-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

-

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

Current & Historical NAV / Dividend

Oops! service is unavailable, please try after some time.

Methodology for calculating subscription and redemption price of units.

- Subscription / Switch-in (from other schemes/plans of the Mutual Fund) (This is the price investor need to pay for purchase/switch-in)

If the applicable NAV is Rs. 10/- and since there will be no entry load, then the purchase price will be Rs. 10/- - Redemption / Switch - out (to other schemes/plans of the Mutual Fund)(This is the price investor will receive at the time of redemption/ switch-out)

If the applicable NAV is Rs. 10/- and exit load is 0.5% then sale price will be 10 - (10 * 0.5%) = 10 - 0.05 = Rs. 9.95/-

The Indian Healthcare Sector

• The wealth of a nation relies on the health of its people – History has proven this time and again.

• The most recent being the pandemic which hindered economic activitiy, causing the Indian economy to contract by 24% in the first quarter following the outbreak.

• Healthcare are required by us at almost every stage of life – from birth to death. This makes the sector vital to the people and the economy.

• With a growing population that remains largely underpenetrated combined with sectoral measures, the growth of the Indian healthcare sector is inevitable.

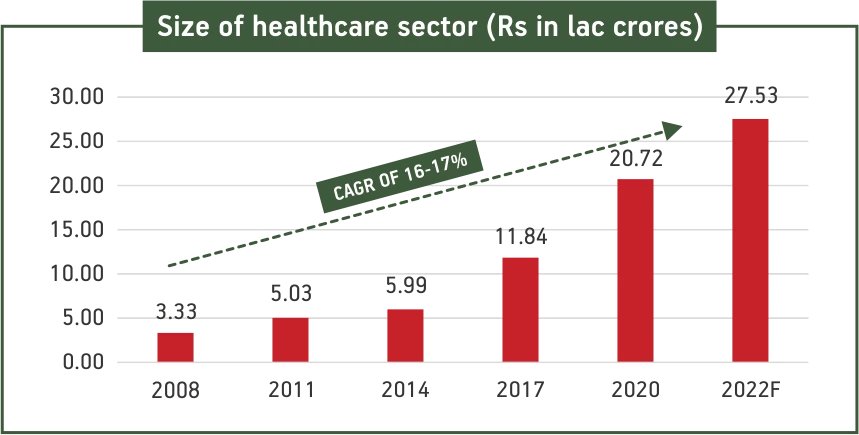

‘Healthy’ Growth of the Healthcare Sector

Grew 6x times over 12 years & expected to continue this ‘double-digit’ growth trajectory

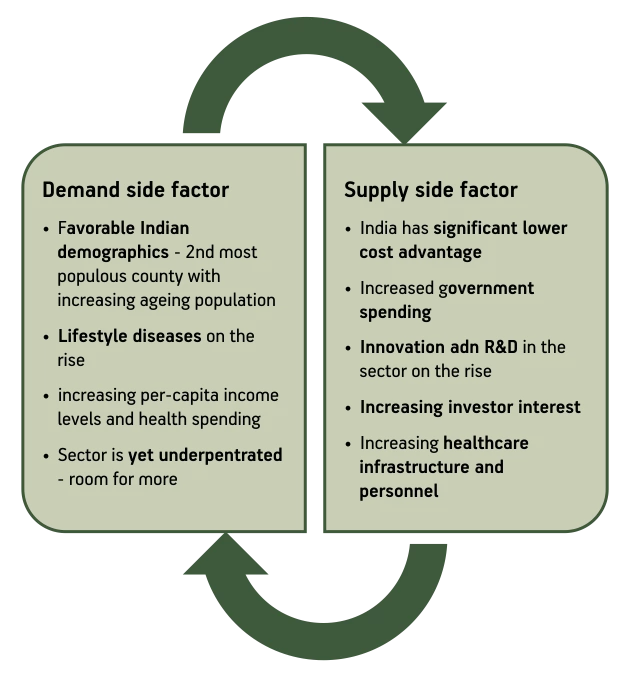

What’s working for the Indian Healthcare sector?

So, how can you participate in this promising sector?

• With a vast universe of pharma and healthcare stocks to choose from, passive investing on an ETF model can be a good route for investors.

• An ETF is a type of mutual fund that invests its portfolio in the same securities and in the same proportion as that of an underlying index, while being listed and traded akin to a share.

• An ETF based on the Healthcare Index offering the benefits of both mutual fund and stock trading, can be a good option to capitalise on the potential growth of the healthcare sector.

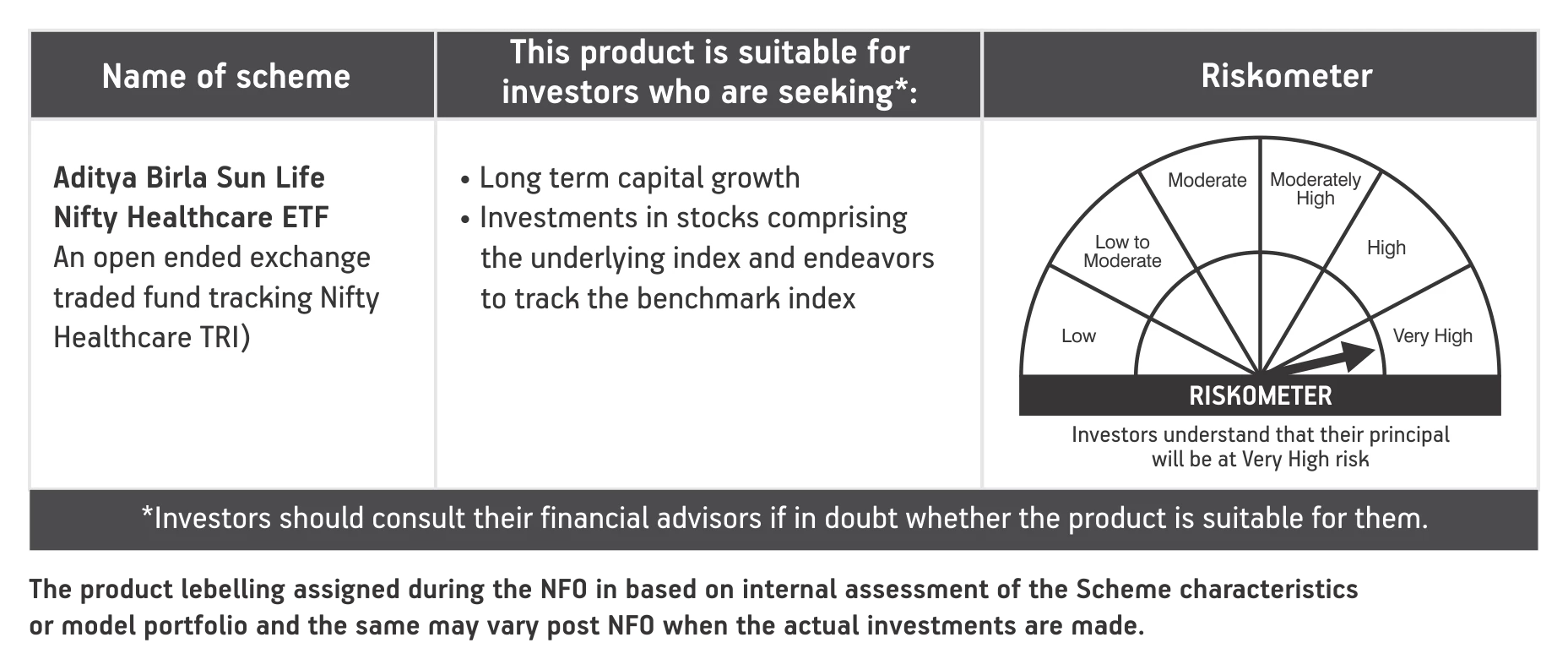

Presenting Aditya Birla Sun Life Nifty Healthcare ETF

• An open-ended ETF tracking the Nifty Healthcare TR Index.

• Its objective is to provide returns that closely correspond to the total returns as represented by the NIFTY Healthcare TR Index, subject to tracking errors.

• The NIFTY Healthcare Index is designed to capture and reflect the behavior and performance of ‘across-the-board’ healthcare companies.

• It comprises of a maximum of 20 tradeable, NSE listed companies that are engaged in the healthcare field such as pharma, hospitals, medical devices and supplies, laboratories and diagnostics, medical insurance etc.

• This fund follows a passive investing model – the index is rebalanced on a quarterly basis and reconstituted on a semi-annual basis.

• Being an ETF, it will be listed on the Indian stock exchange and its units can be bought and sold at real time prices akin to trading of a share.

Why should you invest in Aditya Birla Sun Life Nifty Healthcare ETF?

-

• Access to promising healthcare sector: India is an emerging global health hub ripe with opportunities – this fund gives you access to the top companies of this growing sector..

-

• Diversification across core & sunrise sub-sectors : The fund follows a ‘natural selection process’, allowing the NIFTY Healthcare Index to choose the best in the sector while diversifying across all healthcare sub-sectors.

-

• Affordable: Access to diversified portfolio at low minimum investment of Rs. 500/- and in multiples of Rs. 100/- thereafter during the New Fund Offer period.

-

• Passive investing strategy : A passive investing strategy makes this fund available at lower costs and with lower active stock selection risk

-

• High liquidity & ease of trading: Being a predominantly large cap fund, its portfolio is reasonably liquid. Also, being an ETF, it can be traded just like stocks at real time prices by investors.

-

• Tax efficiency : Being an equity-oriented fund, investors get beneficial tax rate of 15% on short term capital gains and 10% (above 1 lac) on long term capital gains earned on redemption of this fund.

1800-270-7000

1800-270-7000