-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABSL Conglomerate Fund NFO is Live now

A constant maturity debt index fund offering a unique solution for fixed-income investors by utilizing the roll-down strategy

Indian Debt Yields: A Strong Opportunity

As global inflation trends downward, central banks worldwide are implementing rate cuts. In contrast, Indian interest rates remain attractive, presenting an opportunity for investors seeking robust returns in the current economic environment.

-

Financial Services Debt: A High-Quality Investment

The performance of financial services companies, including banks and NBFCs, has steadily improved. With lower NPA ratios, decadal-high return on equity (RoE) and return on assets (RoA), and growing credit demand, their debt offerings are of top-notch quality.

-

Short-Term Debt Instruments: A Premium in the Yield Curve

Debt instruments with maturities of 3–6 months currently offer yields that are competitive within the short-term yield curve. These instruments benefit from improving credit metrics and profitability in the financial services sector, making them a viable choice for fixed-income investors.

-

A Constant Maturity Index Fund: A Strategic Option for Fixed-Income Investors

A constant maturity index fund is a passive debt fund that tracks a benchmark index composed of debt securities. The portfolio is regularly adjusted to maintain a consistent average maturity.

When focused on Commercial Papers (CPs), Certificate of Deposits (CDs) & Corporate bonds with maturities of 3–6 months, such a fund becomes a practical option for fixed-income investors. By maintaining a steady maturity in this range, it can provide competitive yields while keeping credit risk low, supported by the financial strength of the issuers.

-

What it is?

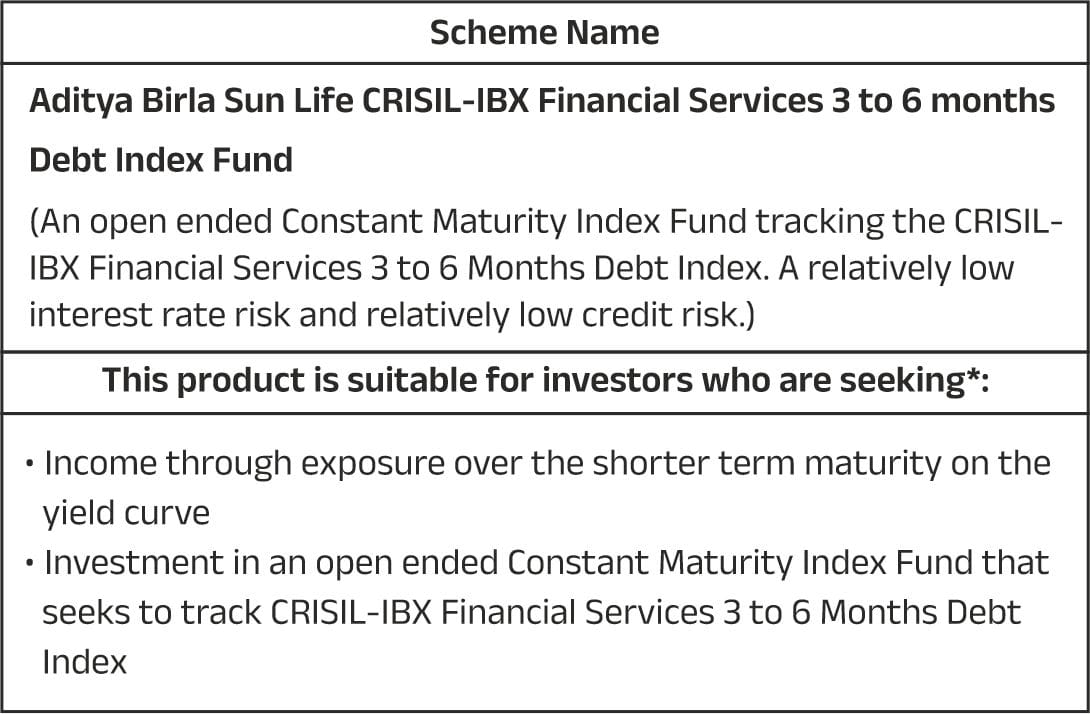

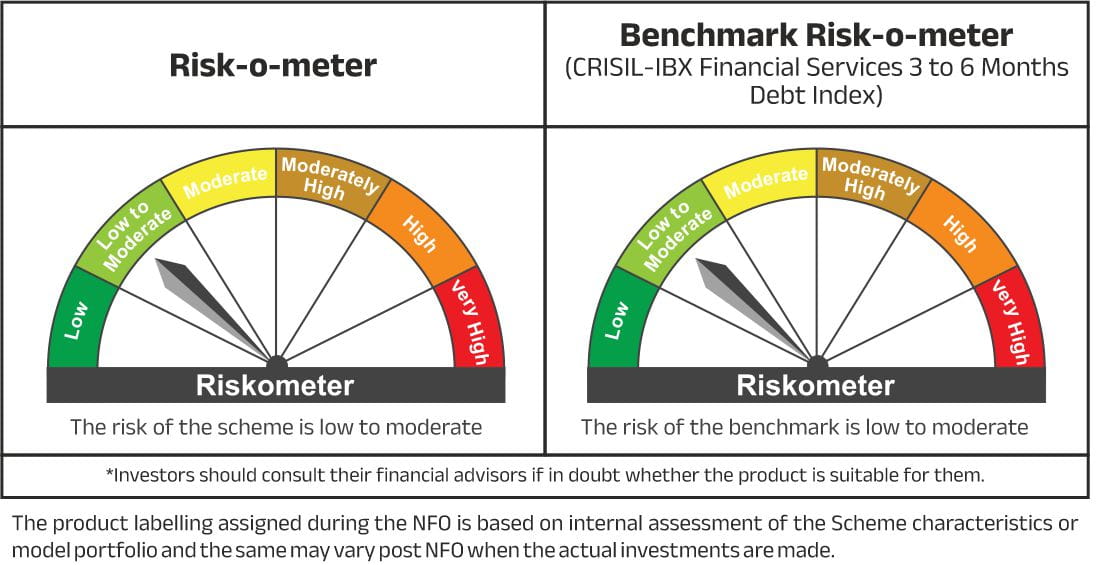

An open ended Constant Maturity Index Fund tracking the CRISIL-IBX Financial Services 3 to 6 Months Debt Index. A relatively low interest rate risk and relatively low credit risk. -

Investment Objective

To generate returns corresponding to the total returns of the securities as represented by the CRISIL-IBX Financial Services 3 to 6 Months Debt Index before expenses, subject to tracking errors.

The Scheme does not guarantee/indicate any returns. There is no assurance or guarantee that the investment objective of the Scheme will be achieved. - Minimum Application Amount

For Lumpsum: Minimum of Rs.1,000/- and in multiples of Re. 1/- thereafter.

For Monthly Systematic Investment Plan (SIP): Minimum of Rs. 1,000/- and in multiples of Re. 1/- thereafter

- Index Construction

The index is a perpetual index with a fixed reset period. It comprises 100% of CPs, CDs and corporate bond securities maturing within 3 to 6 months from the date of inclusion in the index. Listed issuers in the financial services sector with long term conservative rating of AAA are eligible. The index will be reconstituted on a quarterly basis.

Please refer to the SID for further detailed methodology. Key Feature - Key Feature

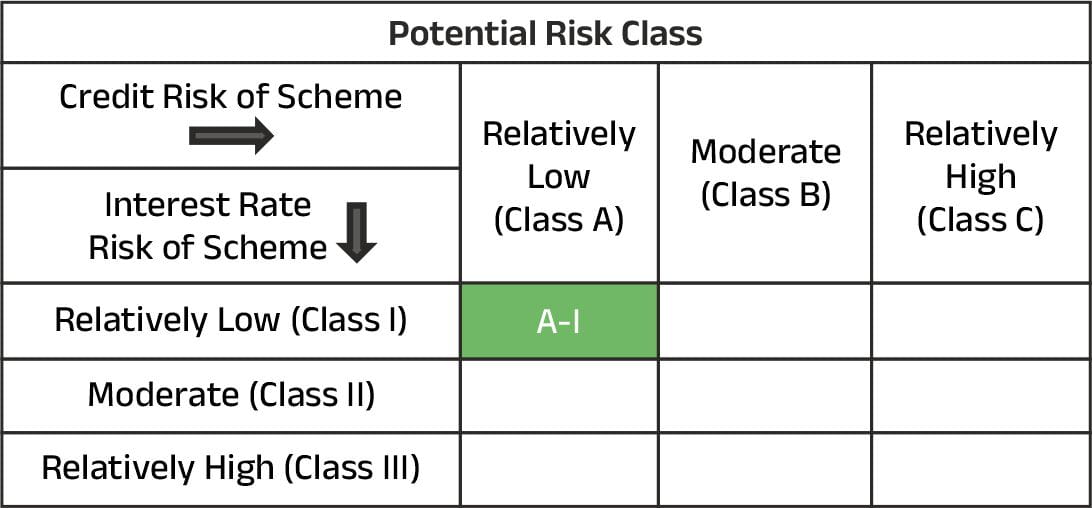

A constant maturity debt index fund that invests in AAA rated debt of the financial services sector, maintaining a constant portfolio duration of 3 to 6 months. It offers reasonable yields with low credit and low interest risk, plus the benefits of passive investing.

The fund invests in debt securities issued by banks, NBFCs, and other financial services companies, targeting the 3-to-6-month duration. These securities currently offer a yield premium compared to other short-term debt instruments, positioning the fund to deliver competitive returns.

The fund employs a roll-down strategy, purchasing securities with just under six months to maturity and exiting them near the three-month mark. This approach takes advantage of strong demand for securities with three months or less to maturity, potentially enhancing yields over the investment period.

The financial services sector is experiencing strong credit demand and improved performance, enhancing the reliability of their debt instruments. Furthermore, the fund takes exposure only to AAA-rated securities within this sector, lowering the overall credit risk for investors.

The fund is open-ended, offering easy access to investments without any lock-in period or exit load. Investors can liquidate their holdings at any time without incurring additional costs, providing flexibility and convenience.

The portfolio comprises short-term debt securities with maturities between 3 to 6 months. These instruments are less sensitive to interest rate fluctuations, helping minimize potential volatility in the fund’s performance caused by changing interest rates.

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000