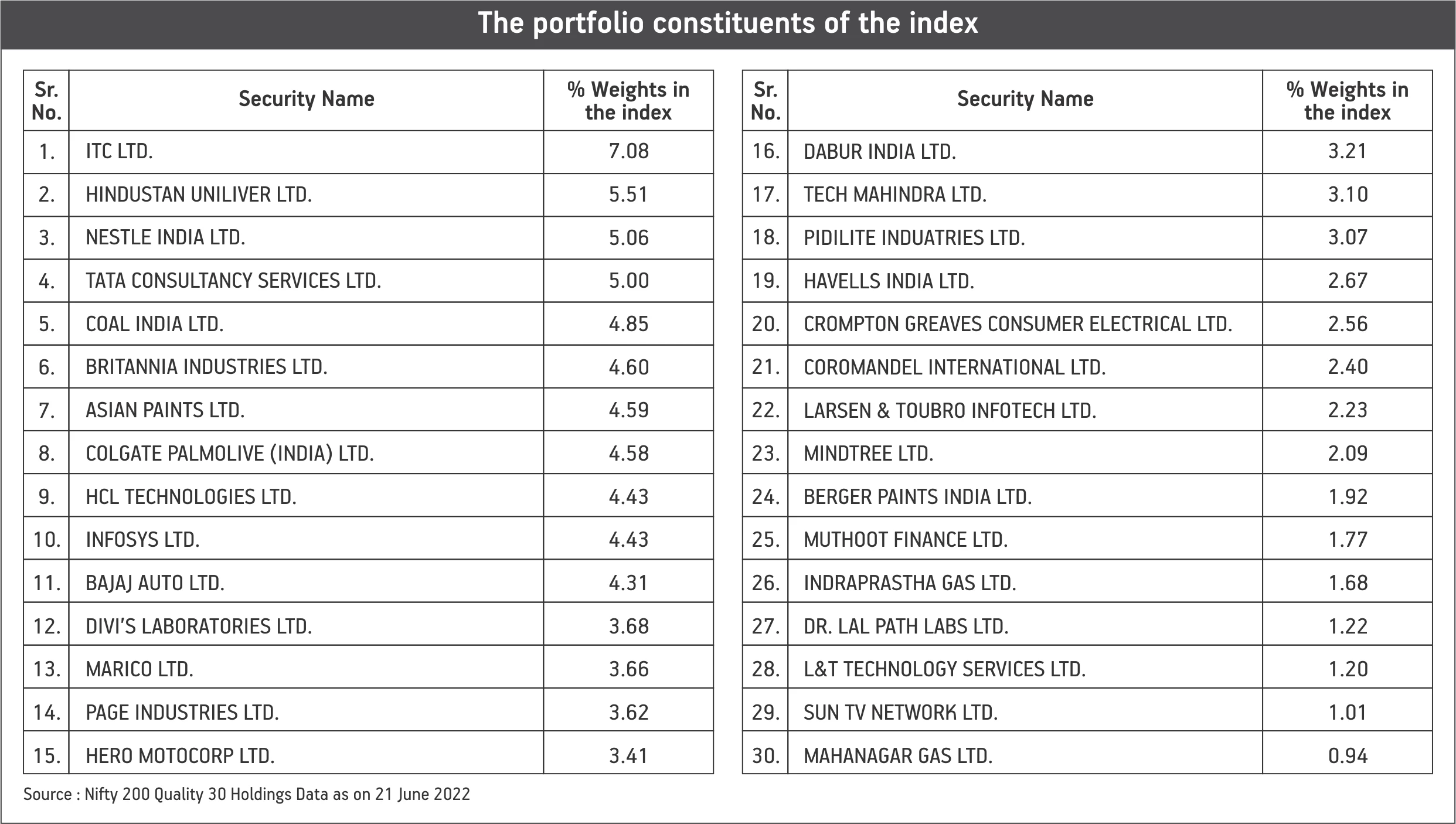

How is the Nifty 200 Quality 30 Index constituted?

• The index comprises of the top 30 stocks from the parent NIFTY 200 Index, basis their ‘quality’ scores - equal weightage to return on equity (ROE), financial leverage (Debt/Equity Ratio) and earning (EPS) growth variability analysed during the previous 5 years

- • Weightage of each stock in the index is derived by multiplying the square root of the free float market cap with the quality score of that stock.

- • The index is rebalanced semi-annually

Source: https://www.niftyindices.com/indices/equity/strategy-indices/nifty200-quality-30

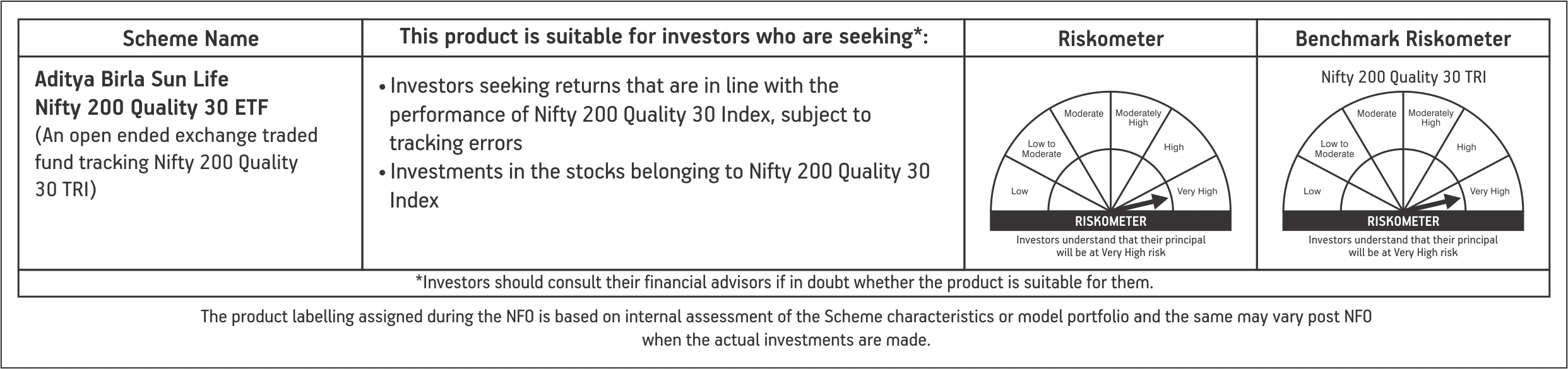

Aditya Birla Sun Life NIFTY 200 Quality 30 ETF

Download

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000