-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

What is Phillips curve and why is it important?

Apr 25, 2023

4 Mins Read

Listen to Article

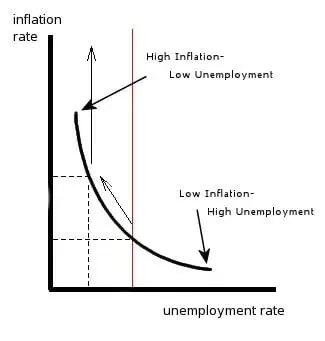

The Central Banks of advanced economies – especially the US, UK and Euro area – take the prevailing unemployment rate as a key monitorable while fixing interest rates to fend off inflation. More specifically, they tend to rely on the perceived inverse relationship between the unemployment rate in the economy and the inflation level that is prevalent. This interpretation, which comes from the Phillips curve, suggests that when the unemployment rate is high, the inflation is low and vice versa.

The argument in favour of this theory is that when a country is in robust growth mode, jobs will be available aplenty, inflation will be high, and unemployment would be low. When unemployment is low, people are likely to hop jobs and demand higher wages, thus stoking inflation. Therefore, policymakers are of the opinion that tweaking rates to slow down (making it difficult for firms to borrow) an economy can have the desired impact on the labour market and eventually on inflation.

In fact, despite the recent bank failures, notably that of Silicon Valley Bank, the Federal Reserve has stuck to its stance of rate hikes to tame inflation and cool the labour market

But there are many opponents to the Phillips curve postulate who cite multiple instances over the past several decades and indeed even during recent years (2015-2020) when both inflation and unemployment remained low in much of the developed world, thus negating the proposition.

Interest rates and an unusual situation in the US economy

Years of low interest rates, COVID-19 stimulus measures, the Russia-Ukraine war, commodity price surges and supply side disruptions took inflation to record highs from late 2021 and into mid-2022 in the US, as well as in most advanced and emerging economies.

The US faced near double-digit inflation, a 40-year record. As a result, the Federal Reserve increased interest rates by 500 basis points (5 percentage points) over 2022 and 2023 thus far. This brought down inflation from 9% in June 2022 to 6% in February 2023. But curiously, the economy and the labour market remain buoyant. The unemployment rate has remained steady at 3.6% in February 2023, the same level seen in October 2023, though it is up a bit from January 2023 level of 3.4%. The per hour wage rate continues to increase (from April 2022) and was at $28.42 as of February 2023.

This development has the US Fed take note, as a strong labour market will mean higher wage expectations and the possibility of inflation persisting and not going down to the 2% level that it targets.

Media reports suggest that the Federal Reserve now expects unemployment rate to hit 4.5% level by the end of 2023.

A probable scenario as argued in the global financial community is that the Fed will keep increasing rates till the labour market cools, which could push the US into a recession.

Does RBI follow the Phillips curve?

India’s banking regulator, the Reserve Bank of India (RBI), and the monetary policy committee (MPC) that set interest rates have not discussed on unemployment as a metric to set rates, at least in the public domain. And India does not have robust labour participation statistics reporting system in place.

In November 2021, the RBI released a paper titled ‘Is the Phillips Curve in India Dead, Inert and Stirring to Life or Alive and Well?’ In the conclusion part, the paper stated that the years after the global financial crisis had seen the Phillips curve being almost obscured. However, the paper also stated that after being irrelevant for 6 years in India from 2014 to 2020, the Phillips curve is alive and recovering.

Much of this discussion seems academic at the moment in India, but the country’s markets and financial ecosystem will keep a track of the Fed’s reaction to the Phillips curve.

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

You May Also Like

Loading...

1800-270-7000

1800-270-7000