-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Indian Pharma: In the pink of health

Sep 06, 2024

5 Mins Read

Dhaval Shah

Dhaval Shah

Listen to Article

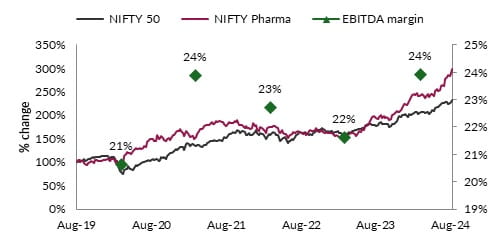

India pharma is flexing muscle, showing little sign of flagging. In the last 12 months, NSE Pharma has returned 50%, comfortably beating the benchmark Nifty that went up by 31% while also returning an average 19% versus Nifty’s 15% in the last 3 years. This is a sharp reversal from the sector’s underperformance in 4 out of the 5 previous years.

The blocks built and added over the decade prior, are finally falling into place for Indian Pharma. The sector is focussed on two markets: the $24 billion branded generics domestic bazaar, and the $28 billion formulations and API exports, to both developed and developing countries. The domestic market is dominated by Indian companies with the top 10 holding a 44% share. Rising non-communicable disease due to lifestyle changes, rising income levels that improve affordability and competitive pricing (average price hike is 5-7%) - should ensure that the 8-10% annual growth rate will continue for the foreseeable future. On their part, pharma companies have added salesforce, expanded doctor reach, ventured into trade generics and collaborated with multi-national corporations. This has grown the segment’s reach to a wider set of the population while offering best-in-class treatment options.

India’s $28 billion exports grew by 10% last year and 8% in the last 6 years. India has the highest number of FDA-compliant plants outside of the US, nearly 1,400 WHO-GMP and 253 European Directorate of Quality Medicines (EDQM) approved plants with modern state-of-the-art technology. It is not for nothing that India is called the pharmacy of the world. With the healthcare burden in developed countries straining systems and cramping access, India presents a perfect partner of choice for those seeking quality medicine and intervention at affordable rates. Indian companies have steadily added capacity as well as capability – rolling out a stream of complex and biological products. India’s pharma prowess is buttressed by its abundance of skilled manpower, low labour costs, friendly government policies – SEZ, pharma parks, PLI – uninterrupted electricity and commitment to global ESG best practices. In the last decade, the number of Contract Development and Manufacturing Organizations (CDMOs) have mushroomed that have partnered global giants from pre-clinical to post-marketing stage. While Indian companies have stolen a march in generic manufacturing, a lot more needs to be done on R&D front from all stakeholders so that India can move from being a follower to a leader; tighten IP laws that make global giants hesitant to partner on patented drugs; standardize quality across manufacturers.

Source: Bloomberg, ABSLAMC Research

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). The article was first published in Financial Express on September 02, 2024 Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

What could derail this story? Factors like compliance failures, increase in raw material costs and price competition in developed markets that could hurt profitability and eventually supplies of critical drugs, leading to sector de-rating. NSE Pharma is trading at 47% premium to Nifty, which is higher than the 10-year average of 31% but lower than the 50-90% premium seen during 2014-15. Given the sharp run-up in pharma stocks, domestic branded market offers a viable investment option: the perfect defensive play with huge untapped potential, inelastic demand, lower regulatory requirements, cost arbitrage vs global peers that other countries would find hard to beat. It is prudent to be invested in a sector that has so many natural advantages!

You May Also Like

Loading...

1800-270-7000

1800-270-7000