-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

Inflation Demystified - All you need to know

Jul 28, 2023

4 Mins Read

Listen to Article

Inflation, the rate of price rise of goods and services, affects the decision-making process of investors, companies, consumers, Central Banks, and governments around the world.

There are broadly four types of inflation that are measured by different agencies.

Consumer price index (CPI): Also known as retail or headline inflation, it is the most followed measure, as it affects most sections of the population. In India, it is measured by the Ministry of Statistics and Programme Implementation (MOSPI) and is published every month.

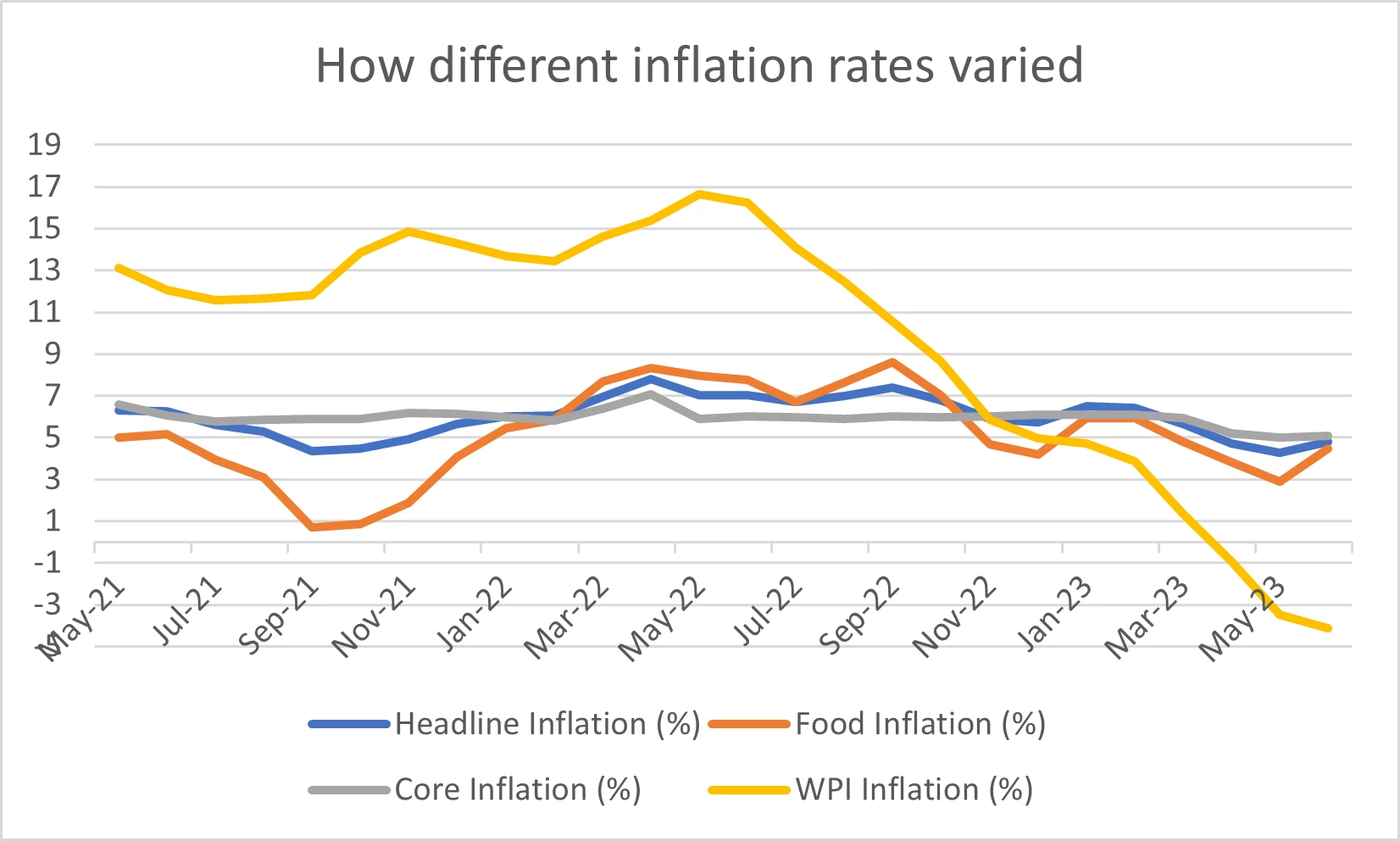

Sources: Ministry of Statistics and Programme Implementation (MOSPI), Office of Economic Advisor

(Data as of July 2023 for June 2023)

A rise in the CPI erodes purchasing power of consumers. It can hurt consumption appetite, especially in rural areas where disposable income could be limited.

After years of low to moderate inflation, we had CPI steadily rising from the second half of 2021 and touching 7.8% levels in April 20225, prompting the Reserve Bank of India to start hiking rates. But by the end of 2022, the CPI started to cool off.

Wholesale price index (WPI): When inflation is measured at the first point of bulk sale, that is at the wholesale level, we get the WPI. It measures the price increase of manufactured products, food articles, fuel & lighting among others. Manufactured products have a weightage of 64% in the WPI, while food has only 24.4% weightage7,. That’s the reason why a spike in food, vegetable and cereal prices gets reflected more in the CPI rather than the WPI. It is released every month by the Ministry of Commerce and Industry.

Core inflation: The CPI index has two key components whose prices fluctuate heavily – food and fuel. When these two are excluded and the remaining basket is used for calculating the inflation dynamics in the economy, we get the core inflation. It is less volatile and isn’t disrupted due to temporary sharp moves.

Food inflation: Since food articles – vegetables, fruits, cereals, milk and other basic items – form the core of the spending in an Indian household, it is a sensitive measure. After fluctuating over 2021 and much of 2022, food inflation peaked at 8.6% in September 2022 and has since been declining steadily. However, the figure for June showed an increase and stood at 4.49% (Source: MOSPI). It can be volatile due to erratic rainfalls, delayed monsoons and droughts.

Inflation has a twin impact on consumption. One goods and services becoming expensive itself can be a dampener. When interest rates are hiked to contain inflation, home and personal loans also become costlier, further hurting fresh purchases.

Sources

Inflation data from MOSPI, Office of Economic Adviser, Press Information Bureau The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, affiliates or representatives (“entities & their affiliates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

However, since the end of 2021, global inflation has been rising, as seen in many of the world's regions.1

And indeed, during the period from the middle of 2021 to early 20232,, inflation truly raged across the emerging and advanced economies alike, with many countries facing near double-digit price rise that had all the stakeholders mentioned earlier seriously worried.

The supply chain disruptions post-COVID, geo-political crisis and trade wars among other factors led to surging prices of essentials, commodities, and inputs for companies and the general population alike. Inflationary pressures were felt the world over, touching various aspects of buying and selling decisions.

But when we mention inflation generically, it is not one broad figure that is followed by everyone. We have several variants of inflation – headline (or retail), core, food and wholesale – that often do not follow a similar trajectory and can result in presenting a confusing picture. The RBI has increased rates by 250 basis points while the US Federal Reserve has hiked rates by 500 basis points in the last one year.3

What number matters then? The answer depends on the type of user. Here’s more on each type of inflation, its significance and the impact it has on your investments.

What each inflation type means

As the name suggests, the CPI measures the price rise in a basket of goods and services – each with an assigned weightage – over a period of time at the retail or consumer level. There is a consumer expenditure survey conducted every five years to analyse consumer spending on various items and to assign weightages in the index.

As per the Economic Survey, food and beverages have a weightage of 45.9% (FY23 data is for the period of April 2022 to December 2022)4 in the overall CPI index and are the largest components. We also have services – education and housing – and other utilities such as fuel and light etc. that have a reasonable representation in the index.

.

As stated by the RBI, it has an explicit tolerance band of 4% +/- 200 basis points. So, the inflation must not exceed 6% under its watch. But it took 250 basis points of interest rate hikes before the CPI came below 6% from March 2023 onwards6. CPI did rise in June 2023 and was at 4.81% for the month, largely due to the recent spike in the prices of vegetables, after being in a declining trend over Jan-May 2023.

As mentioned earlier, because of global supply chain bottlenecks, geopolitical tensions and trade wars there has been an increase in commodity prices such as those of steel, crude oil, edible oil and other inputs to companies, leading to a huge surge in WPI. In fact, WPI was in double digits for over a year and a half, touching a peak of 16.6% in May 2022. It cooled off over the past one year and is now has been in the negative territory for three months now – -4.12% as of June 2023 (Source: Office of Economic Adviser).

This increased costs and hurt margins for several end-user companies such as automobiles, FMCG, steel firms among others.

This core inflation peaked at 7.1% in the middle of last year and is trending down.

However, it continues to be more than the CPI and even the WPI from February 2023. At well over 5%, the core inflation, although decreasing, is still in an uncomfortable zone, which is the reason the RBI still maintains a somewhat hawkish stance on interest rates.

Inflation and investments

Companies find borrowing costs increasing, which could make them reduce or even postpone their capital expenditure plans.

Bond markets react negatively to rate hikes. Yields spiked to over 7.61% on the 10-year g-sec8, before cooling off below 7% recently. This makes bond prices fall, hurting long duration debt fund investors.

Inflation has a mixed impact on equities though. Higher interest costs can hurt margins for companies. But during the low interest regime that prevailed over 2019 to 2021, many corporates refinanced their debt and have cleaner balance sheets9. Bank NPAs are at the lowest in years10.

The frontline index Sensex fell around 16% between the September 2021 peak and June 2022 trough. It is up over 20% over the last one year11, even as interest rates increased, and inflation abated. From June 17, 2022, markets are up well over 20% till June 17, 2023. If we take the latest data, as of July 25, markets are up 29% from June 17, 2022, lows.

1: https://www.statista.com/statistics/256598/global-inflation-rate-compared-to-previous-year/

2: https://www.cnbc.com/2023/04/14/charts-how-much-inflation-increased-since-2021.html

3: https://www.livemint.com/market/stock-market-news/will-potential-us-interest-rate-hike-trigger-fii-selling-in-indian-markets-here-s-what-analysts-say-11687518304063.html

4: https://www.indiabudget.gov.in/economicsurvey/doc/echapter.pdf

5: https://www.indiabudget.gov.in/economicsurvey/doc/echapter.pdf

6: https://tradingeconomics.com/india/inflation-cpi

7: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

8: https://in.investing.com/rates-bonds/india-10-year-bond-yield-historical-data

9: https://www.livemint.com/industry/banking/loan-refinancing-sees-more-takers-11644348456085.html

10: https://economictimes.indiatimes.com/news/economy/indicators/banks-gross-npa-fell-to-a-10-year-low-of-3-9-in-march-rbi-in-financial-stability-report/articleshow/101337543.cms

11: https://www.bseindia.com/

You May Also Like

Loading...

1800-270-7000

1800-270-7000