-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

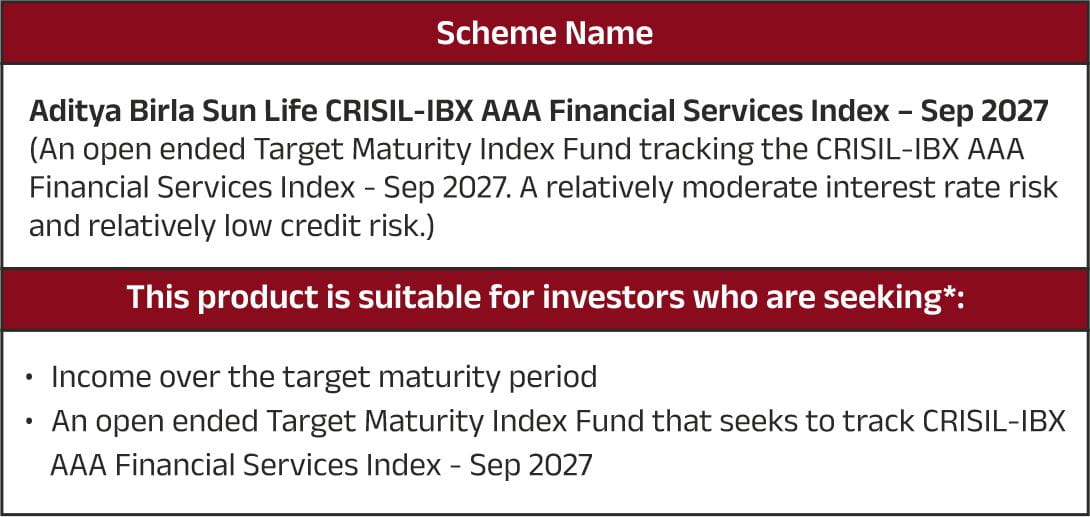

ABSL CRISIL-IBX AAA Financial Services Index - Sep 2027 Fund is Live Now

Invest in a sector-specific target maturity fund that taps into the financial services bonds market - aiming for better yields for your short to medium-term goals!

Indian debt market yields at a high point

Interest rates in India are at decade-high levels, with corporate bonds—especially from financial services—offering attractive yields in the 3-year short-medium term range.

-

Financial Services: Strengthening performance metrics

Financial services companies are showing solid balance sheets, with return ratios near decadal highs and Non-performing Assets (NPA) ratios at multi-year lows. This financial health enhances their credit offtake capabilities, while banks are also reporting stronger performance metrics.

-

Rising credit demand across categories

Improving income, balanced demand, and stabilized inflation are fueling retail credit growth across banks and NBFCs. India’s demographic shift also supports housing demand.

-

Financial Services’ Bonds: A good short-medium term debt opportunity

As financial services companies benefit from improved performance and credit growth prospects; their AAA bond offerings present a high-quality investment for short- to mid-term investors seeking debt opportunities.

-

A sector-specific Target Maturity Fund to capture this potential

A target maturity fund, focused on the financial services sector, allows investors to access short-term debt opportunities with a defined maturity. It offers a structured approach to potentially capture returns in the financial services bond market.

-

What it is?

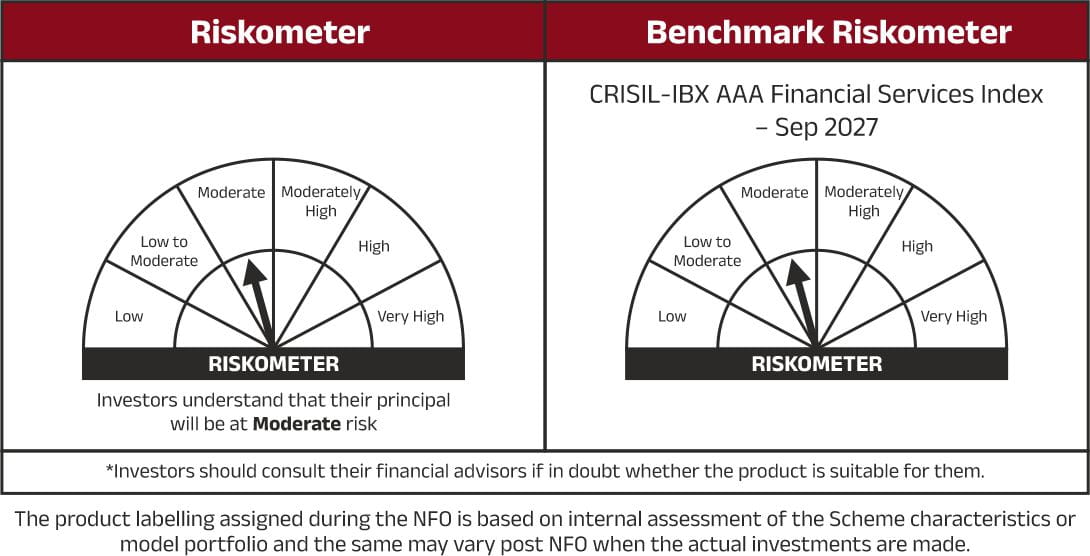

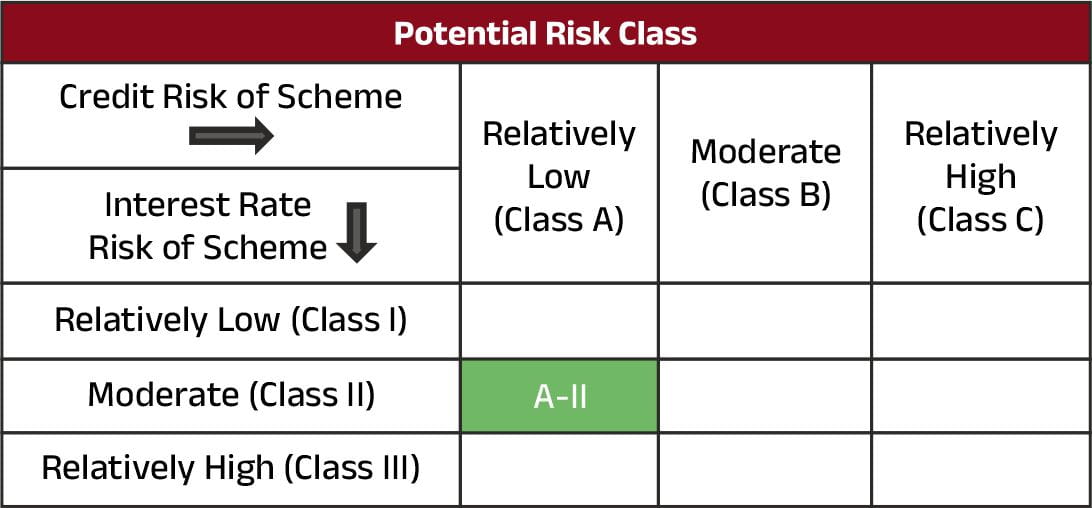

An open ended Target Maturity Index Fund tracking the CRISIL-IBX AAA Financial Services Index – Sep 2027. A relatively moderate interest rate risk and relatively low credit risk. -

Investment Objective

The investment objective is to generate returns corresponding to the total returns of the securities as represented by the CRISIL-IBX AAA Financial Services Index – Sep 2027 before expenses, subject to tracking errors.

The Scheme does not guarantee/indicate any returns. There is no assurance or guarantee that the investment objective of the Scheme will be achieved. - Minimum Application Amount

Lumpsum: Minimum of Rs.1,000/- and in multiples of Rs. 100/- thereafter. Monthly / Weekly Systematic Investment Plan (SIP): Minimum of Rs. 1,000/- and in multiples of Re. 1/- thereafter

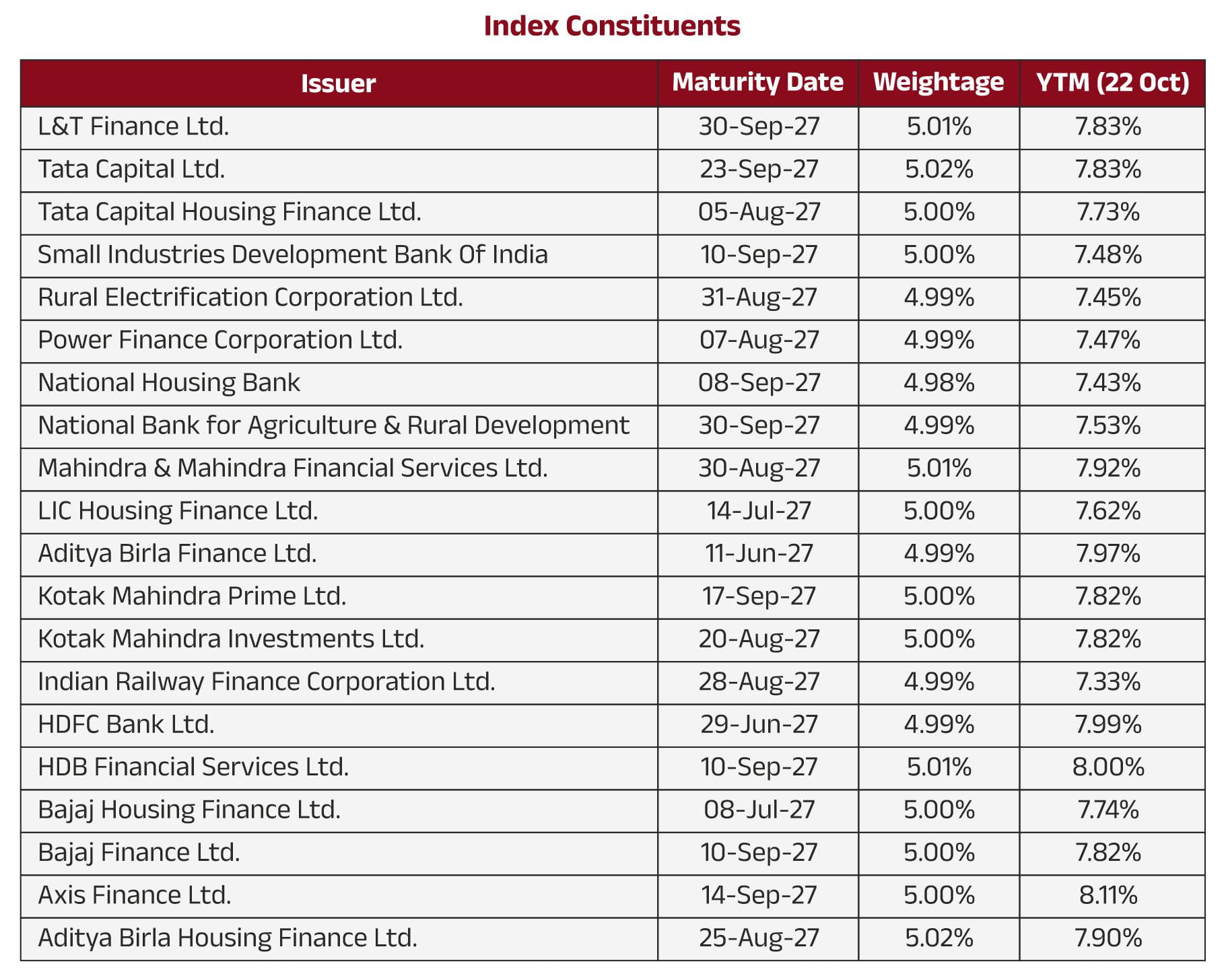

- Index Construction

The index comprises 100% of AAA corporate bonds of the Financial Services sector with securities maturing in 6-month period ending September 30, 2027. Issuer weights should not exceed 15% and Group Capping stands at 25%. Please refer to the SID for further detailed methodology - Key Feature

A sector-based target maturity fund that invests in high-rated bonds from the financial services sector, aiming to offer investors reasonable yields with relatively low risk over the short- to medium-term.

The bond offerings of the financial services sector are attractive at the 3-year point which matches the tenure of this fund. This offers investors better yields for the short-mid-term as compared to its peers in the debt market.

As India may follow the trend of global interest rate cuts, falling yields could lead to price gains, presenting potential capital appreciation for investors.

The Financial Services sector is witnessing strong financial performance increasing the credibility of their bond offerings. Being AAA rated bonds the risk of lender default is limited, lowering credit risk for investors.

The sector’s solid financial position and growth trajectory offer favourable risk-adjusted returns with relatively higher yields.

The fund is open-ended with no exit load, allowing investors liquidity for the entire term.

The fund buys and holds securities till their maturity date with an aim to earn interest at regular intervals. This is useful for capturing a higher present yield and gradually moving towards the shorter end of the yield curve which is less susceptible to interest rate risk.

This strategy is appropriate in an elevated rates environment, as we see today.

For more information on the scheme, please refer to SID/KIM of the scheme. For CRISIL index methodology, click here.

1800-270-7000

1800-270-7000