-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

Investing equally in Nifty 50 could

create a winning portfolio

Investor App

Investing equally in Nifty 50 could

create a winning portfolio

Investor App

Nifty 50 Equal Weight Index Fund

• Investors who have a long-term investing horizon (5 years or more)

• Investors looking for long-term capital growth through equity investments in large cap space.

• Investors looking to reduce risk of active stock selection through investment in a passive investment strategy.

• Investors looking for a plus product over a conventional index fund – ‘Simple, smart and intelligent’ index investing.

What is a Nifty 50 Equal Weight TR Index?

Index investing seeks to mimic the performance of an index. Its passive investing strategy provides for automatic stock selection reducing risk of ‘active’ stock selection while keeping costs low. One of the options in passive investing is Nifty 50 Equal Weight Index.

Nifty 50 Equal Weight Index comprises of the same top 50 large cap companies that constitute the popular Nifty 50 Index, but weighted equally, as against market cap based weightage. In other words, it follows an alternative weighting strategy - all 50 companies are weighted equally i.e., ~2% allocation to each company.

The index’s portfolio is rebalanced quarterly i.e., allocation to all 50 stocks is balanced back to ~2% every quarter. This results in a periodic automatic profit booking since overweight stocks are sold, and underweight stocks are bought.

As the economy moves into a phase of broad-based economic growth, such a strategy which provides equal opportunity to all portfolio stocks to shine as against one which relies on the performance of a few ‘top stars’ can be considered.

About Aditya Birla Sun Life Nifty 50 Equal Weight Index Fund

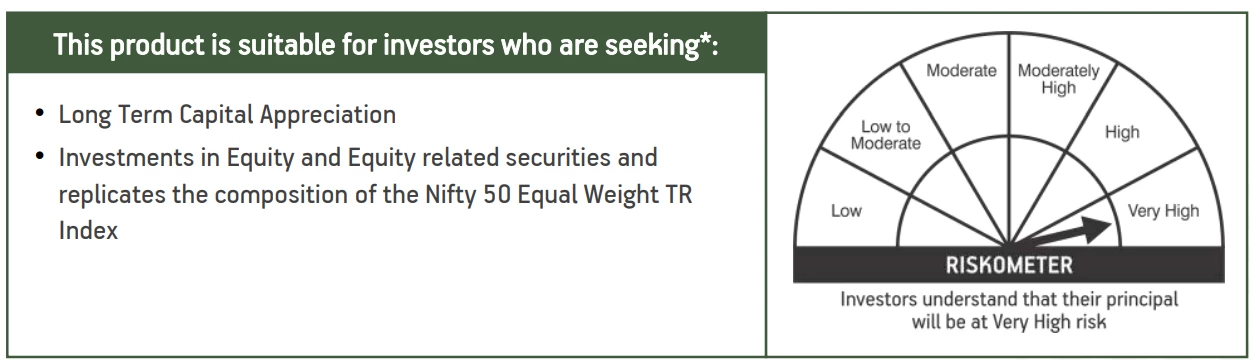

Aditya Birla Sun Life Nifty 50 Equal Weight Index Fund is an open ended scheme tracking Nifty 50 Equal Weight TR Index. The investment objective of the Scheme is to provide returns that closely correspond to the total returns of securities as represented by Nifty 50 Equal Weight TR Index, subject to tracking errors.

The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved.

The scheme allocates 95-100% to Equity & Equity related securities constituting the Nifty 50 Equal Weight Index and 0-5% in Debt and Money Market Instruments. The net assets of the scheme will be invested predominantly in stocks constituting the Nifty 50 Equal Weight TR Index.

The product labeling assigned during the NFO is based on internal assessment of the Scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

Why one can invest in Aditya Birla Sun Life NIFTY 50 Equal Weight Index Fund?

-

• Potential access to leaders of the market: Access to growth potential of the top 50 large cap companies even with low minimum investments. Automatic index reconstitution ensures you stay invested in the ‘top movers’ of the economy..

• Reduced stock and sector concentration risk: Equal weighted investment strategy aims to provide more diversification across stocks and sectors.

• Conducive to a broad-based market rally: Gives equal opportunity to all portfolio constituents with potential to shine, conducive when growth is seen in companies across the board.

• Provides access to a ‘simple yet smart and intelligent’ investing strategy: Simple and hassle-free index investing coupled with automatic reconstitution and rebalancing helps for ‘smart’ periodic booking of profits.

• Lower costs:Passive investing leads to lower turnover and lower expense ratio for investors.

Benefits Of NIFTY 50 Equal Weight Index Fund

Long term capital appreciation

Invests in top 50 large cap companies with an aim to provide an opportunity for long term capital growth.

Stock and sectoral diversification

More balanced stock and sectoral allocation with an aim to reduce concentration risk.

Equal weighted investment strategy

Unbiased equal allocation to all 50 stocks gives equal opportunity to all stocks to contribute to the fund’s growth

Automatic reconstitution and rebalancing

The underlying index is reconstituted and rebalanced quarterly which helps in periodic automatic booking of profits.

For more information on the scheme, please refer to SID/KIM of the scheme.

Why invest now?

High Uncertainty

The pandemic has resulted in high uncertainty in the business environment.

Development of opportunities

With the changing behaviour and as we adjust to the ‘new normal’, several new trends and companies have emerged in different sectors.

Revision of ratings

The companies whose ratings have suffered due to current lack of demand can expect a boost in their valuations once things return back to normal.

1800-270-7000

1800-270-7000