-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Is your portfolio missing the shine of Gold and Silver?

Oct 22, 2024

5 Mins Read

Listen to Article

In an increasingly volatile global market, investors are continuously seeking ways to diversify their portfolios, driven by inflation concerns, geopolitical tensions, and fluctuations in equity markets. The need for stability and resilience is more pronounced than ever, pivoting the two precious metals—gold, long considered safe-haven assets, and silver—play a critical role in the investment landscape.

While equities have provided substantial returns over the long term, they have also been subject to extreme volatility in short to medium term. In times of market uncertainty, precious metals have traditionally been a go-to for investors looking for a hedge against inflation and a store of value. Gold, in particular, tends to perform well during economic downturns and periods of financial instability. Silver, while more volatile, offers unique industrial demand, adding to its appeal as a complementary asset. In the context of portfolio diversification, combining these two metals can enhance risk-adjusted returns over time, particularly through focused funds in passive categories like ETFs, Fund of Funds (FoFs), and index funds.

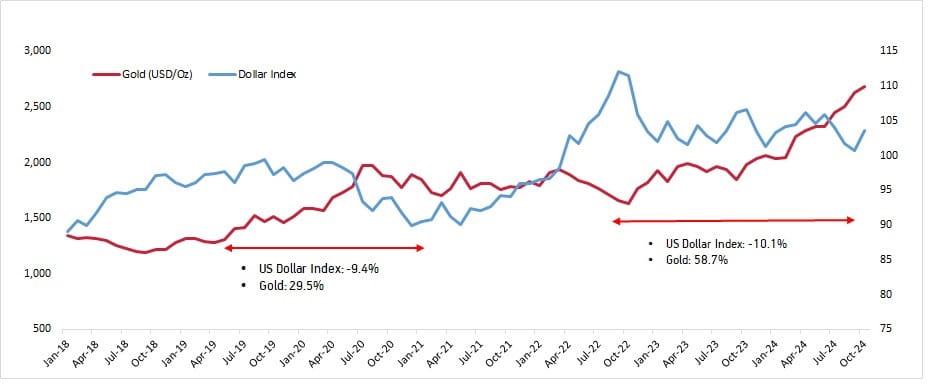

Gold has long been regarded as the go-to metal for wealth preservation – a hedge against inflation, a safe store of value, and an asset that typically performs well in times of economic downturn. Historically, it has had an inverse relationship with the U.S. dollar and equities, making it an excellent diversification tool.

Source: ABSLAMC Research/Gold price.org/World Gold Council; Returns as on 13 Mar’23 based on Monthly data

As inflation erodes the purchasing power of fiat currencies, gold often retains its value. Besides, the yellow metal typically has a low correlation with other asset classes such as equities and bonds. Adding gold to a portfolio can lower overall portfolio volatility and enhance long-term risk-adjusted returns. During periods of high inflation, geopolitical instability or financial market stress, gold is viewed as a safe-haven asset, as investors seek refuge in tangible assets.

This industrial demand provides an additional layer of growth potential that gold lacks. Silver’s correlation with industrial growth makes it a valuable complement to gold, balancing the portfolio with exposure to both a safe-haven asset and an industrial growth driver. Though the white metal tends to be more volatile than gold, it indicates a potentially higher upside during precious metal bull markets.

While individually, gold and silver each have their merits, combining these metals in your investment strategy offers a well-rounded approach. Their unique characteristics complement each other and provide an all-weather portfolio diversification solution: Gold provides stability during market downturns, while silver adds growth potential during economic recoveries.

The history vouches for this approach – during the global financial crisis of 2008, EuroZone matters in 2011, slowdown of Chinese economy in 2015-2016, Brexit, and demonetisation, equities nose-dived but gold shone brightly. According to the World Gold Council, Indian gold ETF inflows doubled from 14.8t to 28.3t in 20201, due to rising gold prices, stock market volatility, and COVID-19. The power duo of gold and silver navigated the COVID year of 2020 exceptionally well, recording 28% and ~50% increase in price, respectively, in that calendar year2. Having gold and silver in building a multi-asset portfolio means exposure to asset classes that are uncorrelated to equities, leading to lower volatility overall.

Leveraging focused passive investment vehicles like ETFs, FoFs, and index funds, investors can efficiently gain exposure to these precious metals, securing long-term resilience and enhancing their portfolios' overall performance. Why invest through the Gold and Silver ETF/Fund of Funds route instead of physical gold and silver? Easy Liquidity Safe & Secure No Maintenance & Storage Cost No Making Charges Convenience to Buy in Small Amounts No Demat for Fund of Funds High degree of purity In uncertain times, a balanced investment approach becomes crucial. The power combo of gold and silver offers both stability and growth, making it an ideal addition to any diversified portfolio. As the global economy continues to evolve, this dynamic duo could prove to be a cornerstone of modern portfolio strategy. The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). 2. Gold price rose 28% in 2020; check out targets for next year - BusinessToday Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Unique benefits of investing in gold and silver

Gold Shines When Dollar Loses its Shine

Silver, on the other hand, brings a different value proposition to the table: Silver is more affordable and has distinct demand drivers due to its industrial applications. It serves as both a precious metal and an industrial commodity whose demand spans various sectors.

Joining hands for future-proofing investments

You May Also Like

Loading...

1800-270-7000

1800-270-7000