-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

The RBI’s Liquidity Management Toolkit and our Outlook on Rates

Nov 04, 2023

5 Mins Read

Vighnesh Gupta

Vighnesh Gupta

Listen to Article

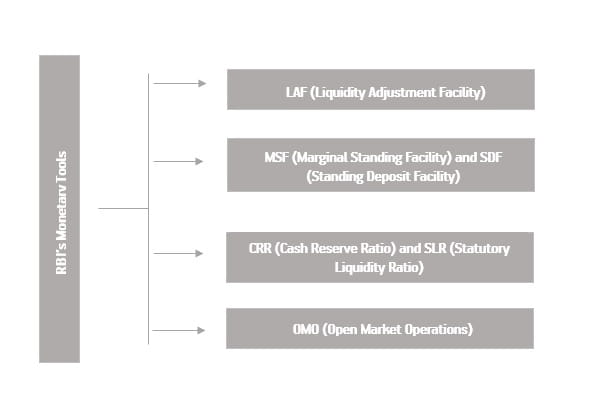

At the start of the year, we had anticipated that liquidity management would be on the RBI’s (Reserve Bank of India) radar in 2023 and beyond rate hikes, liquidity would be used as an active policy tool this year. Our forecast in our annual outlook in January highlighted that monetary policy action in 2023 would shift more towards the quantum of liquidity and its effect on overall financial conditions than on absolute repo rate levels and the possibility of banking liquidity falling into a deficit zone by mid-2023.

As it turned out, over the course of the year, liquidity turned out to be more ample than initially anticipated with higher RBI dividend to the Government, withdrawal of Rs 2000 banknotes and good equity inflows supporting overall liquidity. However, banks were reluctant to park reserves at RBI’s 14-day VRRR (Variable Reverse Repo Rate) keeping overnight liquidity in a large surplus and overnight rates traded close to SDF (Standing Deposit Facility) hampering transmission of monetary policy.

The central bank intervened and introduced an innovative tool called the Incremental cash reserve ratio (I-CRR) which forced banks to maintain a higher CRR (which earns nil interest vs the 14D VRRR or the SDF offering 6.49% and 6.25% respectively). This showed the RBI’s focus on keeping overnight liquidity close to neutral to ensure that the Weighted Average Call Rate (WACR) aligns with the repo rate. The RBI’s actions indicate that it is not comfortable with liquidity exceeding ~1% of NDTL (Net Demand and Time Liabilities) and the actions being taken are consistent with its ‘withdrawal of accommodation’ stance.

The RBI is in active liquidity management mode. In the August 2023 Monetary Policy Committee (MPC) meeting, the RBI announced ICRR to lock up surplus liquidity which was phased out by October 7 before the festive season set in.

Banks are required to maintain reserves as a certain % of NDTL with the RBI, namely the cash reserve ratio or CRR. This tool is used both for liquidity management as well as a buffer for banks in times of stress. An incremental CRR means that the quantum of reserves to be parked with the RBI increases and reduces inter-bank liquidity.

The decision to require scheduled banks to maintain an incremental cash reserve ratio (I-CRR) of 10% on the increase in their NDTL (Net Demand and Time Liabilities) between May 19 and July 28 of this year impacted liquidity in the banking system, further tightened due to advance tax payments. As a result, money market rates firmed up and led to increased CD (certificate of deposit) issuance from banks.

But now let’s shift focus to our outlook for rates. We have long been of the view and had highlighted in our annual outlook that rate cuts are not visible on the horizon and that rates will stay ‘higher for longer’. Consistent with our view and following stronger growth outcomes, markets have priced out rate cuts entirely. The October 2023 MPC further supports our ‘higher for longer’ view with a high bar for both rate hikes and cuts over the next 12 months.

With a 10-year IGB yield of around ~7.3-7.4%, we believe the current level is attractive for someone taking a long-term position if they can tolerate some volatility in their portfolio. Risks are elevated on both sides and although our bias is towards easing of yields from current levels, we will remain very alert on upside risks playing out. In our annual investment outlook released in January 2023, we stated that it was time to dial back actively managed short-duration funds on a risk-reward basis and accrual as “the theme for 2023”. Going forward, we are tactically bullish and expect bond yields to be lower from these levels over the next 6-9 months. We are watching the evolution of liquidity and any announcement of an OMO sales calendar; the movement of global bond yields and oil prices will dictate the direction of bond markets from hereon.

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/ communicating any indicative yield/returns on investments. ABSLAMC has used information that is publicly available including information developed in house. Information gathered and material used in this document is believed to be from reliable sources. Further the opinions expressed and facts referred to in this document are subject to change without notice and ABSLAMC is under no obligation to update the same. Further, recipients of this report shall not copy/ reproduce/quote contents of this document, in part or in whole, or in any other manner whatsoever without prior and explicit written approval of ABSLAMC. Past performance may or may not be sustained in the future. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Active liquidity management – A new factor for money markets?

What surprised bond markets after the last MPC announcement in October 2023 was the discussion on possible OMO (Open Market Operations) sales. Despite the inflow on account of phasing out of I-CRR, liquidity is expected to stay close to neutral in the next few months given higher cash needs during the festive season.

We feel this announcement would have been better timed closer to index inclusion-related flows (JP Morgan recently announced the inclusion of Indian Government Bonds into its GBI-EM family of indices from June 2024) which is expected to be in the range of 30-50 billion USD, to avoid an unwanted easing of bond yields and financial conditions. Further, we believe CRR is a much more efficient way of managing liquidity versus OMO sales which have second-round effects on bond yields.

Yield curves have steepened across the world and major central banks have been conducting QT (Quantitative Tightening) to reduce liquidity and support monetary policy transmission. We believe the RBI has chosen to follow OMO sales as a preferred liquidity management instrument (versus CRR hike or long-term FX swaps) to support Indian bond yields and protect rate differentials versus developed markets. Global bonds have sold off massively over the last few months even as IGBs (Indian Government Bonds) have stayed resilient supported by favourable growth and inflation dynamics locally and bond index inclusion-related newsflow.

The RBI’s past actions are reflective of its intent to keep liquidity conditions tight. It is interesting to note that it has already been selling bonds over the last few weeks with ~17,500 Crores of sales reported over the last 8 weeks. No OMO calendar has been released yet. Given that the RBI Governor clarified that the planned sales will be notified in advance, therefore there is a risk that such sales if and when announced may be large. We believe OMO sales will be used to manage yields more than liquidity itself for which other tools such as CRR are more effective. This announcement was equivalent to a stealth tightening of policy with the focus seemingly being on the back end of the curve.

Rates to remain higher for longer?

We continue to expect no rate cuts over the next 12 months as growth at 6.5% remains near potential and underlying inflation is trending at ~5%. Despite resilient growth, we believe the bar for further rate hikes is high and will require further or more persistent supply-side shocks and/or a broadening of price pressures to core inflation. We remain watchful of the risks posed by oil prices which have moved higher again and any signs of re-acceleration in inflation in developed market economies. We are near terminal rates (peak of the cycle) and not worried on that front unless a new round of risk emerges from commodity prices and global policy.

What should investors do?

We advocate investors having a 3 – 12 months investment horizon to match their investments with the duration of the fund and invest in ultra-short, low-duration or floating rate funds. Investors having a horizon of 12 months+ can look at investing in actively managed funds and we recommend gilt, income or short-term funds. Long-term debt investors having an investment horizon of 3 years can look at dynamic bond funds or target maturity debt funds.

Data source: ABSLAMC Research, RBI

You May Also Like

Loading...

1800-270-7000

1800-270-7000