-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Consumer Discretionary: Recovery around the corner

Sep 09, 2024

5 Mins Read

Subham Sharma

Subham Sharma

Listen to Article

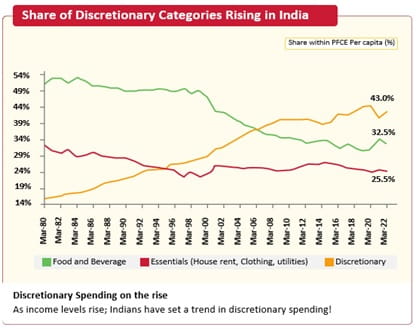

India’s private consumption expenditure forms around two-thirds of the GDP which translates to a retail market size of almost $1 trillion. Historically, this market has grown in line with the Nominal GDP rate of growth. Of this, close to only 20% of the market is organized. Given the tailwinds of the demographic profile, increased disposable income, urbanisation and rise in women employment; the organised retail sector could grow at a faster pace as compared to the nominal GDP growth rate over the next few decades. The other sub-sectors comprising food & grocery, jewellery, apparel, footwear, QSR, alcoholic beverages, beauty, and electronics also have a huge growth potential going forward.

Source: Morgan Stanley

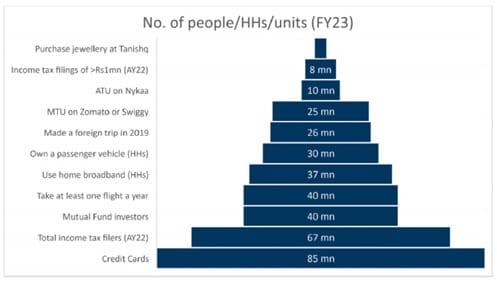

Though the long-term opportunity is ripe for a sector like retail & discretionary in India, it has gone through its own set of challenges over the past two years. A clear trend which has been observed during the post-Covid period is a K-shaped demand recovery, wherein companies catering to high-income households have fared well whereas the mass segment has lagged. While the pandemic dealt a blow to all sectors in the economy, it was those at the bottom of the income pyramid that were perhaps hit the most. That’s the reason why only a few pockets of retail did well while most others struggled.

The muted growth for most retail companies during the same time can be attributed to a mix of internal and external factors. The rise in interest rates impacted the disposable income for consumers; low real wage growth for rural consumers, given higher inflation, also dampened sentiments.

Idiosyncratic reasons attributable to a slowdown in discretionary sub-sectors included a substantial increase in store count across retailers pre-empting the pent-up demand post-Covid to sustain, a large stockpile of inventory and high RM (Raw Material) inflation which was passed on to the consumers. It was during this time that muted consumer demand, coupled with higher fixed costs impacted profitability across players, which led to an earnings downgrade cycle in the sector. Though demand is still lower versus historical levels, we believe recovery is round the corner due to a mix of factors - recovery in overall macro, as well as corrective steps undertaken by the companies to ramp up sales. Barring food inflation which witnessed volatility, at an overall level, inflation continues to be soft. This coupled with better monsoons and market anticipation of rate cuts in the latter half of this financial year bodes well for both urban and rural mass recovery. The announcements in the recent Union Budget should also provide a fillip to some categories through job creation, continuation in infrastructure spending, reduction in import duty on gold etc. Higher spending and improving sentiment will add a fillip to the organised retail segment. While the past year and a half has seen earnings downgrade, we believe the worst is over for the sector with demand picking up over the next couple of quarters. Also, improved profitability will be driven by demand revival aided by operating leverage. Overall, we remain believers in the long-term growth trajectory for the consumer discretionary sector, especially the ones catering to specific consumer needs and having a focused approach. Hence, this could be a good opportunity to look at quality companies with business moats, backed by strong management and balance sheets. Within broader discretionary segments, we like certain select Jewellery, Alcoholic Beverages, QSR (quick service restaurant) and Consumer durable players. Source: Goldman Sachs

While the number of consumers for discretionary products/services in India is still very low, it is expected to increase substantially over the coming years driven by the wealth effect and increasing per capita income. The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Green shoots of recovery

Also, companies during this time have curtailed their store expansion plans and have been selective and organised in growth aspirations. Inventory levels throughout the system are significantly improved compared to the situation before. This along with improved commentary on footfalls, recovery in SSSGs (same-store sales growth) for some players, and a higher number of marriage days in the second half of the year provides confidence for a gradual recovery.

A decadal opportunity

You May Also Like

Loading...

1800-270-7000

1800-270-7000