-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

-

Link to ODR

- Back

-

Shareholders

ABSL Nifty India Defence Index fund NFO is Live Now..

Invest in India's Defence Sector with a Passive Index Fund – As India aims to strengthens its defence capabilities, you can too aim to fortify your portfolio!

-

What it is?

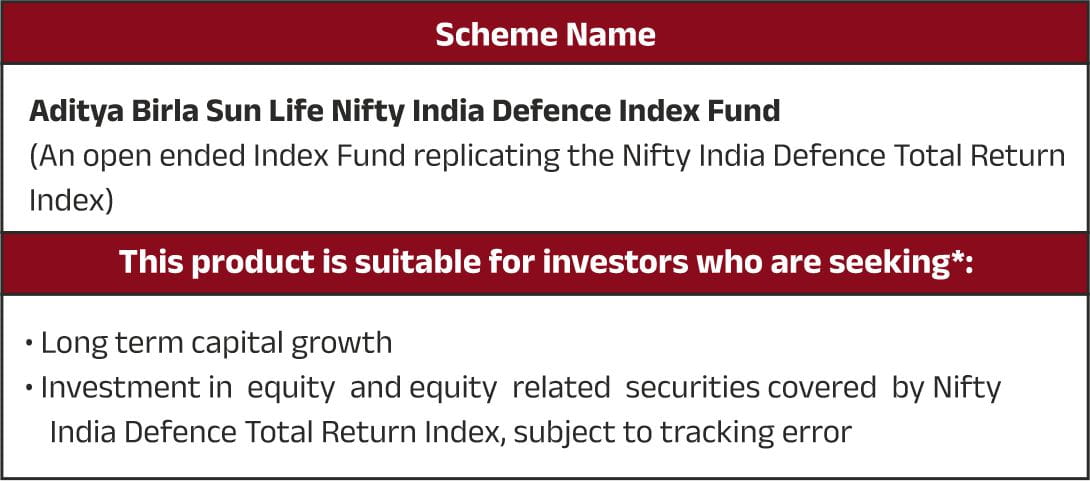

An open-ended Index Fund replicating the Nifty India Defence Total Return Index. -

Investment Objective

To provide returns that, before expenses, correspond to the total returns of securities as represented by the Nifty India Defence Total Return Index, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There is no assurance or guarantee that the investment objective of the Scheme will be achieved. - Minimum Application Amount

Lumpsum: Minimum of Rs.500/- and in multiples of Rs. 100/- thereafter.

Monthly / Weekly Systematic Investment Plan (SIP): Minimum of Rs. 500/- and in multiples of Re. 1/- thereafter

- Index Construction

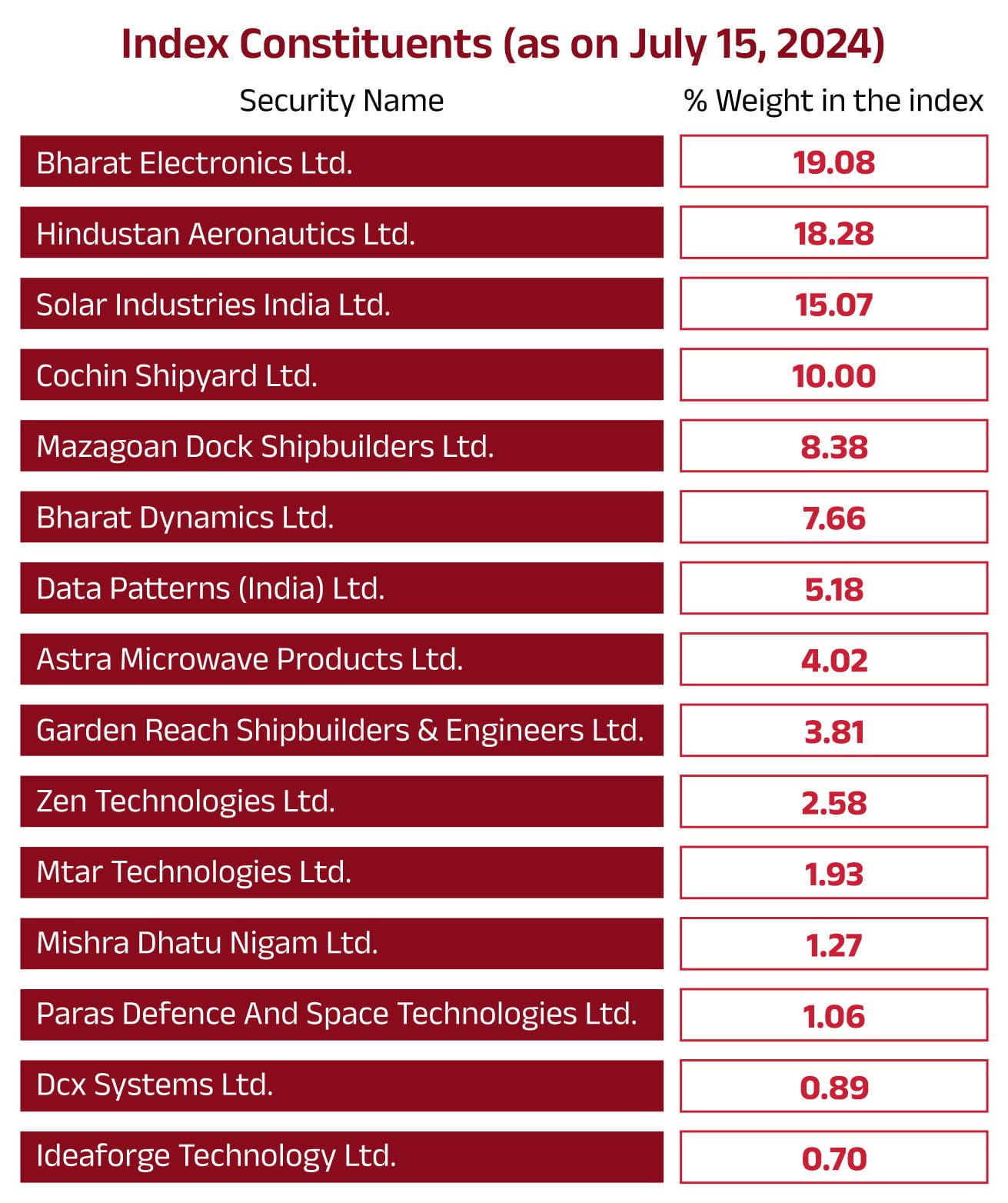

The scheme invests a minimum of 95% in equity constituting the Nifty India Defence Index. The constituents of the Index are selected from the universe of the 750 Nifty Total Market Index. A minimum of 10 stocks are selected that are present in the Society of Indian Defence Manufacturers and who obtain at least 10% of revenues from the defence index. The weighting of stocks will be based on free float market capitalization. There is a stock capping of 30 stocks and no single stock shall have a weight of more than 20%. Please refer to the SID for further detailed methodology. - Key Feature

A passive investing strategy, that tracks defence stocks through a market cap-based Defence index, aimed at generating long term capital gain from a high potential defence sector

Why should you invest in Aditya Birla Sun Life Nifty India Defence Index Fund?

For more information on the scheme, please refer to SID/KIM of the scheme.

Sources:

1. Targets set by Union Defence Minister – February, 2024

Sources:

1. Targets set by Union Defence Minister – February, 2024

There are two ways in which you can invest in this fund:

1. Through a Direct plan – here you can invest directly through Aditya Birla Sun Life Mutual Fund (either at the time of NFO or subsequently through our online portal)

2. Through a Regular Plan – here you can invest through a distributor or broker of your choice

Both modes of investing will give you access to the same investment portfolio of the fund. However, there will be a difference in the expense ratio applicability of these plans and hence they will have different NAVs.

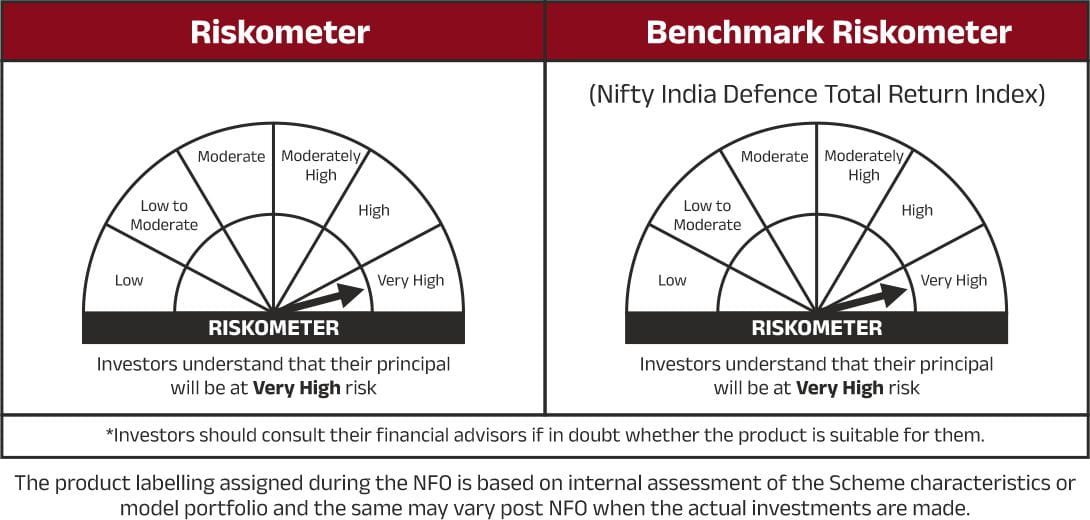

This fund is an open-ended Index Fund. It tracks an equity index which focuses on defence sector stocks. This index is the Nifty India Defence Total Return Index. It thus aims to invest in the stocks comprised in this index, in the same proportion.

Being an index fund, this fund will invest a minimum of 95% of its net assets in equity and equity related securities constituting the Nifty India Defence Index.

Exit Load is an amount which is paid by the investor to redeem the units from the scheme.

The current exit load structure applicable is

- For redemption / switch-out of units on or before 30 days from the date of allotment: 0.05% of applicable NAV.

- For redemption / switch-out of units after 30 days from the date of allotment: Nil.

Thus, there is no exit load charged in case of units redeemed that are held beyond 30 days’ time.

The New Fund Offer (NFO) opens on 9th August 2024 and closes on 23rd August 2024

No, you do not necessarily need a demat account. When you invest with Aditya Birla Sun Life Mutual Fund through a direct plan there is no need for you to have a separate demat account. Your investment can be viewed, tracked, and redeemed on our online portal.

Yes, this fund permits SIP mode of investing. It permits both monthly and weekly SIP which you can choose as per your affordability. During the NFO period as well as subsequently, investment can be made with a minimum SIP of Rs.500/- and in multiples of Re.1/- thereafter.

Equity investors with a long-term investment horizon looking to invest in the defence sector through an index-based fund. The fund is also suitable for investors looking for exposure to a government policy-driven industry which also has a low corelation to broader market during geopolitical volatility.

1800-270-7000

1800-270-7000