-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Could this be the decade for India’s chemical industry?

Aug 01, 2024

5 Mins Read

Farzan Madon

Farzan Madon

Listen to Article

Globally, the chemical industry is estimated at $ 5 trillion, with specialty chemical segment estimated at ~$ 1 trillion. Over the years, chemical manufacturing has shifted from the US, Europe and Japan to China. Prior to the 1990s, the US, Europe and Japan commanded 70% of the global chemical industry. With Easternization underway, the next couple of decades saw China’s ascendance (~40% of global chemical trade) at the expense of the West, whose combined market share fell from ~70% in 1990 to under 30% in 2020. The rest of Asia has also gained market share, while Japan – a high-cost manufacturing location – has lost share.

India’s Emergence: Geo-political tensions have meant almost all Western companies are now increasingly looking to diversify their supply lines away from China, especially towards India because of the secrecy and safety of molecules; security of raw materials; lower cost advantage as Chinese companies tackle pollution and rising wages. Indian entrepreneurs have been quick to spot this opportunity and started investing in setting up R&D labs, manufacturing units and partnering with MNCs. Companies have doubled their gross block over the last 3 years and are expected to add significantly more in the coming years. Some Indian companies have partnered with MNCs right from the early stage of molecule discovery, and others have developed chemicals for novel applications. Over the years, Indian companies are getting a large slice in the pie. India is a mere 1/10th of China’s chemical industry. India would double its market share if it captured a mere 10% of China’s market.

A temporary blip: The last couple of years have seen the global chemical trade decline due to lower volume on account of de-stocking and lower chemical prices due to dumping by China. De-stocking, a temporary phenomenon, can be attributed to the Russia-Ukraine war which resulted in end customers overstocking to compensate for disruption in logistics and transit times. However, once the situation normalized, customers were left with excess inventory. Additionally, increasing interest rates meant clients resorted to just-in-time inventory management. We expect this to resolve over the next 2 quarters. At the same time, Chinese companies which were under lockdown started production full throttle which affected demand-supply dynamics, resulting in prices collapsing for certain commodity chemicals.

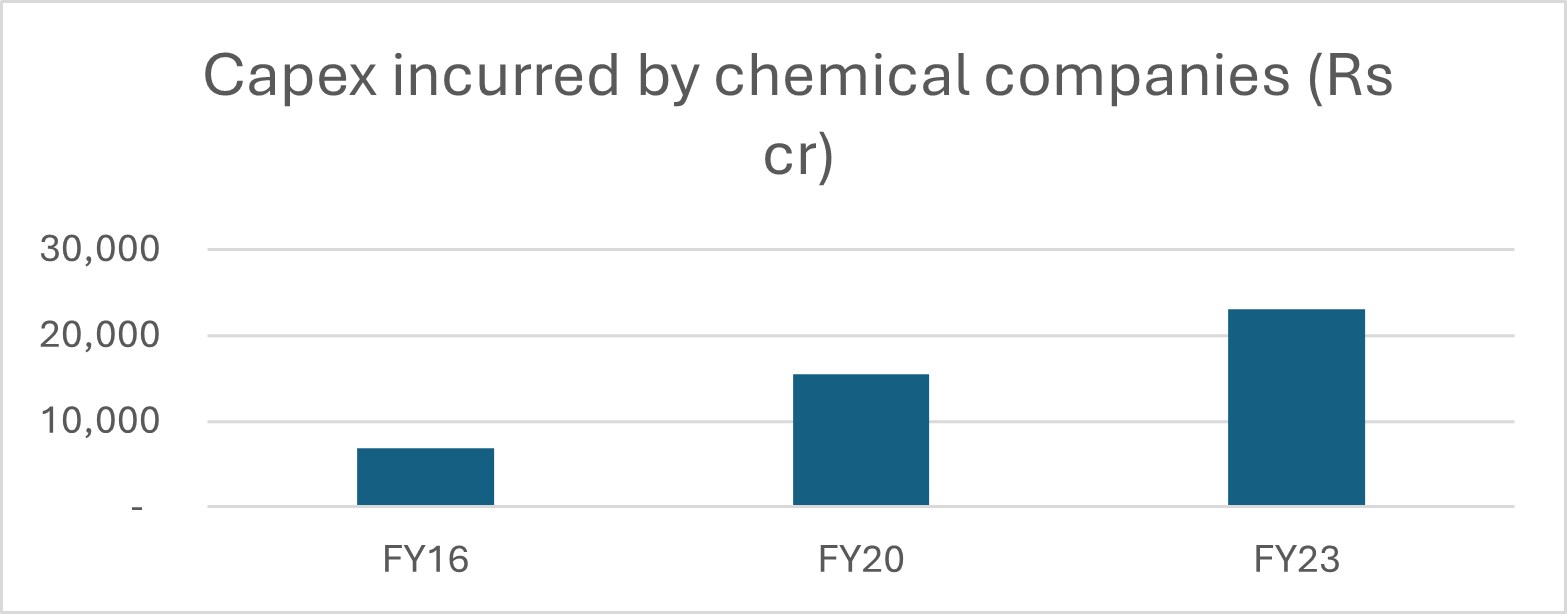

Capex at lifetime highs; balance sheets healthy: Backed by a steady rise in client enquiries and a strong demand outlook, Indian chemical companies are building capacities to benefit from demand uptick from China +1. Most companies have doubled their Gross Block every 3-4 years.

Capex intensity by ~70 Indian chemical companies on the rise Source: Kotak Institutional Research

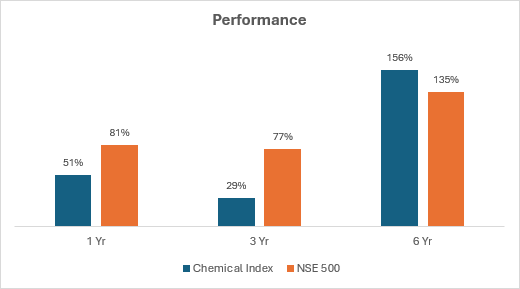

India’s Decade: We believe there is a long runway of growth for Indian companies, especially the ones involved in specialty chemicals, given strong domestic demand; import substitution; and export opportunities as global MNCs diversify away from China.

The chemical index has outperformed Nifty 500 Source: ABSLAMC Research

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

The article was first published in Financial Express on July 08, 2024

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Global clients are eager to diversify their supply chain from China as they look to shift from ‘low per unit cost’ to ‘sustainable supply at a reasonable price’. Indian suppliers with strong chemistry skills, capability to satisfy stringent global standards and timely supply have been able to attract global innovators. This has helped build client confidence, wherein many MNCs are now forthcoming to share newer molecules/ products with Indian suppliers who can bring in process efficiencies to reduce costs. Moreover, Indian companies are also expanding their core domain into adjacencies, targeting higher wallet share and capitalize on client relations.

While the past year and a half has seen earnings downgrade, we believe the worst is over with demand picking up over the next couple of quarters. We see a revival, especially in the specialty chemicals segment where India has an edge due to entrepreneurial skills, and vast talent. This could be a good time to accumulate quality companies with business moats, backed by strong R&D and balance sheets.

You May Also Like

Loading...

1800-270-7000

1800-270-7000