-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

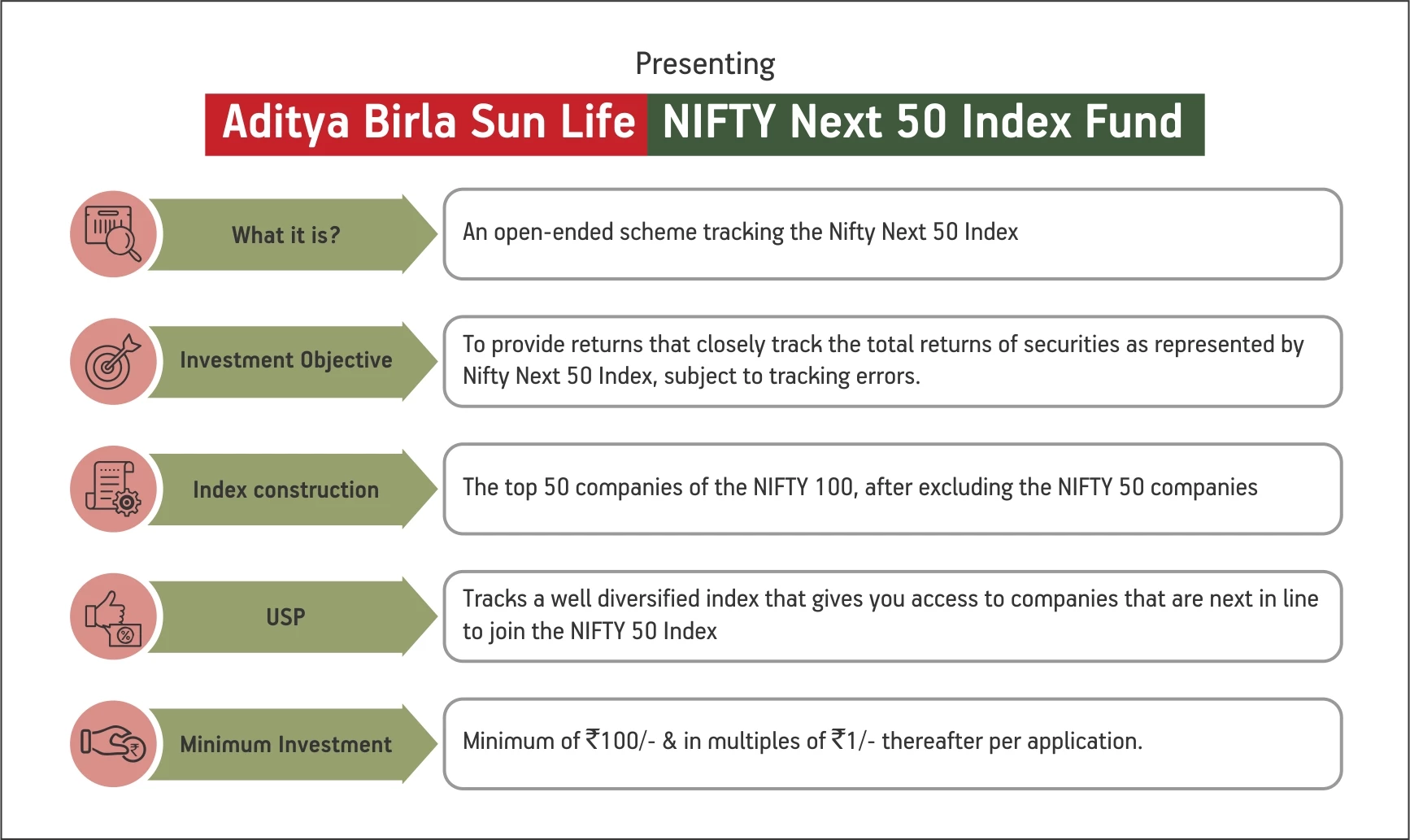

A passive solution to invest in the blue-chips of tomorrow

- Large caps – A ‘go-to’ investment for long term Growth

Large caps have high growth potential along with liquidity. Post Covid, focus on large caps is increasing as the economy increasingly becomes more formalized.- NIFTY Next 50 Index - A predominantly large-cap index

As the name suggests, it includes the ‘next 50’ companies of the NIFTY 100 after excluding the NIFTY 50 stocks- NIFTY Next 50 – The future market leaders waiting in the wings

NIFTY Next 50 stocks are positioned at the ‘sweet spot’ between top blue chips and midcaps; ready to grow to the next level. In fact, most of these stocks go on to get included in the NIFTY 50 Index.- NIFTY Next 50 scores over NIFTY 50

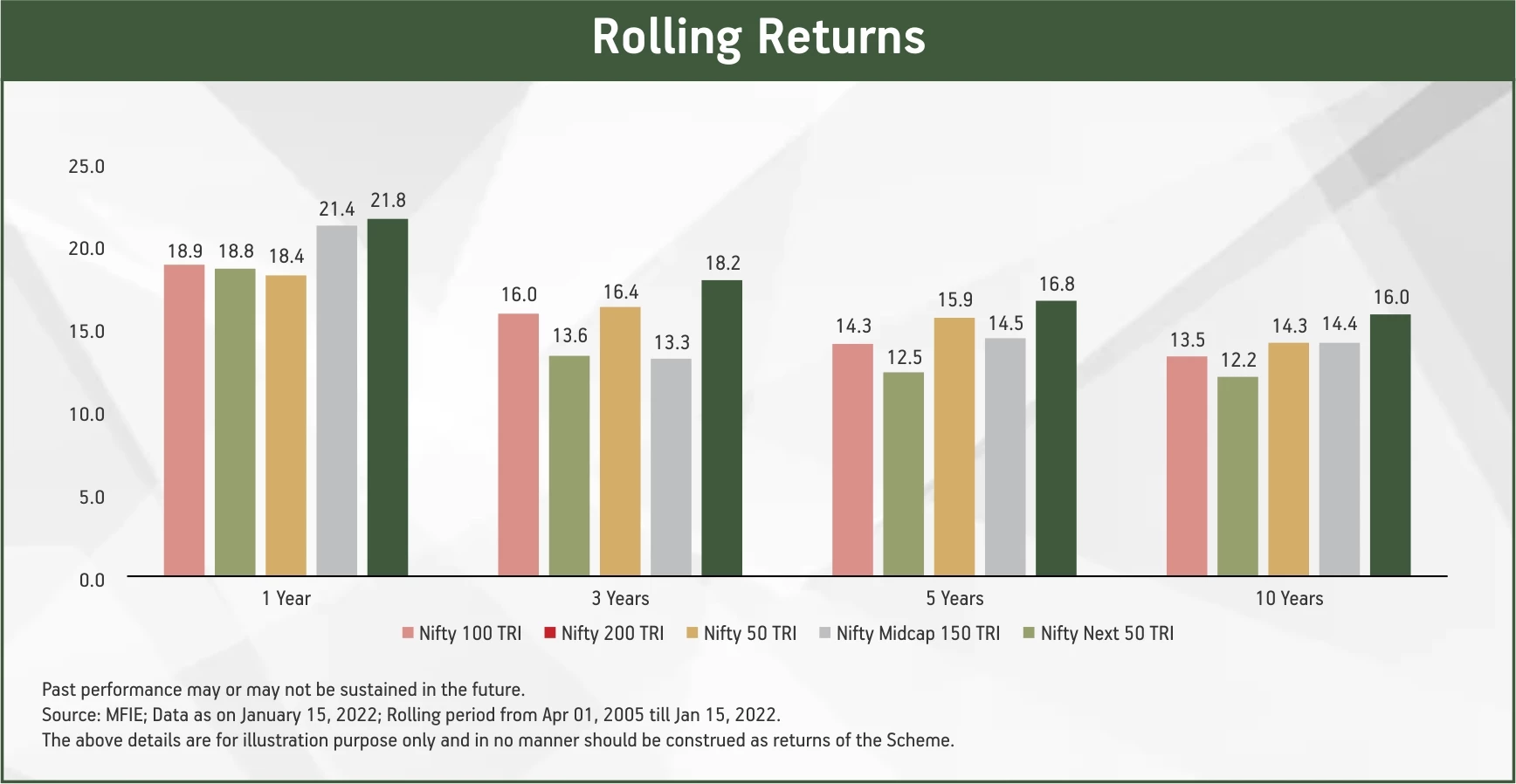

NIFTY Next 50 is a better distributed index with higher diversification across sectors.- Performance Forerunner

NIFTY Next 50 Index, in the rolling returns metric, has performed reasonably compared to other broad-based indices, across time periods

- Access this opportunity through Index Investing

An index fund is a mutual fund that seeks to replicate the performance of the underlying index by investing in the same securities and in the same proportion as the index.

Why should you invest in Aditya Birla Sun Life Nifty Next 50 Index Fund?

Long term Growth Potential

Get the potential of wealth creation over the long term, by investing in a portfolio of large caps that are the potential blue-chips of tomorrow

High Diversification

The Index invests across sectors with greater distribution across stocks as well. This reduces the concentration risk of a single sector or stock.

Passive Investing Benefits

Low-cost investing that follows the principle of natural selection.

Tax Efficient

Being an equity-oriented fund, capital gains on redemption are taxed at beneficial rates. Short term at 15% and long term (above Rs. 1 lac gain) at 10%

Investing Convenience

Hassle-free investing without the need of a demat account. Investment can be started with as low as Rs.100. Convenient investment modes such as SIP, STP etc also available.

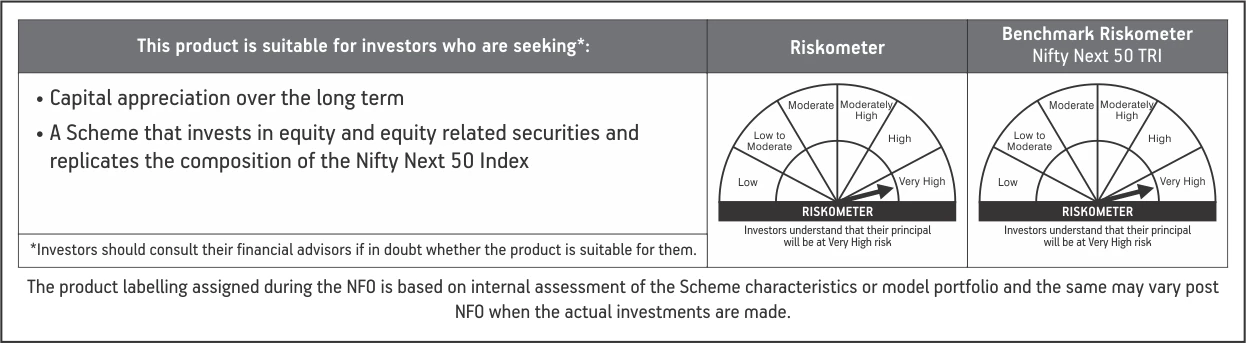

Product Labelling

Aditya Birla Sun Life Nifty Next 50 Index Fund

Download

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000