-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Invest now in target maturity Passive Debt funds, to get an added benefit of tax saving!

• Debt yields continue to look attractive

Against the backdrop of global and domestic banks' actions; India macros continue to be resilient. This is keeping debt yields attractive.• The advantage of State Development Loans (SDLs)

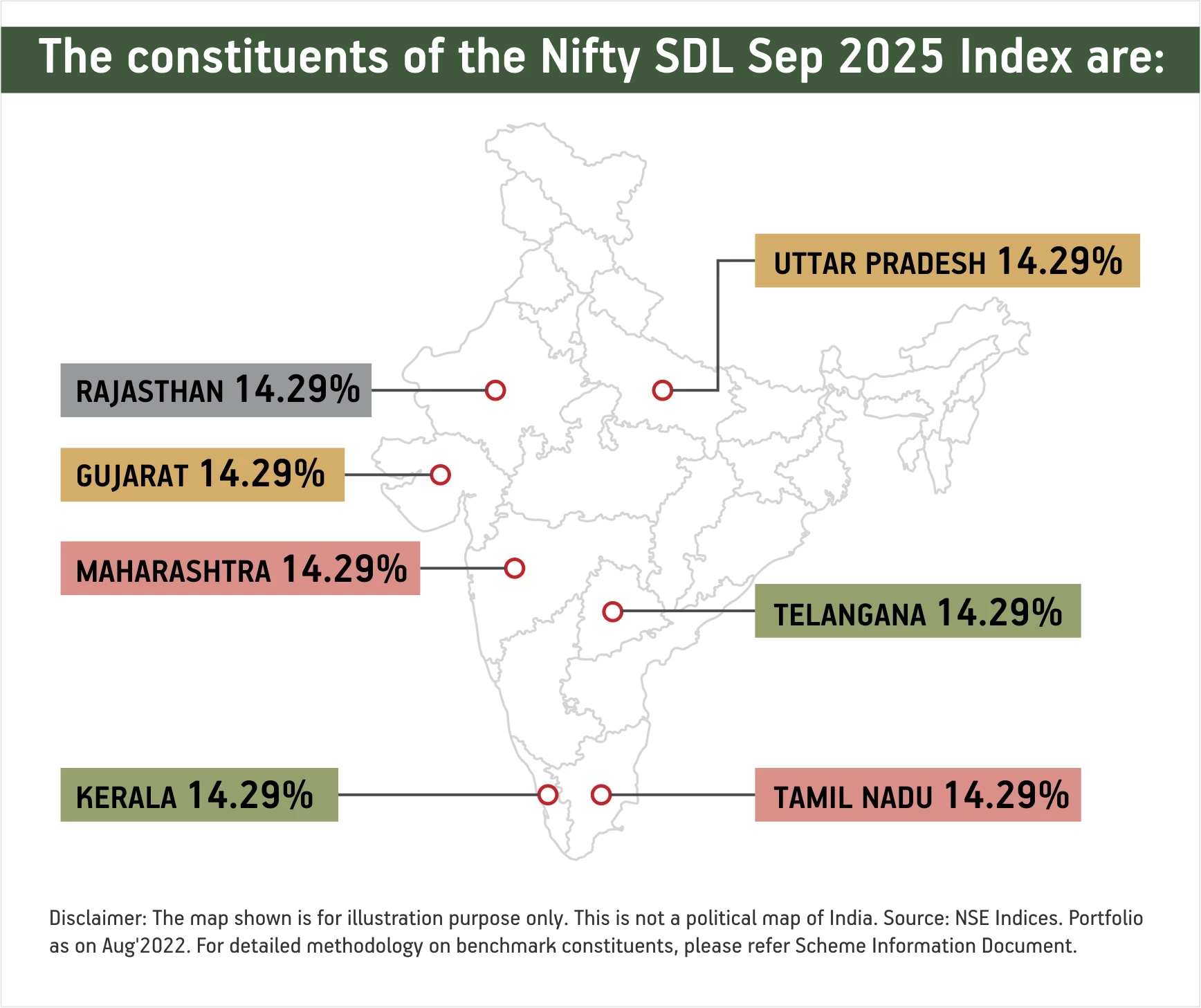

SDLs are bonds issued by state governments. They have a sovereign rating & are facilitated by RBI with a provision to be served from central government’s allocation to states. These features make them akin to G-secs while still offering higher yields than G-secs.• The ‘sweet spot’ for SDL yields

With the short-term rates moving higher as compared to longer end of the curve, current SDL yields up to 3-5year period look especially attractive. Target maturity funds can be the ‘go-to’ investment to capitalise on these yields.• Attractiveness of Passive Debt Index Funds

These are mutual funds that look to replicate the performance of an underlying index by investing in securities with similar risk-return profile as the index.

They seek to provide an ‘all-in-one’ debt investment solution – access to fixed income securities offering reasonable returns and high quality, yet at low costs.

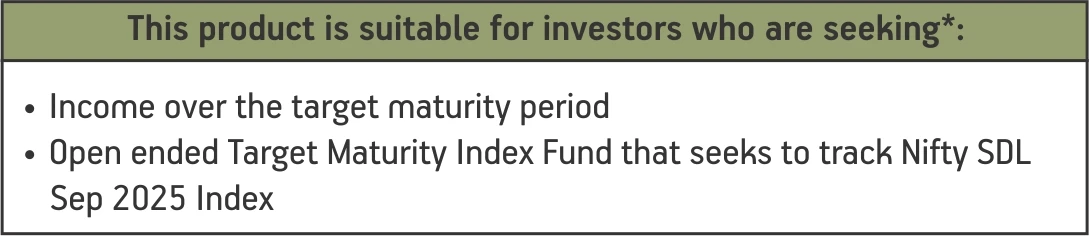

Why should you invest in Aditya Birla Sun Life Nifty SDL Sep 2025 Index Fund?

• Target Maturity Scheme

By investing in SDLs that mature in 2025, this scheme has a fixed maturity term allowing investors to better plan and align their investments and goals.- • Liquidity

Being an open-ended fund with no lock-in period, it offers liquidity to investors throughout the term of the fund. - • Sovereign rated Portfolio

SDLs have sovereign rating similar to the Government securities (G-Secs), thus investors have security of their principal and returns. - • Low Costs

Being a passive fund, it has a lower expense ratio. - • Low Minimum Investment

Investors can start investing in this fund with as low as Rs.500. - • Indexation Benefit in Taxation

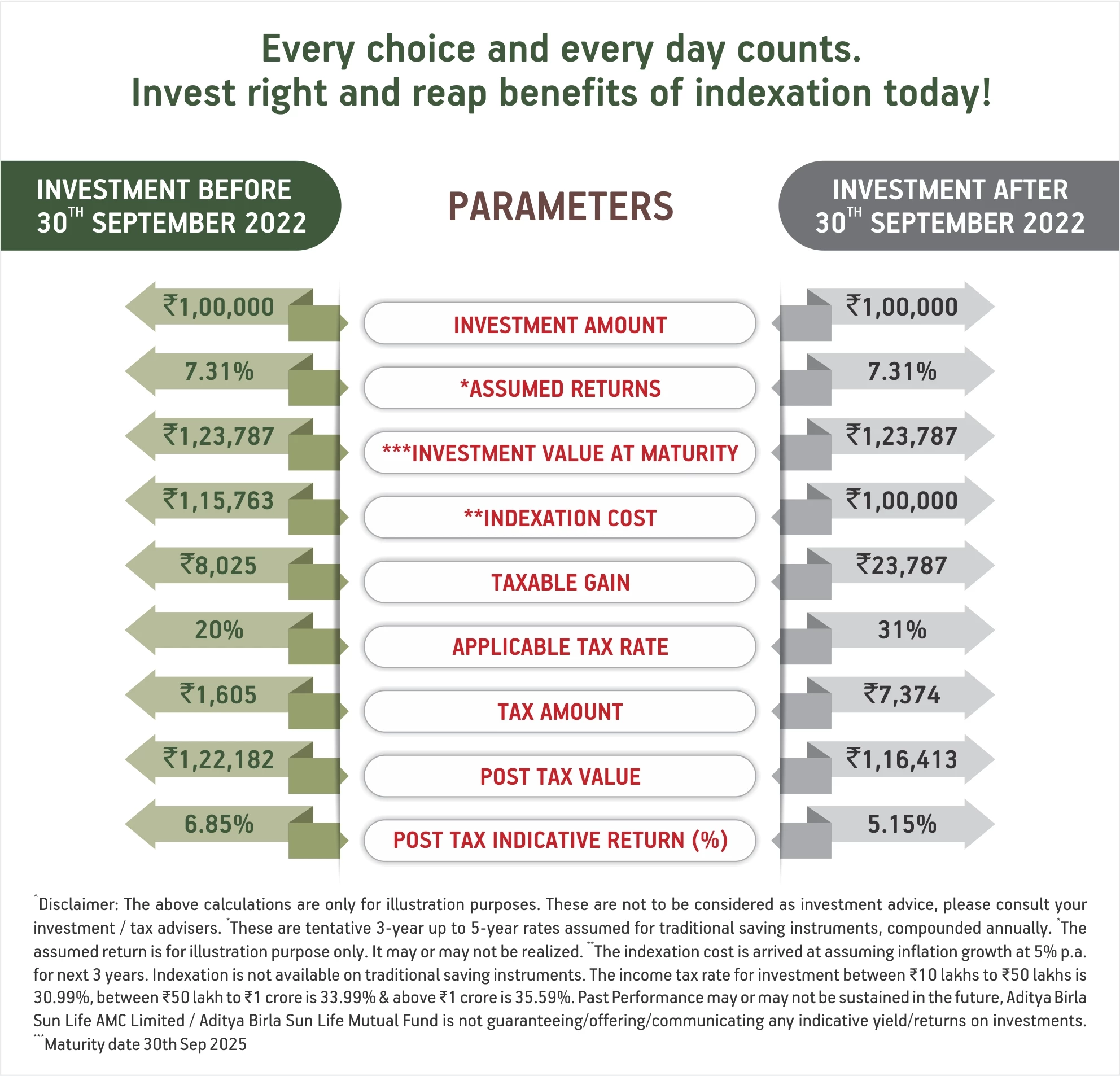

Investments made in this fund before 30th September 2022 will qualify as long-term investments on maturity & thus will be eligible for indexation benefits. This can yield a tax saving or an additional return of Rs. 5,769 on every Rs. 1 lakh invested in this fund as shown in the following illustration:

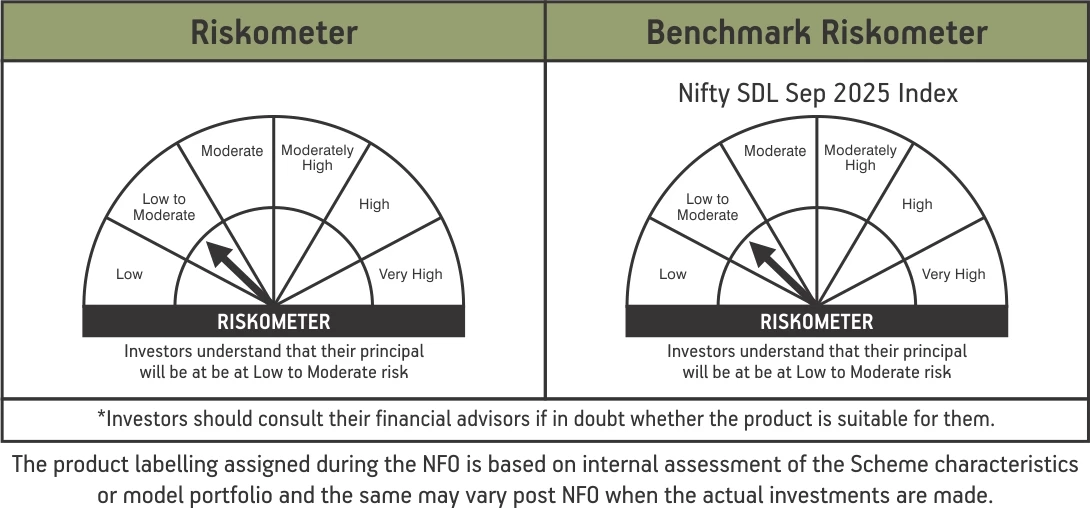

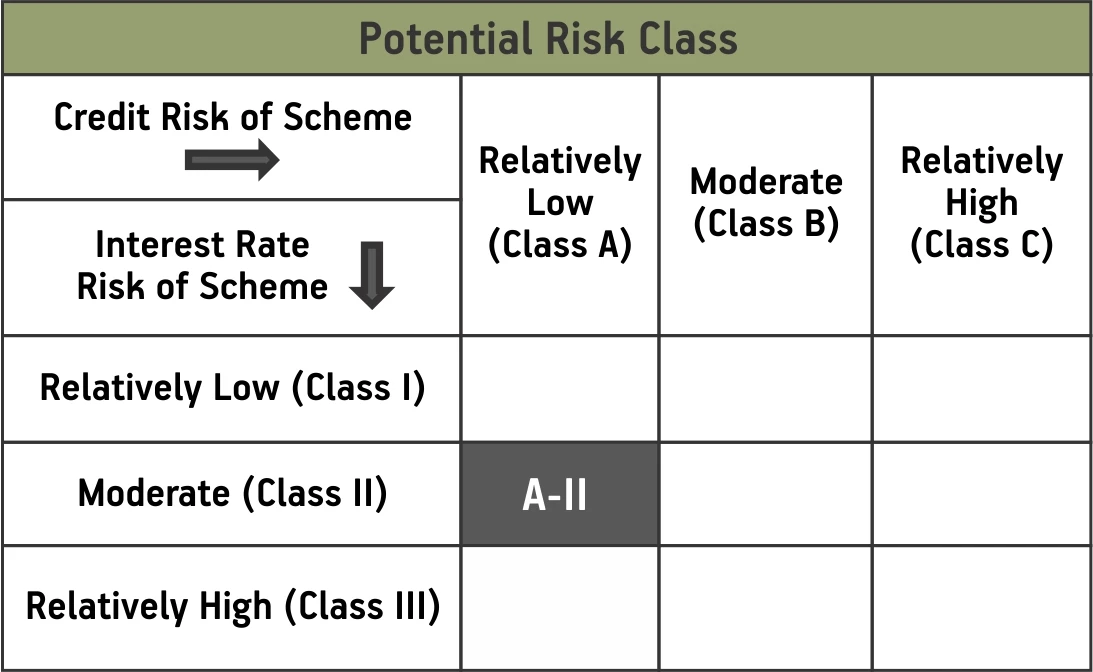

Aditya Birla Sun Life Nifty SDL Sep 2025 Index Fund

Download

NSE disclaimer: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Draft Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the 'Disclaimer Clause of NSE’.

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000