-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Passive Debt ETFs with Target Maturity Approach:

An efficient way to benefit from the prevalent Fixed Income opportunity!

- Debt market yields are becoming attractive

Surplus liquidity position, easing inflation, RBI’s commitment to normalise interest rates albeit gradually; are some of the reasons that are keeping the debt yield curve steep and attractive up to a 5–6-year time frame- G-Secs’ yield attractive for this time frame

Government securities are a highly liquid and safe investment avenue with reasonable yields..- Debt Exchange Traded Funds (ETFs) - An efficient route to invest in G-Secs

These are debt-oriented mutual funds that seek to track and replicate the performance of an underlying debt index by investing in the same securities, and in the same proportion as the index it tracks whilst also providing the liquidity and ease of trading benefits of stocks.

What are Government Securities (G-Secs)?

Bonds/Securities issued by the RBI on behalf of the Government of India to borrow money from financial market to meet its fiscal deficit. These are issued from time to time to raise funds for various governmental purposes.

Why invest in G-Secs?

• Being sovereign debt instruments, guaranteed by the Government of India, they have negligible credit risk.

- • They currently have attractive yields for the 5-6 years investment tenure.

• Traded at high volumes and thus enjoy good liquidity.

• They are on track to be included in Global indices. The increase in demand from foreign investors may lower the G-Secs yield owing to higher demand, increasing G-sec prices and value for domestic investors.

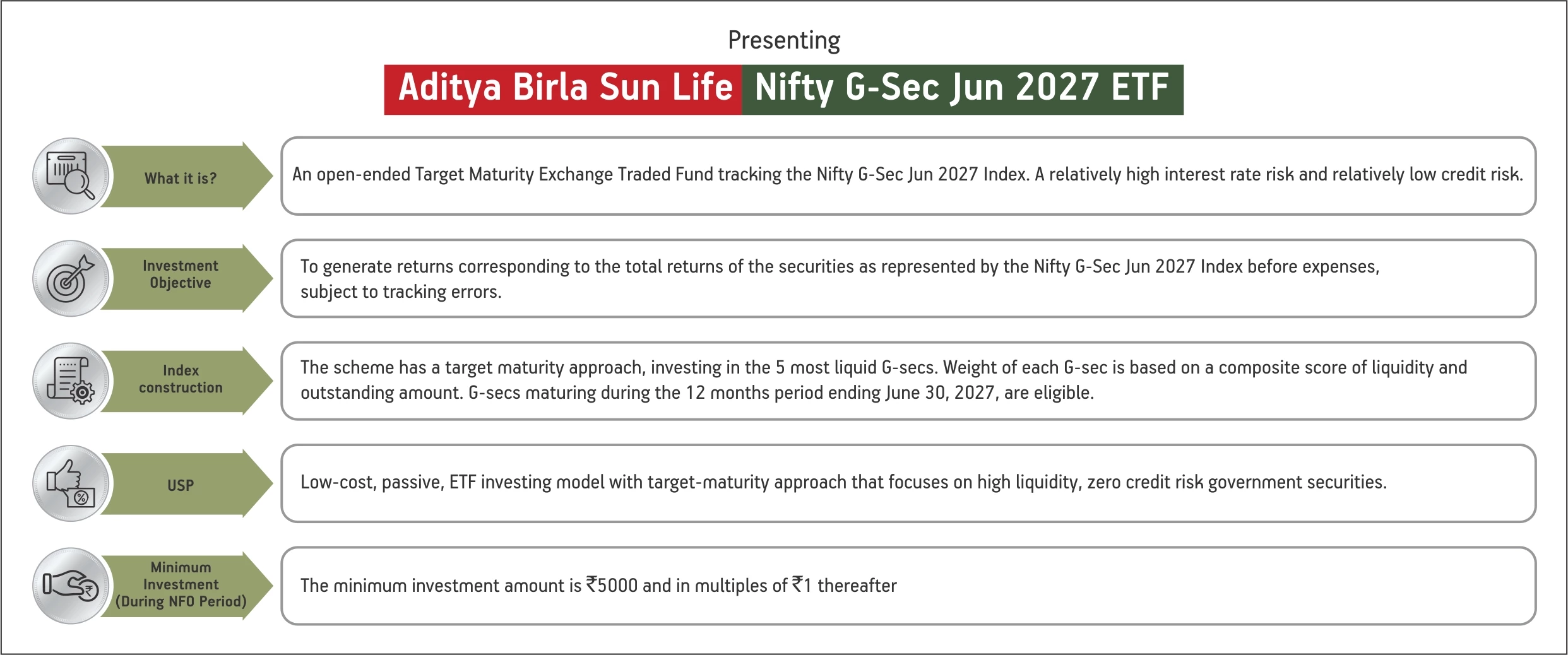

Why should you invest in Aditya Birla Sun Life NIFTY G-Sec Jun 2027 ETF?

• Reasonable Returns

The fund invests in G-secs that have specified interest rate and fixed tenure. This gives investors clarity on expected returns.- • Tax-efficient

Furthermore, if the investment in this fund is held for more than 3years then investors can also get the benefit of indexation on redemption; making returns more tax efficient. • Target Maturity Approach

The maturity of the scheme is expected to be June 30, 2027. This fixed maturity term, makes investments in the fund amenable to goal planning• High Credit Quality

The scheme invests in sovereign, government backed G-secs that have practically no credit risk. The scheme also has no duration risk when held till maturity.• Low costs & low minimums

Being a passively managed ETF, it has a lower expense ratio and low minimum investment. Investors can invest in this scheme with amounts as low as Rs.5000 (through NFO), thereafter units traded on exchange.• Benefits of ETF investing

Being an ETF, its units can be bought and sold on the exchange akin to shares. This gives investors the benefit of ease of trading and high liquidity.

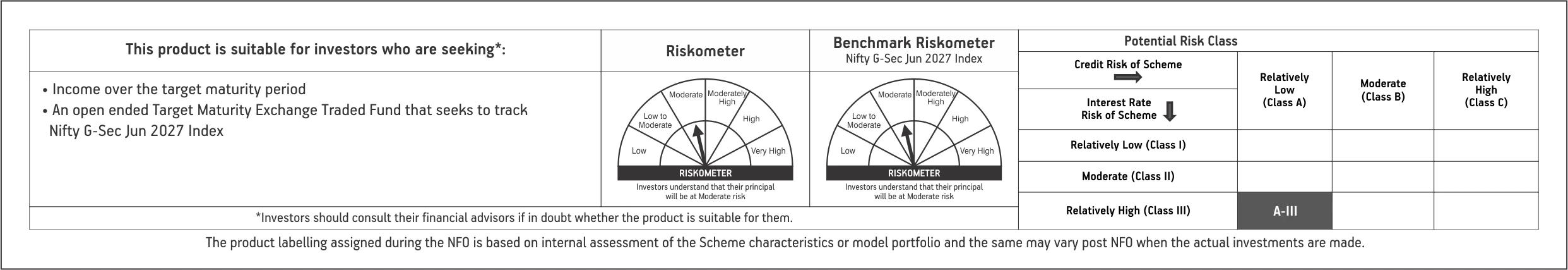

Product Labelling

Aditya Birla Sun Life Nifty G-Sec Jun 2027 ETF

Download

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000