-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Investment Objective

The investment objective of the scheme is to provide returns similar to the returns generated by Aditya Birla Sun Life Silver ETF.

This product is suitable for investors who are seeking

- Investors seeking returns that are in line with the performance of Aditya Birla Sun Life Silver ETF over the long term.

- Investments in the units of Aditya Birla Sun Life Silver ETF, which in turn invests in physical silver of 99.9% purity (fineness)

Fund Details

- Fund Type - (An Open ended Equity Scheme)

- Category - Other-FOF

- Sub-Category - FoF-Domestic-

- Min Investment - Rs. 100/- and in multiples of Rs 1/- thereafter.

- Fund Manager - Mr. Pranav Gupta & Mr. Haresh Mehta

- Latest NAV - 20.934 (as on 24-Sep-2025)

- Inception Date - Feb 02, 2022

View Full Details

Fund Management

-

Mr. Pranav Gupta

Total Experience : 4 years

View Full ProfileMr. Pranav Gupta has over 4 years of experience in capital market across segments such as derivative sales trading and Alternative Research. Prior to joining Aditya Birla Sun Life AMC Limited, he was part of the Alternate Research and Strategy department at Centrum Broking Limited and has also worked with OHM Stock Broker Pvt. Ltd -

Mr. Haresh Mehta

Total Experience : 15 Years

View Full ProfileMr. Haresh Mehta has a total work experience of around 15 years in dealing related activities. Prior to joining Aditya Birla Sun Life AMC Limited, he was associated with Baroda BNP Paribas Asset Management India Pvt. Ltd for over 4 years as a Dealer and Investment Support. He has also worked for over 11 years as a Trader in Institutional equities with First Global Stockbroking Pvt. Ltd.

View Fund Managed by

Load More

Total Schemes managed by {fundmanagername} is {fundmanagerfundcount}

Different plans shall have a different expense structure. The performance details provided herein are of (regular / direct) plan.

Different plans shall have a different expense structure. The performance details provided herein are of (regular / direct) plan.

To check an all-time best return rate for equity funds, check how they've performed in the last 3 or 5 years.

Check your investment performance

Use this tool by entering any amount you would have invested to calculate how much it would be worth today.

Rs

Minimum Amount is Rs 500

Select the type of Fund

Select the Fund name

Select Lumpsum or frequency of SIP

Select the date invested

Your Investment Summary

- Investment AmountRs 5000

- Initial units per month 29.5

- Current valueRs 50,000

- Current NAV value 260

- Current Units 30

-

XIRR

5.10%

Internal rate of return or annualized yield for a schedule of cash flows occurring at irregular intervals.

-

Benchmark XIRR

8%

Internal Rate of return or annualized yield for a schedule of cash flows occurring at irregular intervals for respective benchmark index.

Fund Summary

Entry Load

Exit Load

Load Comments

NIL

For redemption/switch-out of units on or before 30 days from the date of allotment: 0.5% of applicable NAV.

Not Applicable

Highlights

- Easy Liquidity

- Diversification

- No Wealth Tax

A multi-use Commodity

A precious metal, used in Telecom(5G), Electric Vehicles (EVs), Renewable Energy, Pharma, Space & more..Has Strong Demand in Future

With Government push for cleaner energy resources like solar panels, EVs etc., its demand is expected to rise exponentially.A Hedge to your portfolio

Acts as a potential hedge against inflation.Provides Stable Performance throughout Market Cycles

Silver has provided reasonable returns through all phases of the economy.

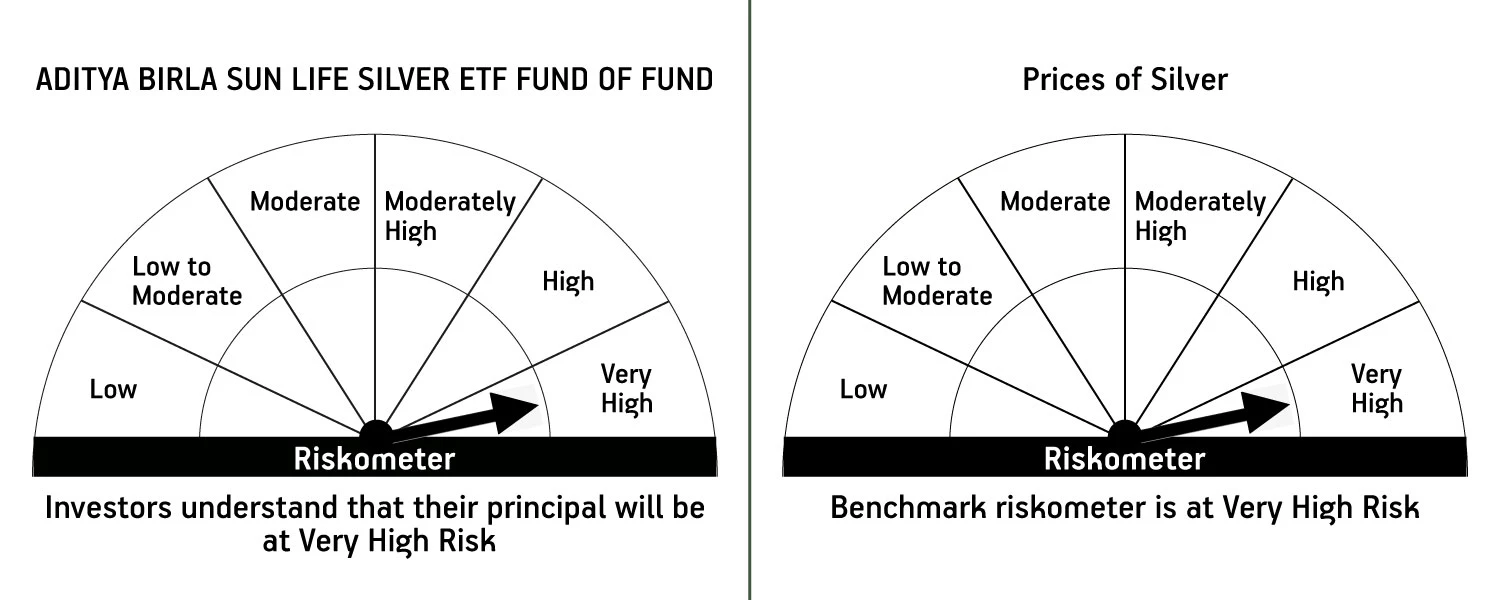

Aditya Birla Sun Life Silver ETF Fund of Fund

(An open ended fund of fund scheme investing in the units of Aditya Birla Sun Life Silver ETF)

This product is specially designed for investors seeking*

- Investors seeking returns that are in line with the performance of Aditya Birla Sun Life Silver ETF over the long term

- Investments in the units of Aditya Birla Sun Life Silver ETF, which in turn invests in physical silver of 99.9% purity (fineness)

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Show More

Similar Funds

-

View Details

Aditya Birla Sun Life Active Debt Multi Manager FOF

Nav

37.8840.01(0.02%)

-

View Details

Aditya Birla Sun Life Gold Fund

Nav

33.12-0.33(-0.98%)

-

View Details

Aditya Birla Sun Life Financial Planning FoF - Aggresive Plan

Nav

54.126-0.03(-0.06%)

-

View Details

Aditya Birla Sun Life Financial Planning FoF - Moderate Plan

Nav

42.698-0.03(-0.07%)

-

View Details

Aditya Birla Sun Life Financial Planning FoF - Conservative Plan

Nav

34.30.01(0.02%)

Disclaimer

For further details on the Scheme, refer Scheme Information Document and Key Information Memorandum.

1800-270-7000

1800-270-7000