-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

How have Money Markets fared in H1FY24?

Nov 24, 2023

5 Mins Read

Listen to Article

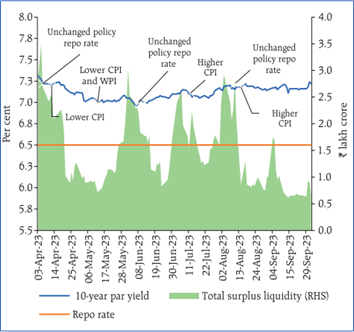

During first half of financial year money market rates hovered within the policy corridor led by evolving liquidity conditions and money market operations of RBI. Weighted Average Call Money Rate (WACR) traded above 5 basis points to repo rate.

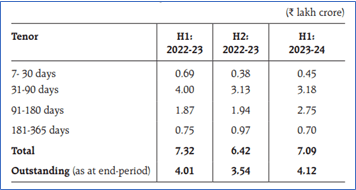

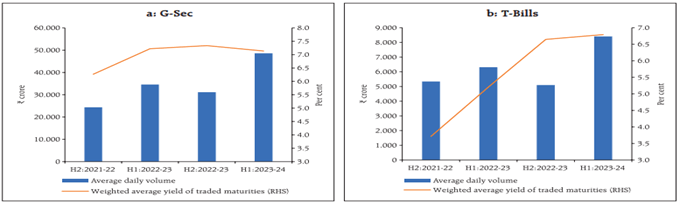

Overnight Money Market Rates, viz Triparty repo (TREPS) moved in tandem with WACR, which intermittently firmed up above the Marginal Standing Facility (MSF) rate – the ceiling of the Liquidity Adjustment Facility (LAF) corridor – in August and September due to frictional liquidity tightness caused by advance tax payments, goods and services tax (GST) outflows and the incremental CRR (I-CRR). The share of TREPS moderated to 64 per cent in H1 from 70 per cent in H2:2022-23, with a corresponding increase in the share of market repo to 34 per cent from 27 per cent. Commercial Papers (CP’s): Resource mobilisation through fresh issuances of CPs increased to `7.1 lakh crore during H1 from 6.4 lakh crore in H2:2022-23. Corporates remained the major issuers of CPs with a share of 39 per cent in H1. Among various maturity buckets, the 31-90 days segment had the largest share in fresh CP issuances [45 per cent in H1 as against 49 per cent in H2:2022- 23] Sources: CCIL and RBI Staff Estimates. Spreads: T-Bills: The yield on 3-month T-bills (TBs) was broadly aligned with the MSF rate in H1 while that on commercial paper (CP) and certificates of deposit (CDs) ruled above the MSF rate. The spreads of TBs, CDs and CPs over the policy repo rate narrowed to 27 bps, 50 bps and 66 bps, respectively, in H1:2023-24 from 30 bps, 85 bps and 99 bps, respectively, in H2:2022-23. During H1:2023-24, the 10-year G-sec yield softened by 9 bps reflecting domestic as well as global factors:

Source: RBI & FBIL

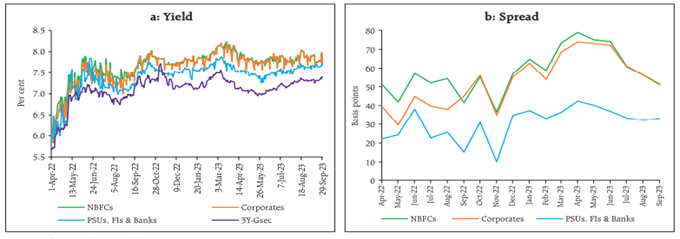

Yields on T-bills softened across tenors between end-March and end-September 2023, with market expectations remaining anchored on unchanged policy rates. Sources: CCIL and RBI Staff Estimates. Primary issuances of corporate bonds rose during H1 (up to August 2023) to `3.4 lakh crore – substantially higher than `1.9 lakh crore during the corresponding period of 2022-23 – due to stable long-term yields and cost advantage vis-a-vis bank loans. Corporate bond yields softened, and spreads narrowed during H1:2023-24, mirroring G-sec yields. The average yield on AAA-rated 3-year bonds issued by non-banking financial companies (NBFCs) and corporates declined by 29 bps (to 7.83 per cent) and 24 bps (to 7.83 per cent), respectively, in September over March 2023. The average yield on issuances by public sector undertakings (PSUs), financial institutions (FIs) and banks softened by 10 bps to 7.65 per cent The risk premium (the spread over 3-year G-sec yields) moderated from 73 bps to 51 bps for NBFCs, from 68 bps to 51 bps for corporates and from 36 bps to 33 bps for PSUs, FIs and banks. Sources: FBIL and RBI Staff Estimates.

Weighted Average Call Money Rate (WACR) – represents the unsecured segment of the overnight money market and is best reflective of systemic liquidity mismatches at the margin – is explicitly chosen as the operating target of monetary policy in India.

Marginal Standing Facility – This short-term borrowing scheme facilitates the scheduled banks to get funds (during emergency situations) from the central bank of India overnight in case of serious cash shortage by offering their approved government securities.

Liquidity Adjustment Facility - A liquidity adjustment facility (LAF) is a tool used in monetary policy, mainly by the Reserve Bank of India (RBI), which enables banks to borrow money through repurchase agreements or banks to lend to the RBI using reverse repo contracts.

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/ communicating any indicative yield/returns on investments. ABSLAMC has used information that is publicly available including information developed in house. Information gathered and material used in this document is believed to be from reliable sources. Further the opinions expressed and facts referred to in this document are subject to change without notice and ABSLAMC is under no obligation to update the same. Further, recipients of this report shall not copy/ reproduce/quote contents of this document, in part or in whole, or in any other manner whatsoever without prior and explicit written approval of ABSLAMC. Past performance may or may not be sustained in the future.

Authored by ABSLAMC Product Desk Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

How about key Sovereign Instruments viz- 10 Year G-Sec & T-Bills?

Yields eased in April-May. 2023 due to the MPC’s decision to pause, lower than expected domestic CPI inflation for March-April and softening US yields.

In June, yields hardened taking cues from rise in US yields. Overall, the 10- year benchmark yield fell by 21 bps in Q1 to close at 7.10 per cent.

In Q2, yields firmed up in July on the back of hardening US yields and crude oil prices but remained steady thereafter in August and September. On balance, yields rose by 12 bps to 7.22 per cent in Q2.

The weighted average spread of cut-off yields on state government securities (SGS) over the G-sec yields of comparable maturities was 24 bps in H1.

What’s going on in Corporate Bond Market?

Key Terms

You May Also Like

Loading...

1800-270-7000

1800-270-7000