-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

India power equipment sector - Recouping the lost decade

Sep 06, 2024

5 Mins Read

Jonas Bhutta

Jonas Bhutta

Listen to Article

India’s power sector landscape is undergoing a change. After almost a decade of under-investment in power generation and transmission, the sector is now poised for a decadal growth in investments.

India’s Power sector is closely linked to economic growth, and with growth slowing between 2012-19, there was not much of a focus on investments in the sector. That, coupled with the overbuilding of capacities in prior years warranted a cooldown. Consequently, peak power demand decelerated from a CAGR of 5.5% over FY04-12 to 4.5% over FY13-20 and the peak power deficit reduced from an average of ~10% in the FY04-12 period to 0.7% in FY20.

There are structural and cyclical changes that are underway in the sector. We see the following reasons for a revival in power demand, firstly, structural changes:

The Indian capital goods industry, particularly the power equipment manufacturers are benefitting from two tailwinds: Source: Bernstein, CEA

This, we believe, leads to a multi-year opportunity for suppliers of products such as boilers, solar and wind generation equipment, transformers, conductors and high-power cables. Incrementally, the developed regions of North America and Europe are also undergoing high demand for power equipment due to their ageing grids, increased demand from electrification of vehicles and the growing number of data centres, thus leading to a global demand-supply mismatch for equipment, resulting in significant growth opportunities for Indian manufacturers to capitalise on the export demand. While the valuations of many of the companies in this segment have recently seen an increase, we continue to be positive in this sector since the demand outlook remains robust.

The article was first published in Financial Express on August 19, 2024 Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1) Post Covid the Government’s focus on reviving manufacturing

2) Higher penetration of air conditioning in households and

3) increasing capacities of data centres. Seasonal weather factors such as stronger-than-expected summers for the past two years also led to demand surprise.

Additionally, the focus of government on raising the share of solar power is leading to the scenario of a lack of peaking power demand in the evening hours. Consequently, India’s peak power demand in FY24 has surpassed the Government’s estimates (as per the Electricity Power Survey). This we believe will lead to an upward revision in the long-term demand estimates, ultimately leading to an accelerated pace of power generation and transmission capacity addition.

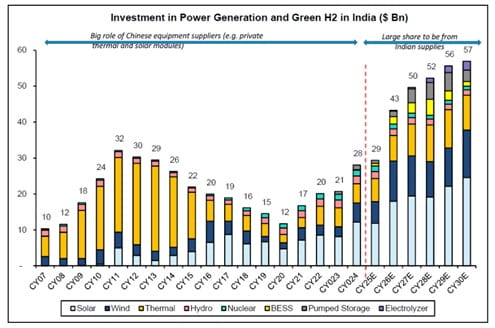

1) structural – the ramp up in power capacity addition followed by India’s intent to ramp up production of green hydrogen that envisages a large capacity addition of renewable power (1MTPA of Green H2 will need ~20GW of renewable power)

2) Cyclical – underinvestment in thermal power in the past few years has now been revived to solve the issue of evening peaking deficits.

The Central Electricity Authority’s draft National Electricity Plan envisages a 366GW of peak power demand in FY32E, which in our opinion has upside risks seeing recent trends. To meet that demand India’s power capacity generation capacity is likely to double from the current 442GW in FY24 to 900GW in FY32E leading to an investment of ~Rs27.5tn (@ Rs60mn/MW). Additionally, the CEA expects an investment of Rs. 4.75trillion in transmission and substation until FY27E. The National Committee of Transmission (NCT) has already approved projects worth ~Rs. 2 trillion in the past two years.

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

You May Also Like

Loading...

1800-270-7000

1800-270-7000