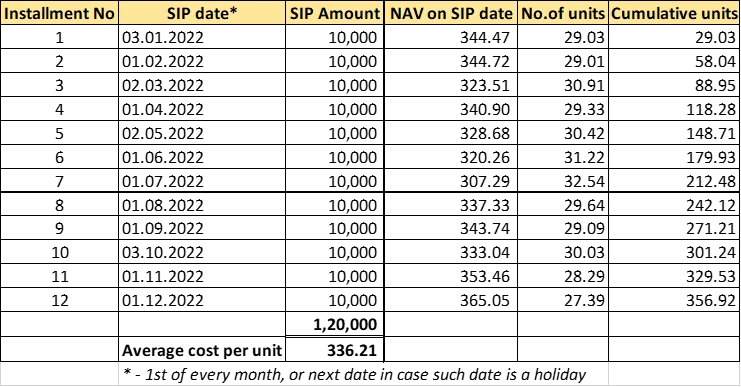

SIP stands for Systematic Investment Plan. It is a mode of investing in mutual funds, wherein investors invest pre-determined sums of money at regular intervals in a chosen mutual fund scheme. The frequency of investing can be at your discretion – weekly, monthly or quarterly. It is a disciplined way of investing in mutual funds.

-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

1800-270-7000

1800-270-7000