-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

ABSL NIFTY SDL Plus PSU Bond Sep 2026 60:40 Index Fund

Fund AUM as on 28th Nov,2021-1464 Crores

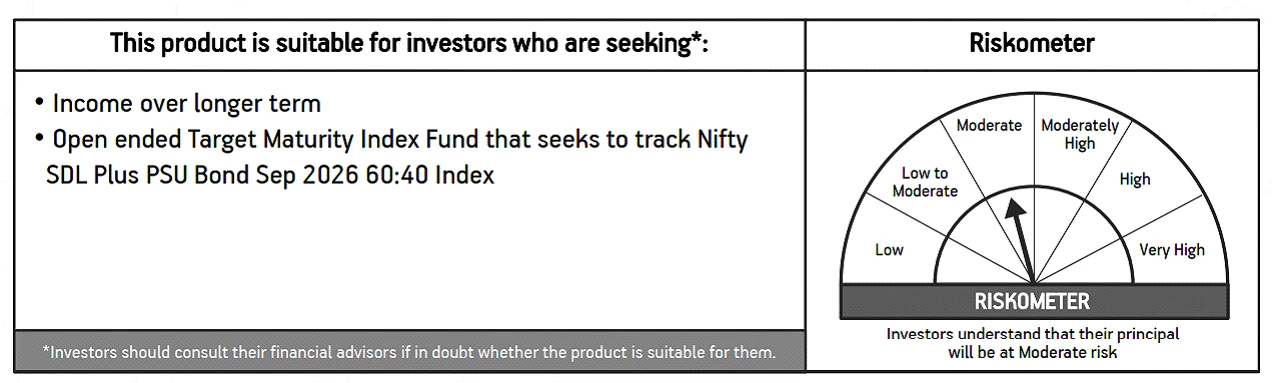

• The objective of the scheme is to track the Nifty SDL Plus PSU Bond Sep 2026 60:40 Index by investing in PSU Bonds and SDLs, maturing on or before September 2026, subject to tracking errors.

• The Scheme will invest in AAA rated PSU bonds and State Development Loans (SDLs), comprising Nifty SDL Plus PSU Bond Sep 2026 60:40 Index.

• The Scheme is a Target Maturity Date Index Fund. It will mature on September 30, 2026.

• The scheme follows a passive investment strategy, seeking to replicate the underlying index, to provide a transparent portfolio with predictable returns

What is an SDL and PSU bond?

•State Development Loans (SDL) are raised by the various state governments in India to meet their planned expenses & investments. Since they are backed by RBI, they are as safe as Sovereign papers and currently available reasonably high yields.

•PSU Bonds is the debt raised by Public Sector Undertakings (PSUs). These entities are owned by central or state governments of India, hence the debt raised through them offers safety and reasonable returns.

Why Debt Index funds?

Investors looking for fixed income securities can typically choose between traditional saving instruments, bonds or debt mutual funds. Debt market yields are becoming attractive against the backdrop of conducive economic environment - moderated inflation, sustained economic growth, monetary policy conviction on interest rates etc.

Passive debt funds can be an option here for investors. Passive debt funds combine the benefits of predictability of returns with the safety of high-quality debt offering investors, the means to capitalise on this rising fixed income opportunity.

Debt Index funds are mutual funds that seek to mimic the performance of an underlying index by investing in the same debt securities, in the same proportion of the index it tracks. Following a passive investing strategy, these funds provide a transparent, tax-efficient way to invest in high quality debt instruments to participate in the fixed income opportunity in the market.

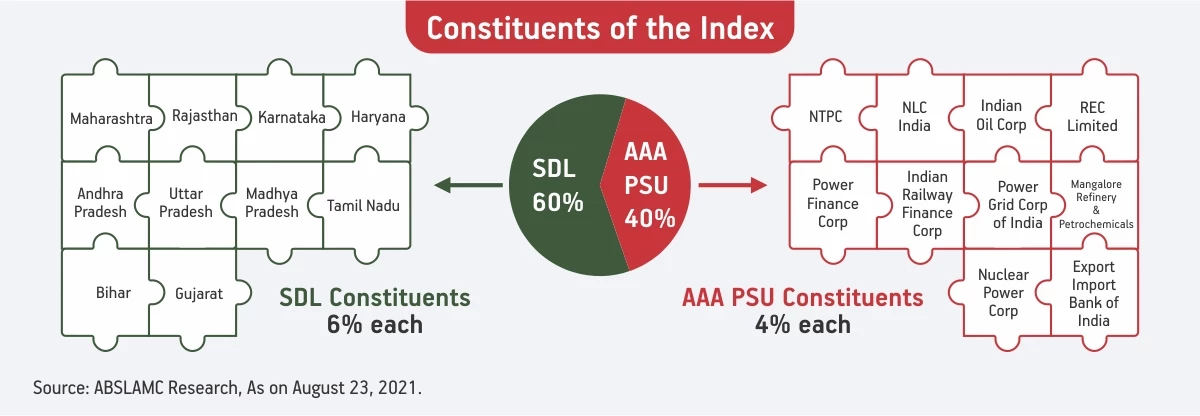

Nifty SDL Plus PSU Bond Sep 2026 60:40 Index

To know more please visit : https://www.niftyindices.com/indices/fixed-income/target-maturity-index/nifty-sdl-plus-psu-bond-sep-2026-60-40-index

Why ABSL NIFTY SDL Plus PSU Bond Sep 2026 60:40 Index Fund

Aditya Birla Sun Life offers a fund – ABSL NIFTY SDL PSU Bond Sep 2026 60:40 Index Fund.

ABSL NIFTY SDL PSU Bond Sep 2026 60:40 Index Fund is an open-ended scheme tracking the NIFTY SDL Plus PSU Bond Sep 2026 60:40 Index. The fund’s objective is to provide returns that closely correspond to the total returns of debt securities as represented by the Index, subject to tracking errors.

•The scheme has a target maturity approach, investing in AAA rated PSU bonds and SDLs that mature between September 30, 2025 and September 30, 2026.

•The underlying index focuses on high quality securities, being equally weighted with 60% allocation to SDLs of Top 10 states/UTs and 40% allocation to top 11 AAA rated PSU bonds.

•The scheme follows a passive investment strategy, seeking to replicate the underlying index, to provide a transparent portfolio with predictable returns.

Why should you invest in this fund now?

-

• Provides predictable reasonable returns : By buying and holding fixed income SDLs and PSU bonds, the fund focuses on earning predictable returns for its investors. The 5-year term appears as ideal period to maximise yields.

-

• Scheme has a fixed maturity : This fund has fixed maturity (30th September 2026), making it amenable to financial planning.

-

• Managed risks : The fund only invests in top SDLs and AAA rated PSU bonds, increasing quality and safety of your investment.

5-year Roll-down strategy reduces interest rate risk. Passive investing style also reduces active stock selection risk of the portfolio. -

• Lends liquidity to your portfolio : The fund is open-ended with no lock-in, keeping your investments liquid while providing reasonable returns and stability.

-

• Tax efficiency : Debt funds with holding period of more than 36 months qualify for long term capital gains and indexation benefit in taxation. Indexation helps in adjusting the purchase price of the investments and in turn lower the tax liability. Since the fund has a maturity tenure of 5 years, it gets the indexation benefit and capital gains tax efficiency.

-

• Low costs and low minimums : The fund has lower cost of investing than actively managed funds. It also provides access to bonds and SDLs otherwise requiring high investments, at low minimums.

1800-270-7000

1800-270-7000