-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Maverick Monsoons: Is monsoon in India becoming unpredictable?

Aug 08, 2023

5 Mins Read

Listen to Article

In India, to a great extent, the first half of a financial year sets the tone of business sentiment across sectors. Data shared by government and private sector companies in the first half of a fiscal reveals a great deal about the direction in which the economy may head. Among the key variables, the data about monsoon is paramount. It elicits considerable amount of attention of analysts, economists and policy-makers. In fact, in the past few months, the data about monsoon has been grabbing headlines. A key reason for this is the far-reaching effect of a good or bad monsoon in terms of its connection with the economy and overall sentiment in the markets. Let us look at these aspects in a nuanced manner:

India’s agriculture sector is highly dependent on monsoons. The Southwest Monsoon (SWM) which falls between June and September in a year provides much-needed water to a fairly large unirrigated land in India. The Southwest Monsoon provides the major portion of India's annual rain. According to a report by The Reserve Bank of India (RBI), “Around 75 per cent of India’s annual rainfall is concentrated during the four months of the SWM season, which is vital for the agricultural output during the kharif cropping season, as almost half of the country’s net sown area is still unirrigated.” Kharif crops include rice, groundnut, maize, soybean, tur, masoor and cotton. This means that inadequate monsoon impacts the production of key foodgrain items. According to a Nomura report titled India Consumer, over 65% of Indian agricultural lands are dependent on the monsoons for the cultivation of kharif crops. Hence, a fall or jump in food production has a bearing on food prices, which in turn has a bearing on inflation. If food production falls, food prices go up. This could result in high inflation which can hurt the economy. The converse of this situation is also true.

The latest data about monsoon from India Meteorological Department (IMD) shows that in July 2023 there was surplus rainfall. The South-West Monsoon recorded in July was 6% higher than Long Period Average (LPA). LPA means the 50-year average of rainfall that transpired during the monsoon period. According to the data released by IMD, the Eastern and North Eastern region has seen lower rainfall. North Western region has recorded higher rainfall. According to IMD, the actual rainfall in the present year (80 mm) has been higher than the previous year (71 mm). Source: CEIC, Bank of Baroda Source: CEIC, Bank of Baroda │ Data as of 28 Jul 2023 Historically speaking, the rainfall in July this year is lower than last July. In July 2022, the South West Monsoon recorded 17% higher than LPA rainfall. According to IMD, in July 2023, the South West Monsoon recorded 6% higher than LPA rainfall. Further, there is a consensus that the August 2023 rainfall flow will be suppressed due to the El Nino effect. El Nino means abnormal warming of surface waters in the equatorial Pacific Ocean. As a result of this, monsoon rainfall is suppressed. Recently, IMD said that in August it is likely to see ‘below normal’ rains. Historical Rainfall Trend Surplus / (deficit) departure to LPA Year June July August September June-September 2001 30 0 -19 -35 -7 2002 2 -51 -4 -19 -21 2003 0 8 -3 7 2 2004 1 -13 -1 -27 -13 2005 -12 19 -25 20 -1 2006 -9 3 13 2 -1 2007 21 5 2 27 5 2008 27 -9 4 -1 -2 2009 -47 2 -24 -15 -22 2010 -15 7 7 18 3 2011 11 -12 13 14 1 2012 -27 -9 4 17 -8 2013 34 11 2 -8 5 2014 -44 -5 -8 13 -13 2015 14 -14 -22 -23 -15 2016 -11 10 -6 1 -3 2017 5 4 -10 -9 -5 2018 -5 -2 -6 -21 -10 2019 -31 6 18 55 9 2020 19 -8 29 6 9 2021 10 -5 -24 37 -1 2022 -8 17 3 8 6 Source: CMIE, Nomura research In the past ten years ending 2022, there have been seven years in which rainfall recorded in the whole monsoon season was below LPA. Also, when one takes into account only July month, in the past ten years ending 2022, there are seven occasions in which rainfall in July has been below LPA. So, in a sense, the 6% surplus rainfall in July 2023 is a favourable development.

According to IMD, rainfall in August 2023 is likely to be less than 94% of LPA. The IMD said that a large part of the south Peninsula, east and northeast India and many areas of western parts of northwest and central India are likely to record above-normal maximum temperatures in August. Some areas of north peninsular India, east-central India and plains of the Himalayas may receive normal to below normal temperatures said IMD.

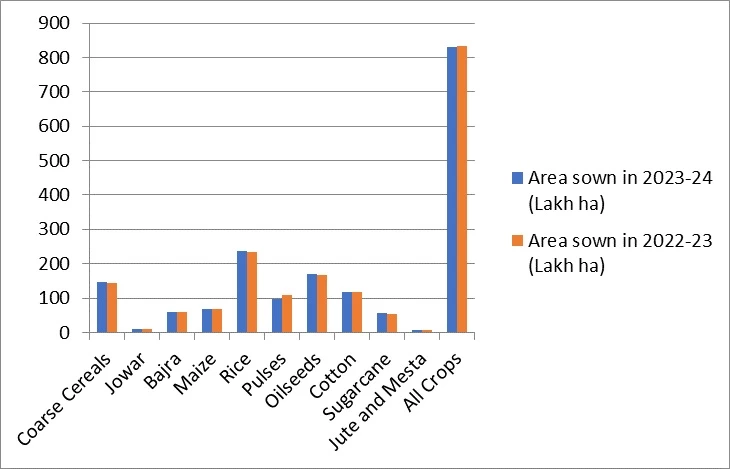

According to experts, the conditions which trigger El Nino are likely to intensify further in the coming weeks. In fact, the second half of the monsoon season is likely to record lower-than-normal rainfall. Besides this, according to CEIC data, due to erratic rains, there has been lower sowing of Kharif crops when compared to the last year. Economists believe this could have inflationary impact in the near term. IMD estimates that El Nino conditions will emerge strongly in the middle of the monsoon. D S Pai, a senior scientist of IMD believes that the impact of El Nino is likely to be witnessed in the winter rains (Source: https://economictimes.indiatimes.com/news/economy/agriculture/el-nino-likely-to-hit-rabi-crops-top-weather-forecasters/articleshow/101171842.cms?from=mdr). He is of the view that there are early indications of the hottest summer season next year as the El Nino is likely to subside only by May 2024. According to The National Oceanic and Atmospheric Administration (NOAA), a US-based scientific and research agency, El Niño may only persist, but strengthen through the 2023-24 winter. If rainfall becomes weaker in the coming weeks it will impact Rabi season (sown during winter season). Rabi crops are sowed using stored rainwater. Lower-than-normal rainfall could impact prices of Rabi crop items such as wheat, barley, mustard, sesame and peas in the coming months.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Vital to the Economy

Besides this, it is vitally important to understand the correlation between equities and a good monsoon. A good monsoon ensures that prices of key raw materials such as cotton, natural rubber, sugarcane and vegetable oils are not prohibitively high. As a result of this, companies do not incur high expenses due to high raw material prices. This ensures that they pass on the benefit of low raw material prices by pricing goods in an attractively competitive price range. This boosts demand for consumer goods and services, which cumulatively boost the economy. As the economy grows, companies listed on the stock markets benefit as their earnings grow. This serves as a good trigger to invest in the markets.

The Present Situation

The Historical Perspective

In the Near Future

Conclusion

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). ABSLAMC has used information that is publicly available including information developed in house. Information gathered and material used in this document is believed to be from reliable sources. Further the opinions expressed and facts referred to in this document are subject to change without notice and ABSLAMC is under no obligation to update the same. Past Performance may or may not be sustained in the future.

You May Also Like

Loading...

1800-270-7000

1800-270-7000