-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

Should you invest in PSU funds? A fund manager’s take

Mar 06, 2024

2 Mins Read

Dhaval Gala

Dhaval Gala

Listen to Article

“Ajeeb daastaan hai yeh.

I am reminded of this popular yesteryear song every time someone asks me “Aur kitna bhagegi?” (how much further will it run) about the markets. This is now a usual question for PSU stocks. As a fund manager, my job is to focus on the fundamentals of the companies I pick to build a portfolio, instead of engaging in a guessing game of market levels. And as the fund manager of the Aditya Birla Sun Life PSU Equity Fund, my response remains the same.

As per data from Value Research, PSU funds have run up 94 per cent on average over the past year. The questions are thus obvious. But let’s rewind to December 2019 when we launched the fund. We believed in the theme and the investment thesis we had. The PSU pack were largely quality companies with the potential of getting re-rated. This combined with attractive valuations and their underlying intrinsic value made them a compelling investment choice. Over time, a favourable economic environment, heightened capital expenditure, the government's unwavering focus on indigenization and export, and a transformative boost in the country's infrastructure, have further added fillip to the sector.

A simple answer would be - Yes. And there are some notable factors.

Dominant Sectoral Control: PSUs wield near-monopolistic control in key sectors vital to India's economy, highlighting their strategic significance through their overwhelming presence in critical industries.

Kahan shuru kahan khatam.

Yeh manzile hai kaunsi.

Na voh samajh sake na hum.”

Fast forward to 2024, and PSUs have turned a new leaf and the surge in PSU stocks has strong pillars to stand on. And we continue to have conviction in the investment thesis we started with.

Does the Growth of PSU Companies Have Legs?

Improving financials: PSUs currently exhibit robust improvement in financials, enabling them to seize emerging opportunities. Moreover, higher interest rates have helped PSU companies compared to others. Initially, PSU RoEs experienced a decline from the 14-15% level in 2013-14 to 4-6%, primarily due to the drag from PSU banks among others. However, overall RoEs have rebounded to 12-13% as profitability recovered, leading to a substantial re-rating.

Source: Screener, MOSL

Additionally, most PSUs have witnessed significant EPS upgrades. Moving forward, sustaining both earnings growth and top-line expansion could fuel further re-rating.

Conducive Environment and Government Backing: The segment enjoys ongoing momentum fuelled by a favourable environment and government support. Enhanced capital expenditure further bolsters their foundation for enduring growth. The era of cyclicality has ceased, paving the way for a robust growth trajectory reminiscent of the early 2000s, fostering an environment conducive to sustained expansion. PSU stocks have surged across the spectrum, partly due to the Government's accelerated capex spending, along with sector-specific catalysts.

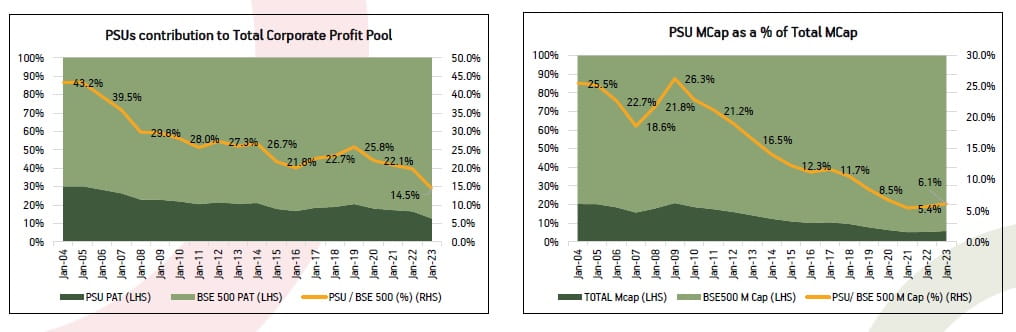

Market Share Recovery: Following a prolonged consolidation phase from 2008 to 2020, the PSU sector is now poised for outperformance. Historically, PSUs ceded ground in India's corporate profit pool and market capitalization. Nevertheless, a remarkable resurgence and operational turnaround have occurred, setting the stage for substantial revival. Of utmost significance is the cessation of market share loss, with the sector now actively reclaiming lost ground.

Source: Haitong Research

The Valuation Conundrum

While assessing broader valuations for PSUs might not be entirely appropriate due to the diverse sectors involved, it's worth noting that the PSU index currently reflects elevated valuation metrics. The forward price-to-earnings ratio (PE) stands at 11.2x, and the price-to-book ratio (PB) is at 1.8x, both exceeding the historical average by one standard deviation (+1SD). However, we should not look at index level valuation multiple and they remain cheaper vs Private sector / broader markets.

Valuations for select sectors seem stretched however, PSUs contribution to the Total Corporate Profit Pool and PSU Market Cap as a % of total Market cap is at 2 decades low as shown in the graphs above.

Despite the somewhat high valuations, investors are encouraged to look beyond short-term fluctuations, as the structural nature of the theme suggests long-term sustainability. Market turbulence may occur periodically due to various factors, but the underlying strength of the theme is expected to endure.

What’s the way forward?

I believe a reasonable valuation re-rating in select PSU stocks is stretched or pricing in a lot of positives. And there are still select PSU companies which are still at reasonably average or just above average valuations of their last five years or ten years average. So, for us, it is very important to try and understand where there is a stronger revenue profile, reasonable margin expansions and therefore good earnings growth or earnings upgrades and then look at valuations and to decide which companies to look at within the PSU pack.

PSU funds are expected to continue performing well in medium to long term due to several key factors (though taking a 6-12 month call after a sharp run-up is always a challenge). Firstly, the sector has moved beyond its traditional cyclicality, setting the stage for sustained growth due to visibility around select sectors' revenues/earnings (Railways, Defense, Banks, Power). Valuations across select sectors / industries look stretched (whereas Banks / Oil & Gas sector still seem to be cheaper vs their past high valuations), however, the structural story remains intact reflecting the growth potential of this theme over a medium to long term. Watch out for a detailed note that we will be releasing shortly on PSU Banks and PSUs in the Energy segment – sectors that look attractive.

It would also be prudent to highlight some of the factors that could result in a pullback. Factors such as political instability, divergence from intended capex deployment, profit realization by major shareholders, and the scope for incremental and ongoing earnings upgrades could affect the sector.

The views expressed in this article are for information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). Views expressed herein should not be construed as investment advice. Recipients of this material should exercise due care and read the scheme information document (including if necessary, obtaining the advice of tax/legal/accounting/financial/other professional(s) prior to taking of any decision, acting or omitting to act. Past performance may or may not be sustained in the future.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

You May Also Like

Loading...

1800-270-7000

1800-270-7000