-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Impact of Policy on Financial Markets

Jul 03, 2024

5 Mins Read

Listen to Article

Policy impacts financial markets through multiple different channels. While fiscal policy directly influences broader economic growth, the specific areas and sectors where government spending is channelised, directly correlate to stock outperformance. Responsible fiscal policy ensures macro-economic stability, increases investor confidence in the economy and promotes private investment. Expansionary fiscal policy through increased spending or tax cuts can boost economic growth leading to higher stock prices and bond yields and vice versa.

On the other hand, monetary policy decisions directly influence the cost of borrowing and the risk-free rate at which all financial assets are priced. All corporations have their debt priced off the sovereign curve. The consumption and saving behaviour of households is also influenced by monetary policy. Inflation-targeting central banks anchor inflation expectations and preserve the real value of financial assets. Further, counter-cyclical monetary policy acts to support an economy which is running below potential and to cool down an over-heating economy.

Current Backdrop: The Indian economy is showing healthy growth momentum, growing by a strong 8.2% in FY24, the third straight year of strong growth, after growing by 7.0% in FY23 and 9.2% in FY22. RBI is forecasting India's economy to grow by 7.2% in FY25, which is quite strong compared to pre-Covid 10-year CAGR of 6.6%. On a longer-term basis, we believe that India is on the cusp of a private capex cycle. However, the post-Covid recovery has not been uniform so far, and there is still some residual COVID-related scarring resulting in a K-shaped recovery. While growth is strong in manufacturing, construction, capital formation and financial services, but sectors like private consumption, and informal services have been underperforming.

The healthy recovery has happened while being careful of macro-stability parameters like inflation and fiscal deficit. The external account remains healthy with the Current Account Deficit expected to be less than 1% of GDP and the Balance of Payment in surplus. Hence, the main policy challenge for monetary and fiscal policy will be to steer the recovery, which is gaining momentum, while keeping the stability parameters benign.

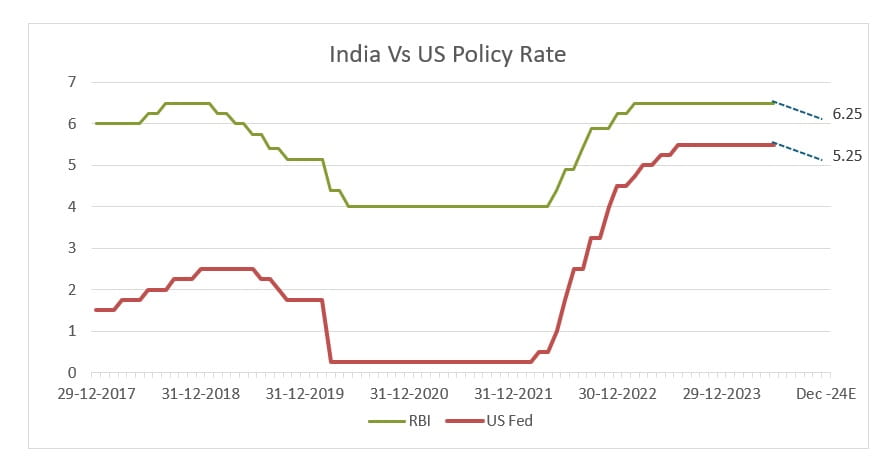

Monetary Policy: The mandate of India’s monetary policy is inflation at 4% while being mindful of the growth imperative. Given that growth has been healthy we expect monetary policy to remain focussed on inflation to ensure the last mile of disinflation goes on smoothly. Inflation is likely to come down to an average of 4.5% in FY25, a healthy decline from inflation levels in the last two years of 5.36% (FY24) and 6.66% (FY23). We therefore expect only a gradual easing of monetary policy this year.

Fixed-income markets are already priced for a very shallow easing this financial year and would be fine with this outcome, especially given the strong FII capital inflow coming to Indian government bonds (India is now part of the Global Bond Index since June 24). The gradual easing should be fine for equity markets as well, given that growth momentum is anyway expected to be strong. However, the monetary policy of the US Federal Reserve and other major central bankers are also likely to influence our markets. We expect some easing from major global central banks this year (about two rate cuts in the US in CY24) and more easing next year, and if our expectation is realised then it would positively influence our fixed income and equity markets. Source: ABSLAMC Research

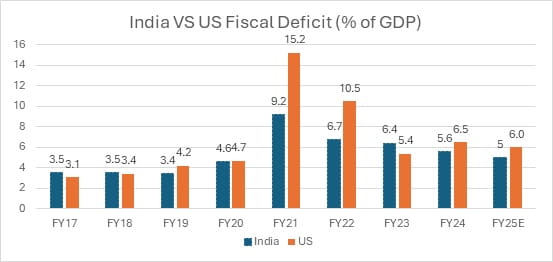

Fiscal Policy: We expect fiscal policy to remain conservative in India and reduce fiscal deficit from 5.6% in FY24 to 5.1% this year and 4.5% in FY26. Although this is higher than the erstwhile FRBM target of 3%, it is still a sharp decline from 5.8% in FY24 and 6.4% in FY23. Moreover, we expect higher government allocation towards capital formation. Lower fiscal deficit and focus on capex will be positive for the markets in our view. While the fixed-income market will be happy with the lower supply of government papers, equity markets particularly like the focus on capital expenditure which is important for sustaining long-term growth. Globally, we note that government debt levels have gone up significantly in the wake of Covid and we expect fiscal policy to turn incrementally conservative across the world. This can adversely impact global growth, especially in the US in the coming years.

In the post-COVID DM (developed market) global recovery, monetary and fiscal policy has worked at cross purpose: while monetary policy was very tight, it was not able to bring down inflation or slow demand because fiscal policy was super easy. Next few years we should see a reversal of that with fiscal policy turning less easy giving monetary policy space to ease. The impact of the policy reversal on the global economy and markets will be interesting and uncertain.

Source: ABSLAMC Research Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

The views expressed in this article are for information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

You May Also Like

Loading...

1800-270-7000

1800-270-7000