-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

Investing in ESG Fund

can help boost your

portfolio

Invest Online

Investing in ESG Fund

can help boost your

portfolio

Investor App

Investing in ESG Fund

can help boost your

portfolio

Invest Online

Investing in ESG Fund

can help boost your

portfolio

Investor App

ESG Fund

This is an open ended thematic equity scheme investing in companies following ESG theme where it will follow a bottom-up approach for portfolio construction.

• The fund will maintain a market cap agnostic portfolio with 60-80% in Large Cap and remaining in Mid & Small Cap

• The fund will seek to have a focused portfolio of 40-50 ESG compliant companies with high growth potential

• Fund will seek to maintain a “True to Label” portfolio by excluding non-conforming sectors/companies.

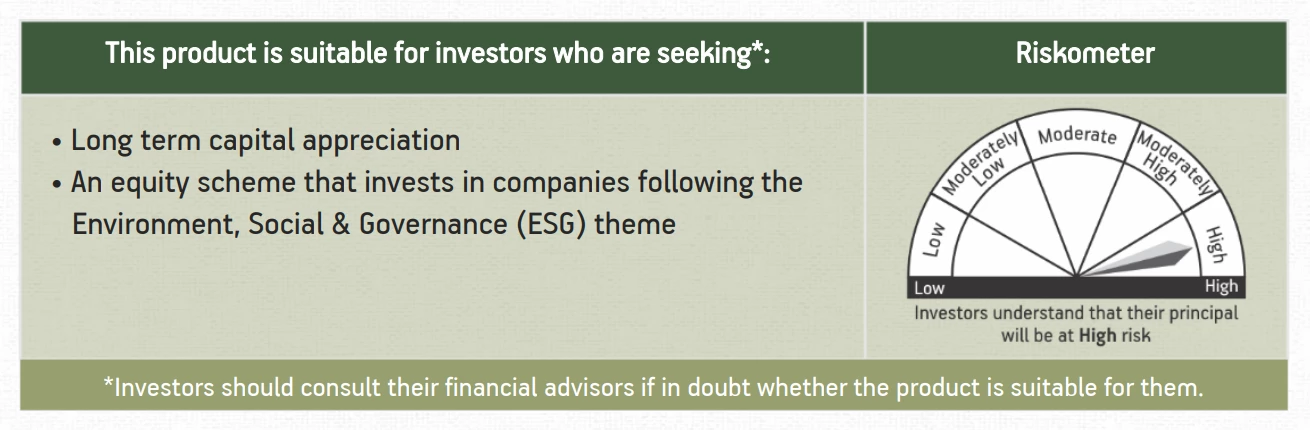

The fund is suitable for Long term Equity Investors with an Investment horizon of 5 years and above.

.

What is ESG Investing Fund?

We are making 'Sustainable' choices in many aspects of everyday life. Investing too, is not far behind. Globally, ESG investing has found favour as it looks beyond the financial parameters and seeks out stocks based on 3 ESG parameters:

• Environmental impact – companies that have eco-friendly policies

• Social responsibility – companies that protect interest of people

-

• Corporate Governance practices – companies that work with transparency

With corporates recognising the need to adopt such practices and consumers favouring such brands as well, opting for ESG investing can aim to give better long-term growth prospects.

Why Aditya Birla Sun Life ESG Fund?

It is an open-ended equity scheme investing in companies following Environment, Social & Governance (ESG) theme.

The Scheme will seek to invest minimum 80% of its net assets in equity & equity related instruments. It could also invest in foreign securities up to 35% of its net assets.

The Scheme will follow a diligent investment approach to seek out ESG compliant stocks:

-

• Companies would first be scored on the 3 pillars of ESG basis their actions:

1. Environmental impact on the planet and resources

2. Social responsibility towards customers, employees, investors and the public at large

3. Robust, implemented Corporate Governance practices for transparency and stability of management

• Non-conforming companies’ stocks will be excluded.

• ESG compliant stocks with high growth potential would then be selected.

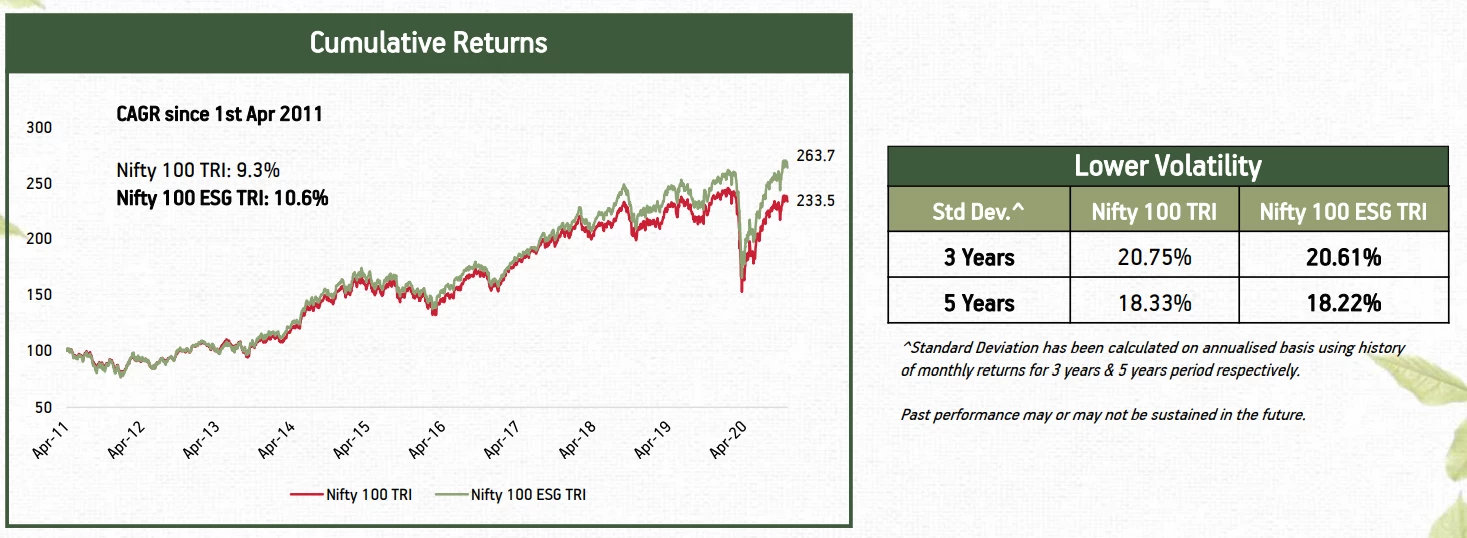

Historically, ESG investing has outperformed the market and generated better risk-adjusted returns

Index data rebased to 100 since 1st April 2011 till 30th Oct 2020; Source: MFIE Index

Why invest in ESG Fund Now?

-

• ESG Investing Approach: ESG investing looks for companies which in addition to robust financials, have sound governance practices & tenable business models as well. This can help in delivering reasonable returns along with positive societal impact over the long term.

• Risk Mitigation for your portfolio: This scheme looks to avoid modern-day risks that can arise from non-compliance with ESG parameters, thus having potential for providing better risk-adjusted returns.

• Emerging Investing Theme: ESG concept is a well-established theme globally. It is nascent in India, thus offering the potential to generate reasonable returns over the long term.

• Capitalising on opportunities: The need for sustainability gives rise to several new business opportunities which this fund seeks to reap returns from.

Benefits Of ESG Fund

Long term capital appreciation potential

Identifies companies that have the potential for long-term viable growth as a result of adherence to ESG parameters

Risk Management Potential

Focus on risk mitigation arising from ESG factors by selecting high quality stocks that score high on these factors

Capitalise on opportunities

May have the potential to take advantage of emerging business opportunities that arise from the modern-day consumers’ choices

Fund manager expertise

Get access to expert fund manager knowledge for selecting ESG stocks

Why invest now?

High Uncertainty

The pandemic has resulted in high uncertainty in the business environment.

Development of opportunities

With the changing behaviour and as we adjust to the ‘new normal’, several new trends and companies have emerged in different sectors.

Revision of ratings

The companies whose ratings have suffered due to current lack of demand can expect a boost in their valuations once things return back to normal.

1800-270-7000

1800-270-7000