-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Tactical Opportunity - India Sovereign Exposure

Nov 24, 2023

4 Mins Read

Harshil Suvarnkar

Harshil Suvarnkar

Listen to Article

US growth has now started slowing, after strong growth and positive surprise for most of the year. Back-to-back lower inflation prints have further supported the soft-landing view (the October print has already surprised markets on the lower end). The US labour market, while still strong in absolute terms, is now showing signs of softening. The Euro area economy has been weak led by the manufacturing sector. Chinese growth data has remained weak, and the property sector continues to struggle with home sales and prices both on a downward spiral. Global central banks, after aggressively raising policy rates in the last one and a half years, have become data-dependent and are very close to the end of the hiking cycle.

We believe that we are at the terminal rate in India and the bar for another rate hike is very high. The key risk to inflation outlook stems from higher commodity prices, particularly crude.

JP Morgan (JPM) recently announced the inclusion of Indian Government Bonds into its GBI-EM (Government Bond Index-Emerging Markets) family of indices from June 2024. Total funds tracking the indices is about US$236 billion. India has been given the highest weight of 10% in its GBI-EM GD (Global Diversified) Index where the inclusion will be in a staggered manner with a 1% rise in weight every month, reaching the maximum weight of 10% by March 2025. Net flows into fully accessible route (FAR) securities post announcement of JP Morgan index inclusion have already surpassed 18,000 crores as on 22nd November 2023. Estimates of foreign inflows in the Indian bond market due to the inclusion in the JPM suit of indices is in the range of 30-50 billion USD (nearly a quarter of FY24BE net borrowing for GOI). This is a significant amount of foreign capital which is positive for Indian bonds and should depress Indian yields. The share of foreign investors in Indian bond markets has been quite low and the index inclusion with the maximum 10% weight will be difficult to ignore both for active and passive investors. Besides the existing FIIs (Foreign institutional investors) this will likely bring in a new set of FII investors into the Indian bond market. The entry of a significant new player into the Indian bond market shall be positive for Indian bond markets not only in the immediate period of index inclusion but also going ahead. India with its large size of economy, stable polity, healthy growth prospects and impeccable credit record shall continue to elicit interest from foreign fixed-income investors. It will bring in new foreign savings to fund Indian growth and will lead to the deepening of Indian financial markets. Besides the direct impact on bond yields the index inclusion will also be positive for external account, forex reserve and INR. The inclusion in JPM Index (which has the largest AUM tracking in EM indices) will also potentially be a catalyst for India’s inclusion in other major indices, which can result in further inflows upfront and/or down the line.

Global growth is moderating, and inflation is slowly coming down. Global central banks are close to the end of the rate hiking cycle. Domestic growth is robust and core inflation is behaving well. In this backdrop, the inclusion of Indian Government Bonds (FAR Securities) in the GBI-EM index presents a very good tactical opportunity. We foresee a favourable demand scenario for G-sec, especially FAR securities, in the next 12-18 months. Investors with more than 1yr investment horizon should allocate money to funds that carry FAR securities.

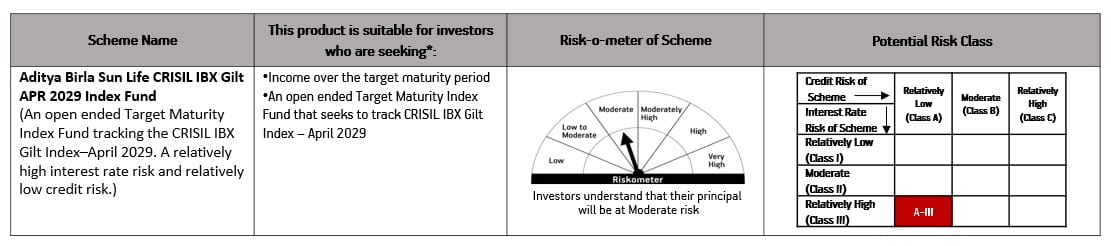

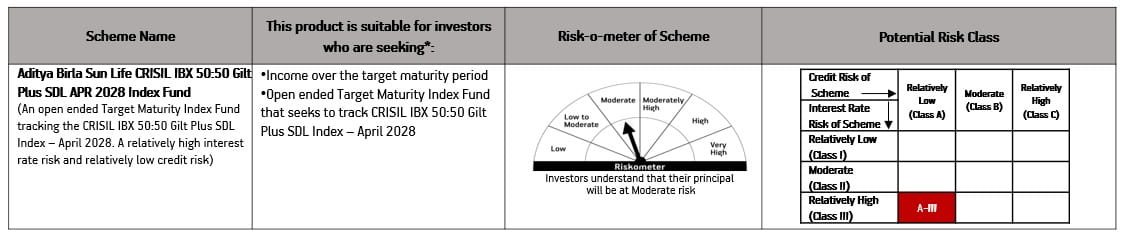

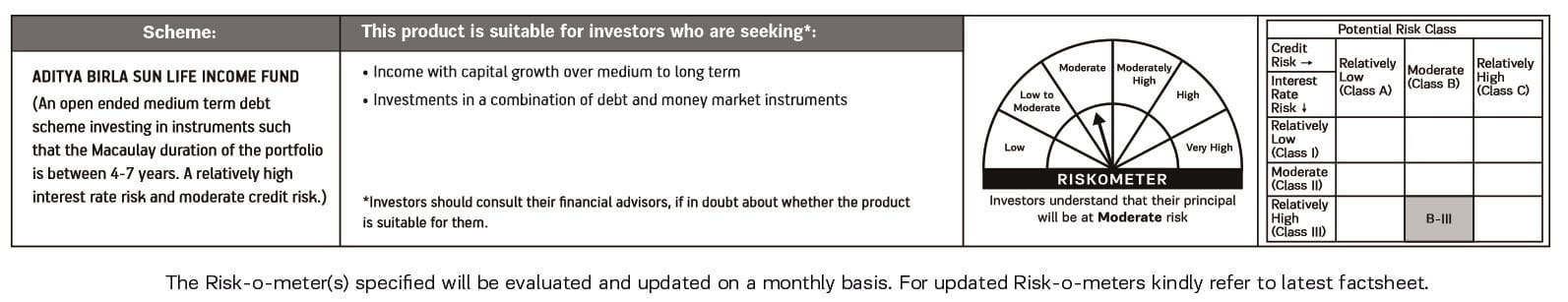

We recommend Aditya Birla Sun Life CRISIL IBX GILT April 2029 Index Fund, Aditya Birla Sun Life CRISIL IBX 50:50 GILT Plus SDL April 2028 Index Fund and Aditya Birla Sun Life Income Fund. To take advantage of this tactical opportunity these funds have big allocations to FAR securities and going ahead most of the allocation will be done in FAR securities only.

Source: ABSLAMC Internal Research, Bloomberg, Gavekal Research, JP Morgan, CEIC and RBI

*Investors should consult their financial advisors, if in doubt about whether the product is suitable for them.

*Investors should consult their financial advisors, if in doubt about whether the product is suitable for them.

*Investors should consult their financial advisors, if in doubt about whether the product is suitable for them.

This article is for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/ communicating any indicative yield/returns on investments. ABSLAMC has used information that is publicly available including information developed in-house. The information gathered and the material used in this document is believed to be from reliable sources. Past performance may or may not be sustained in the future. Before you consider investing, please make an assessment on whether the proposed investment meets your investment objective and asset allocation that you have set for your investments. Please go through the Scheme Information Document to understand the investment objective, asset allocation, and risk factors associated with the Scheme before investing.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.The Macro Setup

Indian growth story remains intact with 1QFY24 GDP coming at a healthy 7.8%, broadly in line with RBI (Reserve Bank of India) and market estimates. Headline inflation has moved within the target band. Core inflation has been well behaved with the latest number coming in at 4.3% y-o-y (43-month low). Consumer Price Index or CPI (ex-veggies) in October month came in at 5% y-o-y which was at a 46-month low.

Index Inclusion

Impact of index inclusion:

Conclusion

Our recommendation

You May Also Like

Loading...

1800-270-7000

1800-270-7000