-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

Investment objective

The investment objective of the Scheme is to generate returns

corresponding to the total returns of the securities as represented by the

CRISIL IBX Gilt Index – April 2026 before expenses, subject to tracking

errors.

The Scheme does not guarantee/indicate any returns. There can be no

assurance or guarantee that the investment objective of the Scheme will be

achieved.

This product is suitable for investors who are seeking

- Income over the target maturity period

- Open ended Target Maturity Index Fund that seeks to track CRISIL IBX Gilt Index – April 2026

Fund Quants as of 30th June 2023

- Total Net Assets (Cr) :336.69

- The Average Maturity Of Complete Portfolio (Yrs) :2.73

- YTM (%) :7.16%

- Mark to Mkt (%) :99.70%

- Modified Duration (Yrs) :2.43

- Mac Duration :2.51

Fund Details

- Fund Type - Open-Ended

- Category - Other

- Sub- Category - Index Funds

- Min Investment - Minimum of Rs. 500/-

- Fund Manager - Mr. Bhupesh Bameta & Mr. Sanjay Godambe

- Latest NAV - 11.165 (as on 02-May-2024)

- Inception Date - Oct 07, 2022

View Full Details

Fund Management

-

Mr. Bhupesh Bameta

Total Experience : 12 years

View Full ProfileBhupesh Bameta is a Fund Manager and Economist with Aditya Birla Sun Life AMC Limited. He brings with him an overall experience of 12 years in the financial services industry, and joined ABSLAMC’s Fixed Income Investment team in December 2017.

Prior to joining ABSLAMC he was the Head of Research in Forex and Rates Desk at Edelweiss Securities Limited, covering global and Indian forex markets and economies. He was also associated with Quant Capital for 6 years as an Economist and was covering Indian and global economy and markets.

Bhupesh is an Engineering graduate from IIT-Kanpur and was All India Rank 1 in Graduate Aptitude Test in Engineering (GATE). He also holds the CFA Charter (USA). -

Mr. Sanjay Godambe

Total Experience : 14 Years

View Full ProfileMr. Sanjay Godambe is a finance professional with an experience of over 14 years in the area of finance, Mutual Fund dealing and its related activities (including fixed income dealing). He possesses proficient knowledge in Capital Market i.e. in Government Securities, Corporate Bonds, Certificate of Deposits and Commercial Papers. He also has prior experience of managing operations and implementing strategies towards enhancing market penetration, business volumes and growth.

View Fund Managed by

Load More

Total Schemes managed by {fundmanagername} is {fundmanagerfundcount}

Different plans shall have a different expense structure. The performance details provided herein are of (regular / direct) plan.

Different plans shall have a different expense structure. The performance details provided herein are of (regular / direct) plan.

To check an all-time best return rate for equity funds, check how they've performed in the last 3 or 5 years.

Check your investment performance

Use this tool by entering any amount you would have invested to calculate how much it would be worth today.

I had invested

as an

CALCULATE RETURN

Rs

Minimum Amount is Rs 500

in

Select the type of Fund

Fund

Select the Fund name

as an

Select Lumpsum or frequency of SIP

starting on

Select the date invested

Your Investment Summary

- Investment AmountRs 5000

- Initial units per month 29.5

- Current valueRs 50,000

- Current NAV value 260

- Current Units 30

-

XIRR

5.10%

Internal rate of return or annualized yield for a schedule of cash flows occurring at irregular intervals.

-

Benchmark XIRR

8%

Internal Rate of return or annualized yield for a schedule of cash flows occurring at irregular intervals for respective benchmark index.

Fund Summary

Entry Load

Exit Load

Load Comments

NIL

NIL

NIL

Highlights

- G-secs are sovereign debt instruments, guaranteed by the Government of India. This means they have low credit risk.

- They have attractive yields for the 6-year investing tenure.

- Trade at high volumes and thus enjoy good liquidity.

- Traditional savings products may suffer from some disadvantages

Certain traditional savings products may suffer from lower liquidity on account of premature withdrawal charges coupled with lower net of tax returns. On the other hand, corporate bonds potentially offering high returns may come come with higher risk levels.

- G-Secs - an investment option for the medium term

G-secs are highly liquid and have sovereign rating making them a safe avenue. Their likely inclusion in global indices could also drive capital appreciation for investors in the medium term.

- G-secs yield curve attractive up to a 5-6-year period

Hawkish global banks, strong high frequency domestic indicators and RBI rate hike expectations have elevated the short end of G-sec yield curve; thus, currently offering attractive yields.

An efficient way to invest in G-secs – Passive Debt funds

These funds seek to track and replicate the performance of an underlying debt index by investing in the same securities, and in the same proportion as the index it tracks. They have no lock-in making them highly liquid, at the same they offer predictability of returns, safety and tax efficiency.

Why should you invest in Aditya Birla Sun Life CRISIL IBX Gilt – April 2026 Index Fund?

- Target Maturity Approach :

The maturity of the scheme is expected to be April 30, 2026. Clarity on when the scheme matures makes investments in the fund amenable to goal planning. - Benefit of Indexation:

If held till maturity or for a period of more than 3 years, redemption gains from the investment will get the benefit of indexation making them tax efficient. - Credit risk mitigated as part of design:

Being backed by the government, G-secs have sovereign rating which can help mitigate the risk of default on either interest payment or principal repayment. - Liquidity available during the tenure of the fund:

The fund is open ended without applicability of any exit load nor any lock-in period. Thus, investments can be easily liquidated at no additional cost. - No duration risk at time of maturity:

Investments held till maturity are redeemed at principal value, eliminating risk of price changes and this eliminating duration risk at the time of maturity. - Roll down strategy – apt in the current interest rate environment:

An accrual approach that seeks to earn only coupons/yields at regular intervals by buying and holding securities; suited in elevated rates environment. . - Low minimum investment:

Investors can invest in this scheme with amounts as low as Rs.500 during the NFO period. .

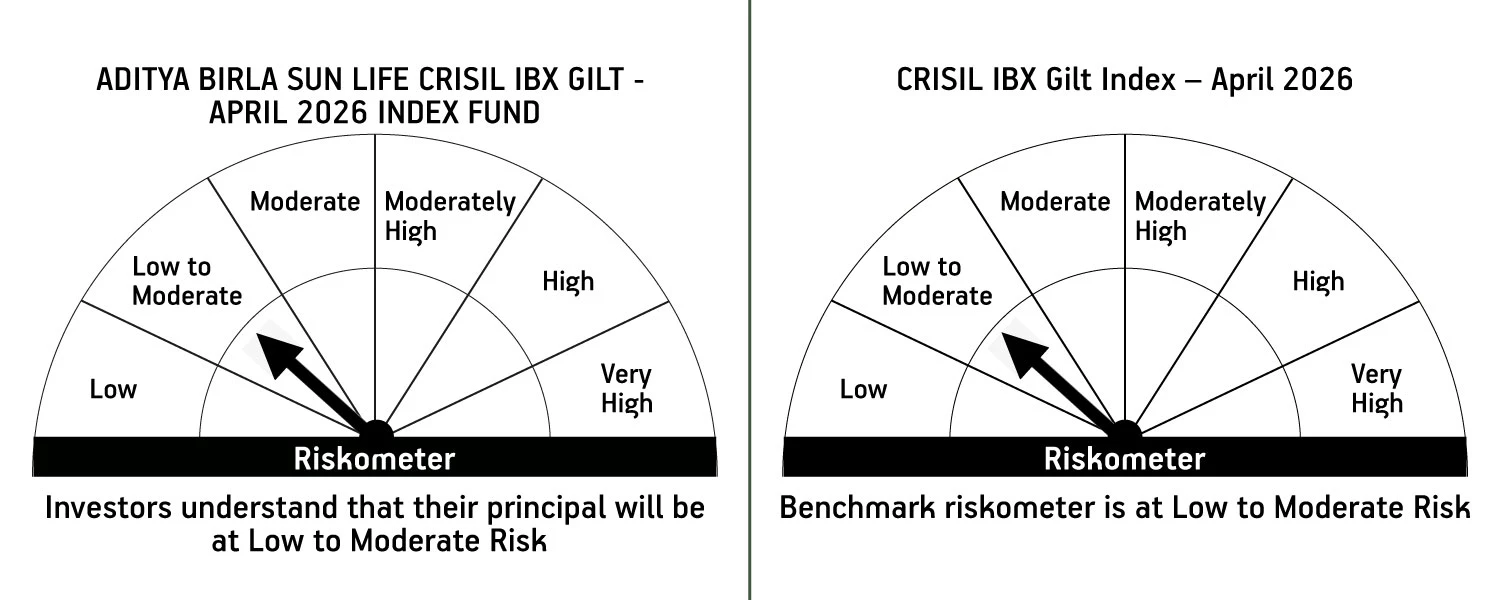

Aditya Birla Sun Life CRISIL IBX Gilt – April 2026 Index Fund

(An open ended Target Maturity Index Fund tracking the CRISIL IBX Gilt Index – April 2026. A relatively high interest rate risk and relatively low credit risk.)

This product is suitable for investors who are seeking*

- Income over the target maturity period

- Open ended Target Maturity Index Fund that seeks to track CRISIL IBX Gilt Index – April 2026

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Show More

Similar Funds

-

View Details

Aditya Birla Sun Life CRISIL IBX 60:40 SDL + AAA PSU - Apr2027 Index Fund

Nav

11.0790.01(0.06%)

-

View Details

Aditya Birla Sun Life Nifty 50 Index Fund

Nav

226.3160.43(0.19%)

-

View Details

Aditya Birla Sun Life CRISIL IBX Gilt Apr 2029 Index Fund

Nav

11.2670.02(0.14%)

-

View Details

Aditya Birla Sun Life CRISIL IBX 50:50 Gilt plus SDL – Apr 2028 Index Fund

Nav

11.2350.01(0.07%)

-

View Details

Aditya Birla Sun Life Nifty 50 Equal Weight Index Fund

Nav

16.0180.06(0.38%)

-

View Details

Aditya Birla Sun Life CRISIL IBX 60:40 SDL + AAA PSU - Apr 2025 Index Fund

Nav

11.1020(0.04%)

-

View Details

Aditya Birla Sun Life Nifty Midcap 150 Index Fund

Nav

20.9450.09(0.43%)

-

View Details

Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

Nav

18.820.01(0.06%)

-

View Details

Aditya Birla Sun Life Nifty Next 50 Index Fund

Nav

16.0320.27(1.7%)

-

View Details

Aditya Birla Sun Life Nifty SDL Sep 2025 Index Fund

Nav

11.1690.01(0.07%)

-

View Details

Aditya Birla Sun Life Nifty SDL Sep 2027 Index Fund

Nav

10.8870.01(0.06%)

Disclaimer

For further details on the Scheme, refer Scheme Information Document and Key Information Memorandum.

1800-270-7000

1800-270-7000