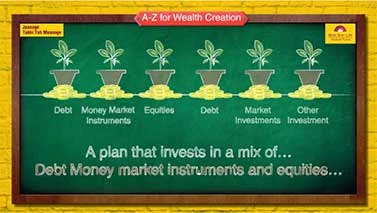

Income funds are a class of debt mutual funds that invest in a combination of government securities, certificates of deposits, corporate bonds and money market instruments. They seek to generate returns, both in declining and rising interest rate scenarios by managing their portfolio actively.

-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

1800-270-7000

1800-270-7000