-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Investor Message - FY25 Q2

As we enter the second quarter of this financial year, I am pleased to share an optimistic macroeconomic outlook for India. According to the Reserve Bank of India, the real GDP growth for current financial year 2024-25* is projected at 7.2% with first quarter at 7.3%, second quarter at 7.2%, third quarter at 7.3%, and fourth quarter at 7.2%. The recent election results have ensured the continuation of many key economic policies, which is expected to further stimulate economic growth.

The global economy has been navigating a complex environment characterized by fluctuating growth rates, evolving trade dynamics, and geopolitical tensions. Despite these challenges, we have observed steady progress in key markets. The U.S. economy continues to show resilience with stable growth rates, while emerging markets are witnessing varying degrees of recovery. Central banks worldwide are adapting their monetary policies to balance growth and inflation, which has a profound impact on investment flows and asset valuations.

.

The upcoming Union Budget is expected to underscore the Government's commitment to maintaining fiscal discipline while implementing measures to boost consumption. With India's favourable demographic profile and a significant working-age population, we have high expectations for a budget that balances fiscal responsibility with initiatives to stimulate consumer spending.

The inclusion of India in the ‘JP Morgan Emerging Market Bond Index’, is expected to bring in strong inflows and further boost business and consumption growth in India. This development is also likely to positively affect interest rates and borrowing rates in the country, contributing to further economic expansion.

Looking ahead, there is cautious optimism about potential rate cuts towards the end of the year or early next year. This gradual reduction will support our growth momentum while keeping inflation in check.

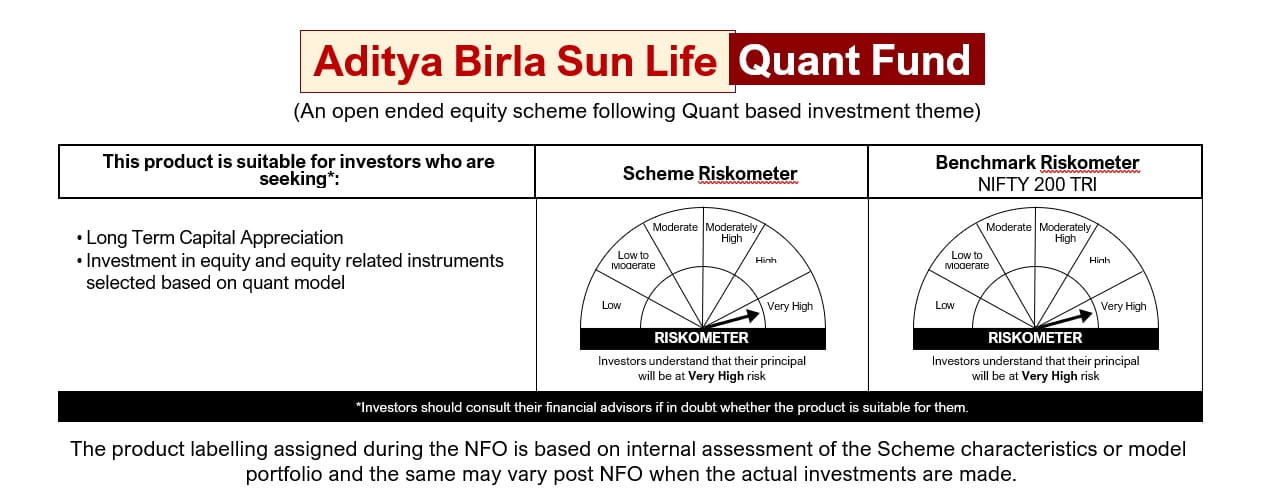

Aditya Birla Sun Life Mutual Fund has also recently launched the Aditya Birla Sun Life Quant Fund, which blends quantitative techniques, such as advanced mathematical models, with investment expertise to identify investment opportunities. To harness the momentum in India’s economic growth, investors can also consider funds like the Flexi Cap Fund, India GenNext Fund, and Digital India Fund for wealth creation opportunities.

In conclusion, the current economic indicators and government policies suggest a stable and growth-oriented market environment. I encourage you to consider a diversified investment approach to capitalize on the various opportunities available.

Happy Investing!

Regards,

A. Balasubramanian

Click here for other riskometers

*Source: RBI MPC meeting (5th - 7th June 2024)

1800-270-7000

1800-270-7000