-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Voluntary Provident Fund (VPF)– It was preferred by many since it provided the same tax-free interest rate as Employees Provident Fund (EPF). However, w.e.f. 1st April 2021, the interest earned on VPF contributions beyond Rs. 2.50 lakhs in a financial year, has become taxable*. It is time to look for a viable alternative.

VOLUNTARY SIP – AN EFFICIENT ALTERNATIVE

• Starting a Voluntary Systematic Investment Plan (SIP) in a suitable mutual fund scheme can be an alternative.

• Along with providing tax efficient returns, a Voluntary SIP can help you build wealth over the long term.

• Depending upon the investment horizon and risk appetite, a suitable fund can be chosen for starting the SIP.

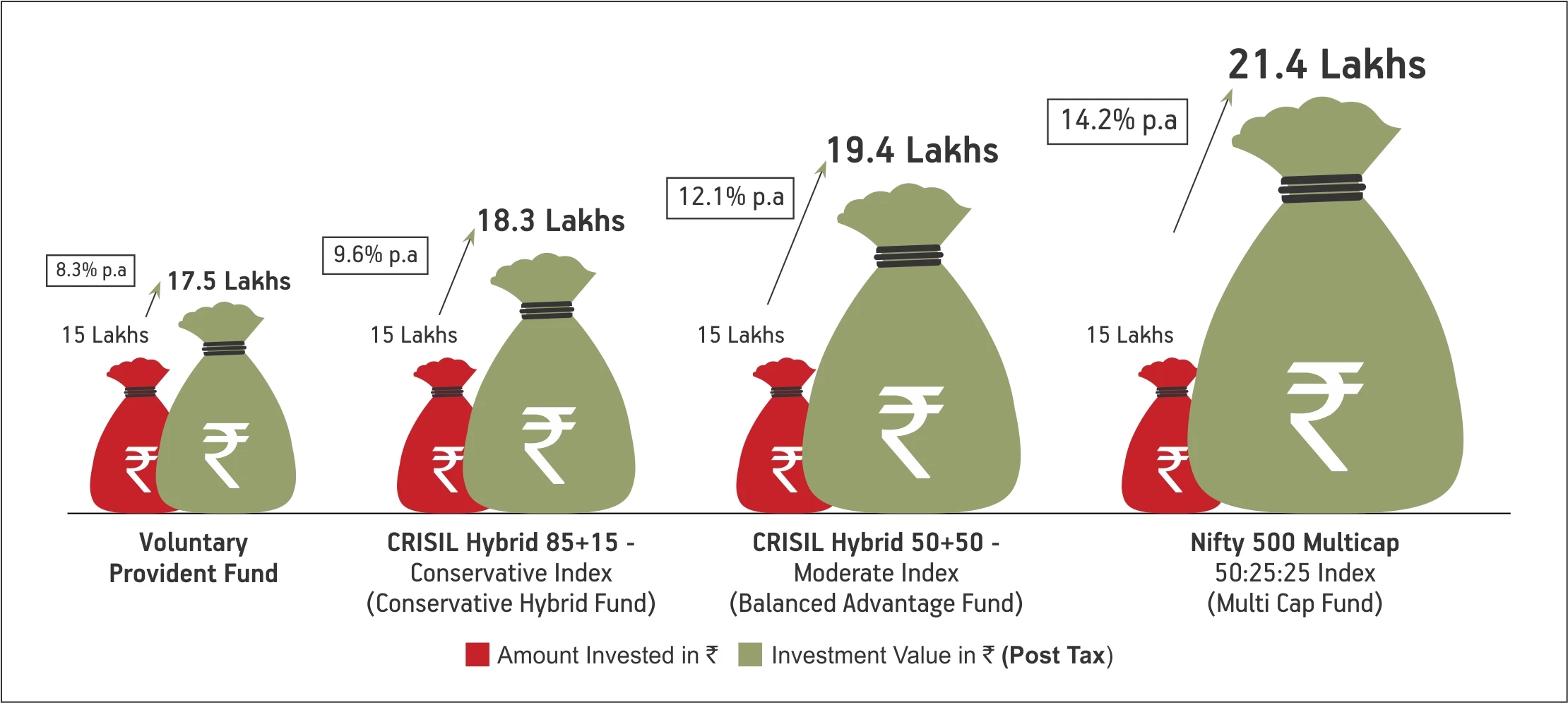

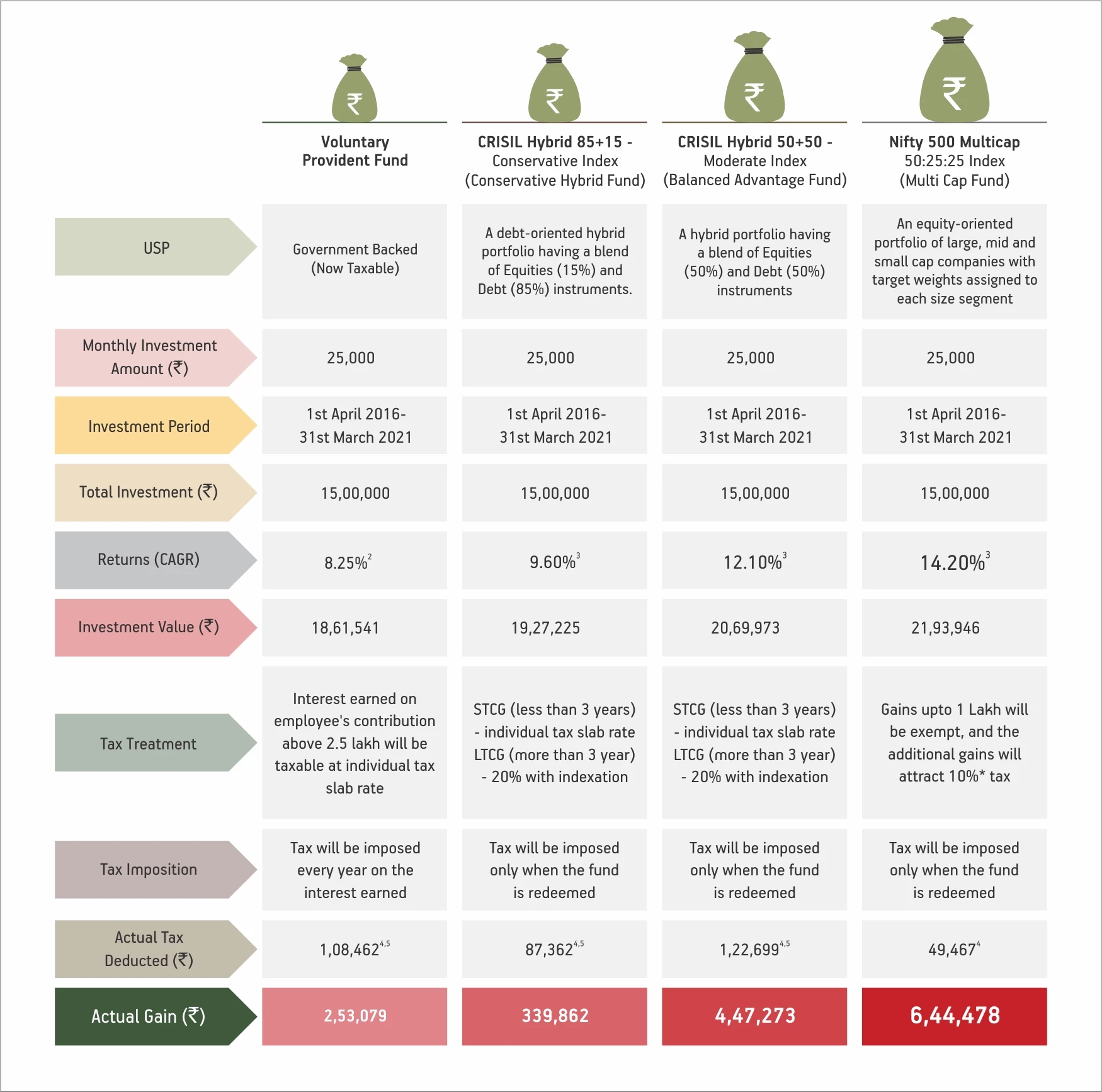

Post Tax Returns of Voluntary Provident Fund vis-a-vis Voluntary SIP in Mutual Funds

Illustration below depicts how a monthly investment of Rs. 25,000 in various investment products would have grown in 5 years’ time. We would like to highlight that we have used active mutual fund schemes benchmarks for calculation of returns in the below chart. Generally, active mutual fund schemes aim to outperform their respective benchmark.

The above table is for illustration purpose only. Data as on 31st March 2021. Investment is done on the 1st of every month.

VPF Interest data source: https://www.epfindia.gov.in/ As VPF investment is compounded annually hence CAGR is slightly lower than actual VPF interest rate.

Benchmark data source: MFIE.

Applicable cess and surcharges extra.

Assuming the highest tax bracket @30% plus applicable cess and surcharge.

Reference of VPF has been given for the purpose of the general information only. CAGR has been considered with monthly compounding consistent with SIP investing. PF investments are compounded annually which may result in a slightly lower CAGR.

Investment in Mutual Funds Schemes carry high risk. The Tax calculation shown above is for illustration purpose and general information only. Amount(s) mentioned above may undergo a change if assumptions specified herein do not hold good. Investors are advised to read the scheme information document of the scheme carefully before investing and consult their Tax Consultant or Financial Advisor to determine tax benefits applicable to them.

BENEFITS OF VOLUNTARY SIP

Flexible Investment Amount starting from as low as Rs 100 with no upper limit

Helps you build wealth for your long-term goals like retirement etc

Can be started in different mutual fund schemes basis your risk profile, investment horizon and goals

Provides Tax Efficient Returns

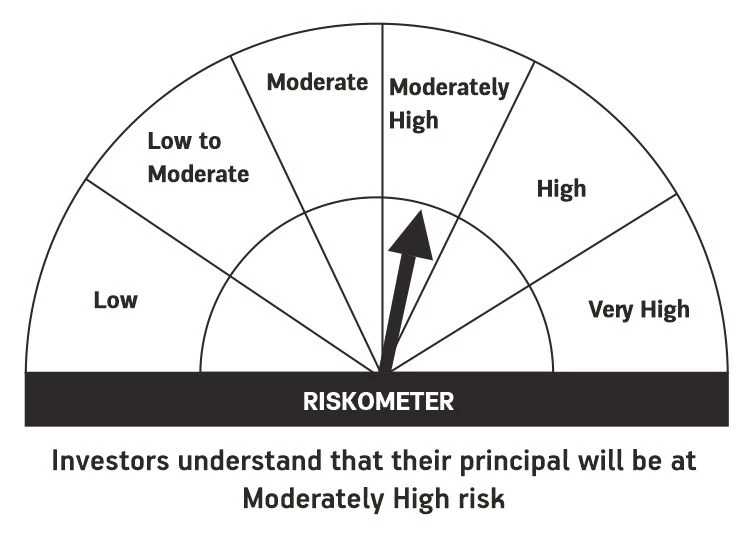

Aditya Birla Sun Life Regular Savings Fund

(An open ended hybrid scheme investing predominantly in debt instruments)

This product is suitable for investors who are seeking*

- • Regular income with capital growth over medium to long term

- • Investments in debt and money market instruments as well as equity and equity related securities [10-25%]

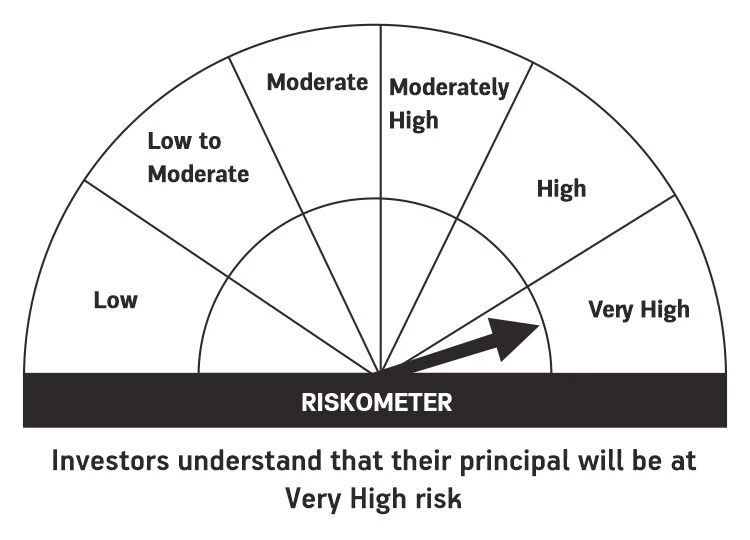

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

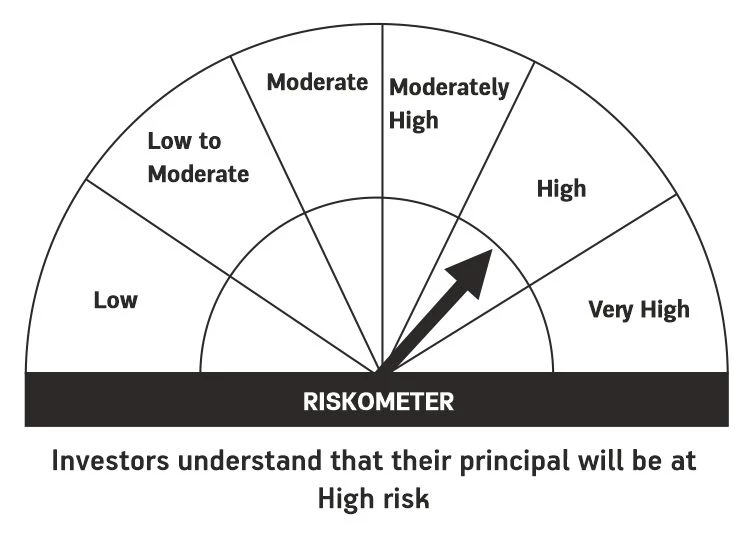

Aditya Birla Sun Life Balanced Advantage Fund

(An open ended Dynamic Asset Allocation fund)

This product is specially designed for investors seeking*

- • Capital appreciation and regular income in the long term

- • Investment in equity & equity related securities as well as fixed income securities (Debt & Money Market securities)

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Aditya Birla Sun Life Multi-Cap Fund

(An open ended equity scheme investing across large cap, mid cap & small cap stocks))

This product is suitable for investors who are seeking*

- • Long term capital growth and income

- • Investment predominantly in equity and equity related instruments as well as debt and money market instruments

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

1800-270-7000

1800-270-7000