-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

What is Turbo STP (Systematic Transfer Plan)? Why should your investors opt for this?

Investors aim to buy low and sell high. This has been the most popular strategy amongst investors across the world. This investing strategy offers a black and white take on how one can realize the profits in the market.

When your investors ask – Is it truly possible to optimise the cost of purchase?

You can suggest that a systematic transfer plan may have the potential to do so.

What is Turbo STP?

Aditya Birla Sun Life Turbo Systematic Transfer Plan (“Turbo STP”) is a facility wherein your investors can opt to transfer variable amount from a source scheme to the target scheme at particular intervals decided by them.

Your investor will have to provide a Base Instalment Amount that needs to be transferred to the Target Scheme. The base instalment amount will be multiplied with the Equity Valuation Multiplier (EVM) score which is an inhouse model to arrive at the value of transfer for each instance of Turbo STP.

What is a systematic transfer plan in mutual funds?

A systematic transfer plan (STP) is a way to invest in mutual funds where an investor sets up a plan to transfer money from one fund to another.

The money is transferred at the decided interval as per your investor’s choice (weekly, monthly, etc.) and this helps them take advantage of market movements.

Who uses the STP facility typically?

STPs are often used by investors who want to invest in equity mutual funds but are worried about volatility in the stock markets.

By starting an STP, your investor can send small amounts of money into an equity mutual fund every week or month. This can help them to reduce the risk of investing in equity mutual funds.

Why should your investor use a systematic transfer plan?

There are several reasons why your investor should consider using an STP:

Averaging out their investment costs: Through STPs, your investors can buy units at different prices. This technique is called rupee cost averaging and it can help them reduce the risk of investing in equity mutual funds.

Timing the market: Many investors try to time the market by waiting for the perfect moment to invest. This may lead to missed opportunities. By investing through an STP, they can try to take advantage of market movements without having to time the market perfectly.

Disciplined investing: An STP can help your investors stay disciplined with their investments. It takes away their temptation to time the market or try to second-guess where the markets are headed.

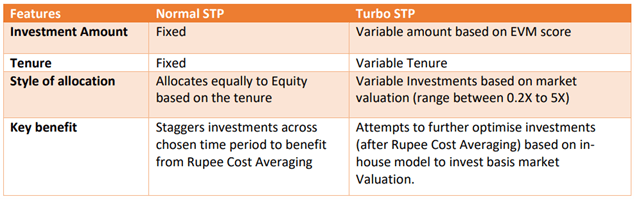

What is the difference between Normal STP and Turbo STP?

Image Description – A comparison between the features of Normal STP and Turbo STP.

Conclusion:

Turbo STP is an innovative investment facility which automatically invests higher in equity schemes when market valuations are attractive and invests lower amount when the markets are expensive. It intends to optimize allocation of lumpsum money through an in-house valuation model.

For AMFI/NISM Certified partners only. For private circulation only.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000