-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Aim to invest in the growing Financial Services sector of India

• Financial Services are all Encompassing

A crucial sector for the economy, Financial Services sector covers Banks, NBFCs, Insurance companies, AMCs and other financial institutions. These companies are omnipresent and are required at each stage of life and business.• Innovation & Technology to support its Future Growth

From offline to online, cash to UPI, FDs to MFs – financial services across the board have continuously innovated and come a long way today.

• Growth across the spectrum of financial services

From Banks to NBFCs, Insurance to AMCs; all type of financial services are likely to witness good growth. With high growth, upcoming segments such as Fintech and Digital lending, this space is likely to have an even higher propensity for growth.• Nifty Financial Services Index – Home to the financial stalwarts

This Index is home to 20 of the top financial services’ companies listed in India. Primarily a large cap index, it has given reasonable double digit returns over both 5 and 10 years investing periods1.

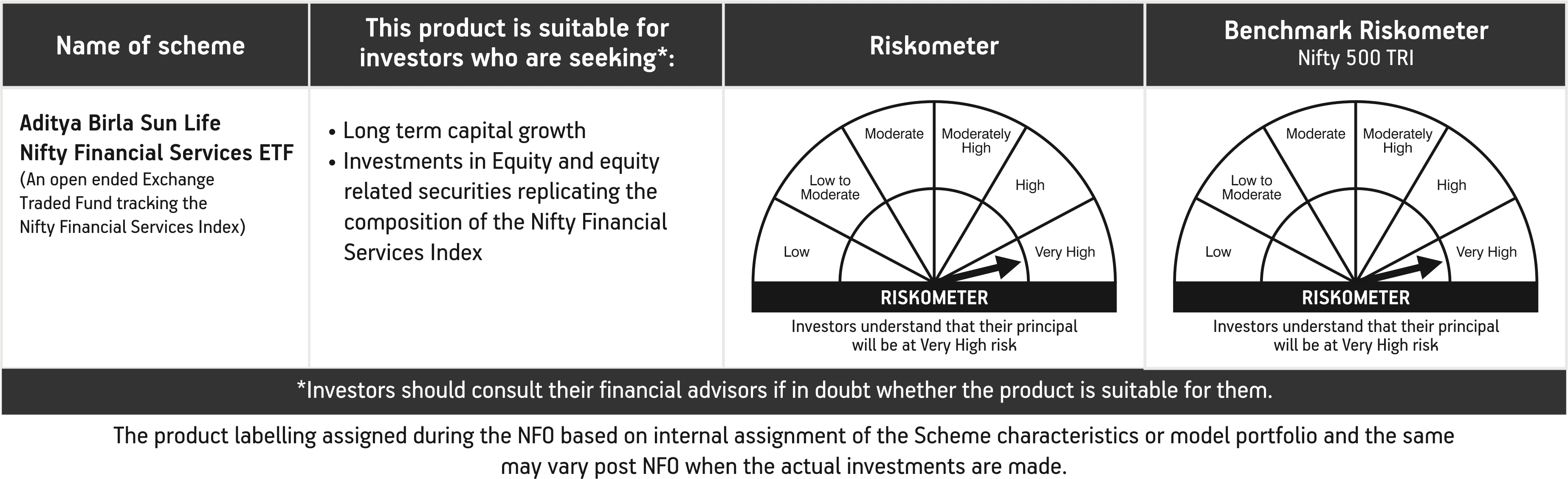

Why should you invest in Aditya Birla Sun Life Nifty Financial Services ETF?

1. 17.20% for 5 years and 16.80% for 10 years on rolling return basis as on May 31, 2022; Data Source: Bloomberg

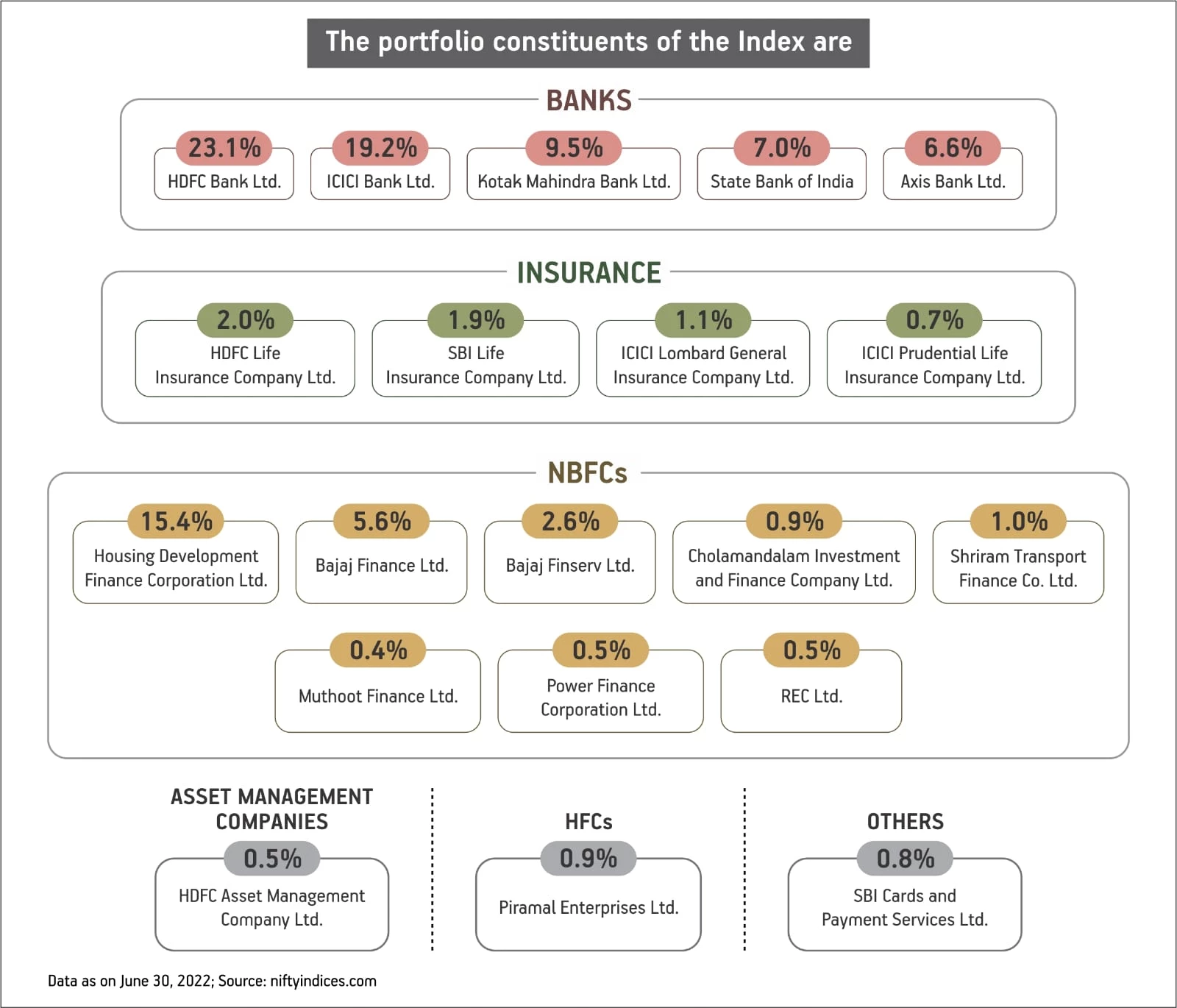

Index Structure

- The weightage of a single stock shall not exceed 33%. Also, the cumulative weight of top 3 stocks shall not be more than 62% at the time of rebalancing.

- The index is rebalanced and re-constituted semi-annually. The scheme will accordingly also be re-balanced or reconstituted within 7 days.

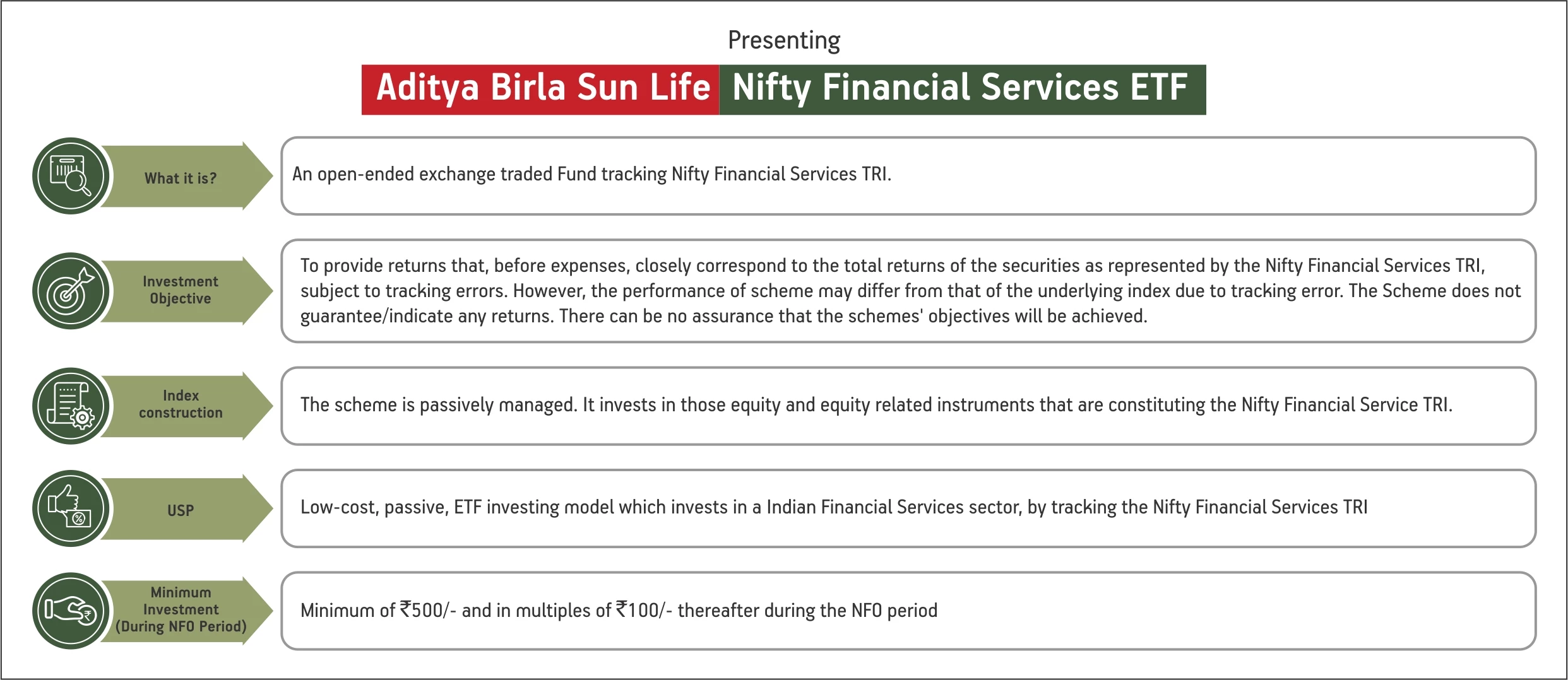

Aditya Birla Sun Life Nifty Financial Services ETF

Download

For more information on the scheme, please refer to SID/KIM of the scheme.

NSE disclaimer: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Draft Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the 'Disclaimer Clause of NSE’.

1800-270-7000

1800-270-7000