-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

IT Services: Green Shoots in Demand

Jul 15, 2024

2 Mins Read

Kunal Sangoi

Kunal Sangoi

Sarthak Batra

Sarthak Batra

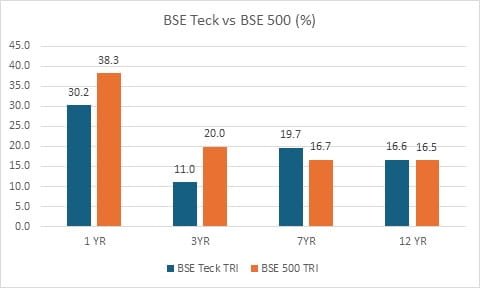

Listen to Article

After the initial Covid-induced accelerated tech spends from 2020-2022, the last one or two years have seen enterprises rationalising excessive spending and a pullback in discretionary spends, led by geopolitical tensions, concerns over economic slowdown, and high interest rates. This has led to the BSE Teck index underperforming the broader BSE 500 index by 8.1% and 9% over the last 1 and 3 years. We believe this was a cyclical slowdown and we are on the verge of a revival in tech spending which should also lead to the sector starting to do well vis-à-vis the broader market.

Source: ABSLAMC Research, Bloomberg

For the past 15 years, Indian IT services have grown every year, despite several instances where most global corporations witnessed revenue contraction or decline. We have seen tech intensity (tech spending as a % of revenues) for companies only go up over the years. Most of the enterprises are early in their digital transformation journey with only 40% of workloads transitioned to the cloud (only 20% are modernized). The explosion of data in the past decade, advanced analytics, and customers' demand for a better experience have made it mandatory for enterprises to modernize their systems, thus the need to embark on large-scale digital transformation programs. BFSI – which is the largest vertical for Indian IT services is seeing green shoots in demand as macro uncertainty has reduced, and banks increase investments in risk and compliance, and new areas such as AI/ML.

Generative AI/AI has become the topic of conversation in all boardrooms and most of the enterprises are running some pilot project on the same. To attain the full benefits of the efficiency that AI/Generative AI promises, enterprises would need to fix their data strategy first, which would include migrating data to the cloud, and modernizing their databases. Indian IT services are the implementation partners for Hyperscalers, SaaS companies, which would benefit from this AI wave and have continued to invest in building capabilities around AI/Gen AI. While Generative AI might impact low-end work (BPO/Testing), we believe AI would be a net positive for the sector as the companies would be able to handle more volume of work with higher efficiency.

Overall, while the commentary remains cautious, we expect the earnings for the sector to have bottomed out and see signs of stabilization in the demand environment. We expect the demand for IT services to rebound in CY25 as major central banks start a rate-cut cycle and uncertainty around the US election recedes. We believe the IT sector can be a good defensive bet with a large addressable market, high-quality companies, and an excellent execution track record. The sector looks attractive to take exposure as valuations are reasonable (supported by strong cash flows and high payout ratios) and is likely to see an acceleration in revenue growth. BSE Teck one-year forward PE premium (x) over Nifty 50

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). The article was first published in Financial Express on July 08, 2024 Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

You May Also Like

Loading...

1800-270-7000

1800-270-7000