-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Why Doing Nothing May Be Best In Volatile Markets

Jun 19, 2023

4 Mins Read

Listen to Article

Volatility is a measure of price movements/changes (both price rise and fall) of a security over a specified period of time influenced by investors’ reacting to various macro and micro factors and is a fundamental attribute of capital markets. Market volatility is inevitable and can be caused by wide-ranging factors from changes in interest rates to rises in crude prices, geopolitical events, and even expectations ahead of events such as a budget announcement. It can also be a reaction to any corporate development, policy changes or political events. Volatility is tracked to gauge market sentiments and even economic conditions. The intensity, frequency and duration of volatility have a commensurate impact on market returns.

But predicting market movements is difficult, and investors are often left wondering – What should I do when markets are volatile? Perhaps doing nothing could be one of the solutions. Here’s why:

1. Avoid Emotional Decisions

During volatile markets, investors tend to make emotional decisions. Selling your mutual funds, because of fear of volatility, may lead to book losses upfront. But continuing with them would mean the loss or lower returns are just on paper and will be reversed once the market recovers. For investors, it’s very crucial to stay cool and avoid being distracted by their emotions.

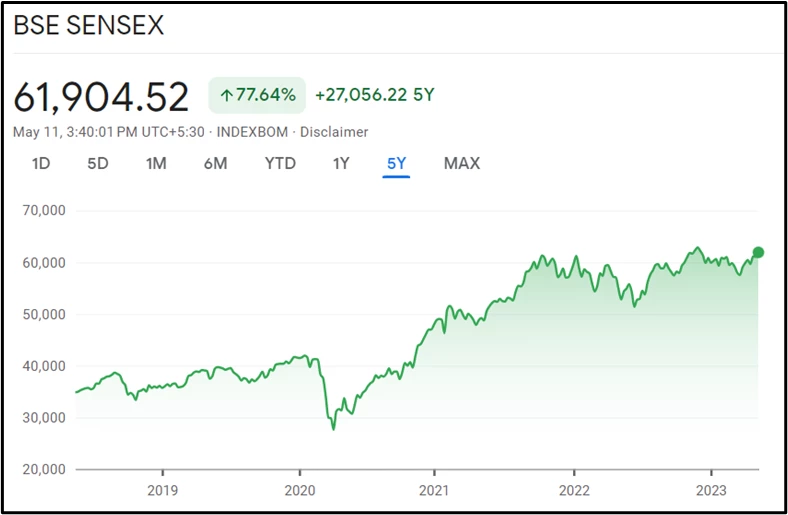

For instance, do you remember Covid-19, when the market was highly volatile, and the SENSEX fell over 28.6% (Source: Business Standard) in the January-March 2020 period?

If you were among the investors who feared this volatile market and exited the market, you missed a valuable opportunity.

The category average returns for large-cap funds between March 24, 2020, and March 31, 2022, was 109%, with average returns for the category at 44% on an annualised basis (Source: Moneycontrol). Investors who didn’t exit the markets during this period saw the fruits of this bullish period in their portfolios.

Source: Moneycontrol

If you make decisions hastily, you may lose out on the opportunity of seeing your portfolio recover from falls and even grow in value.

2. Keep the Portfolio Diversified

We may never accurately predict what event triggers volatility and which sectors will be most affected. Since not all sectors and companies have equal risks or growth prospects at any given point, your diversified holdings will help you reduce risk and protect against individual stock fluctuations.

3. Reap the Benefits of Rupee Cost Averaging

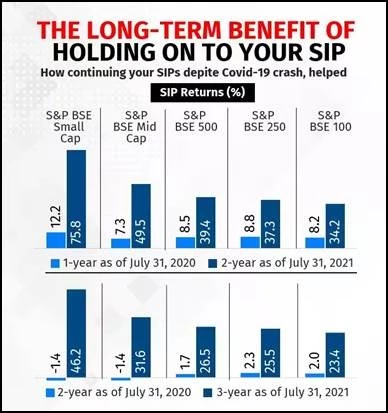

The long-term advantages of SIPs, such as the power of compounding and rupee cost averaging, not only smooth out losses but also lower the cost of investment and maximise returns.

If investors had continued their SIPs after the Covid-19 crash, they would have been the winners. According to data, the S&P BSE Small-Cap TRI delivered a staggering 75.8% on two-year SIP returns, whereas its one-year return was 12.2% until July 31, 2020. Similarly, the S&P BSE Mid Cap TRI also delivered two-year SIP returns of 49.5%, which was 7.3% up until July 31, 2020

(Source: Moneycontrol).

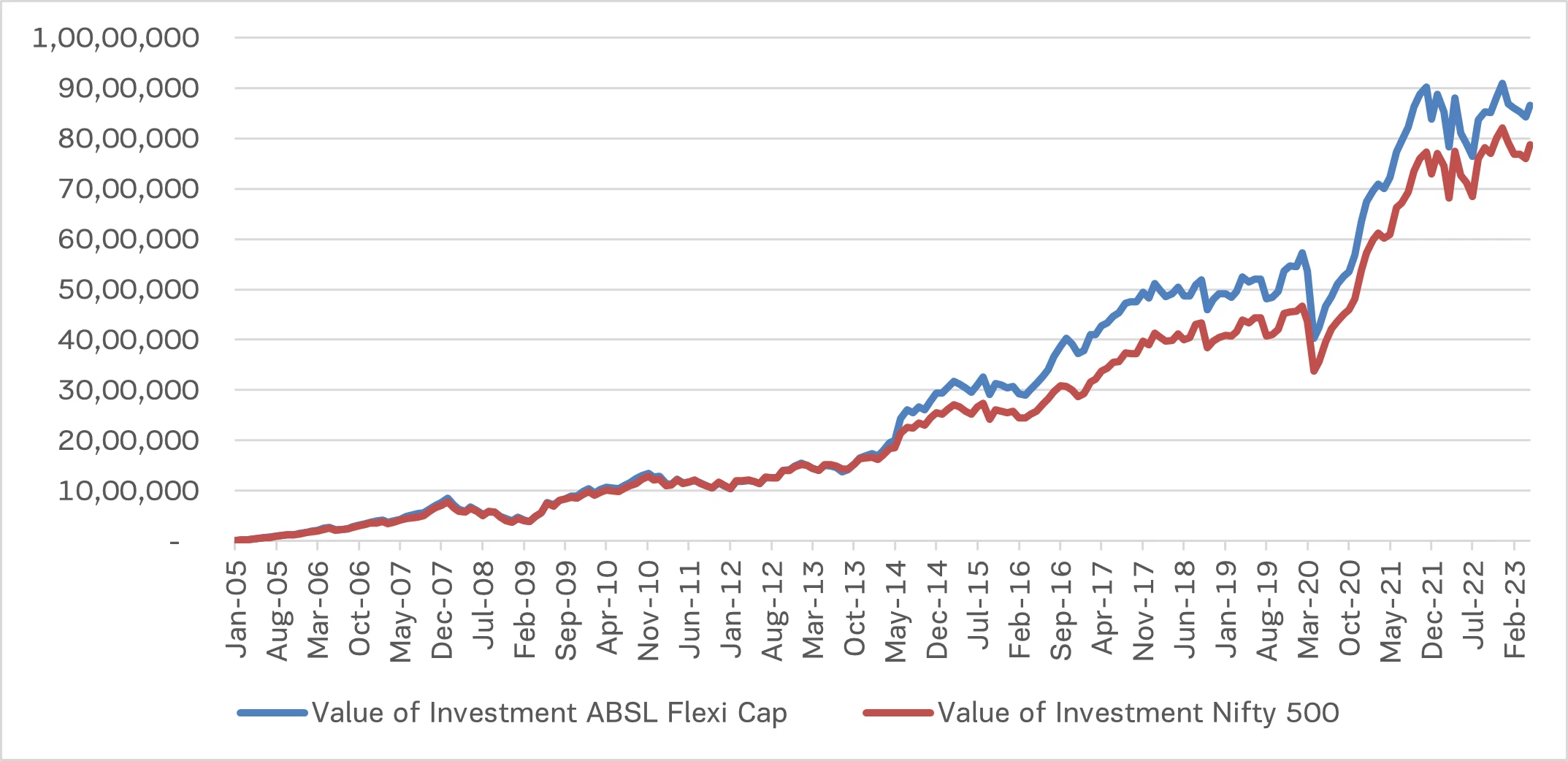

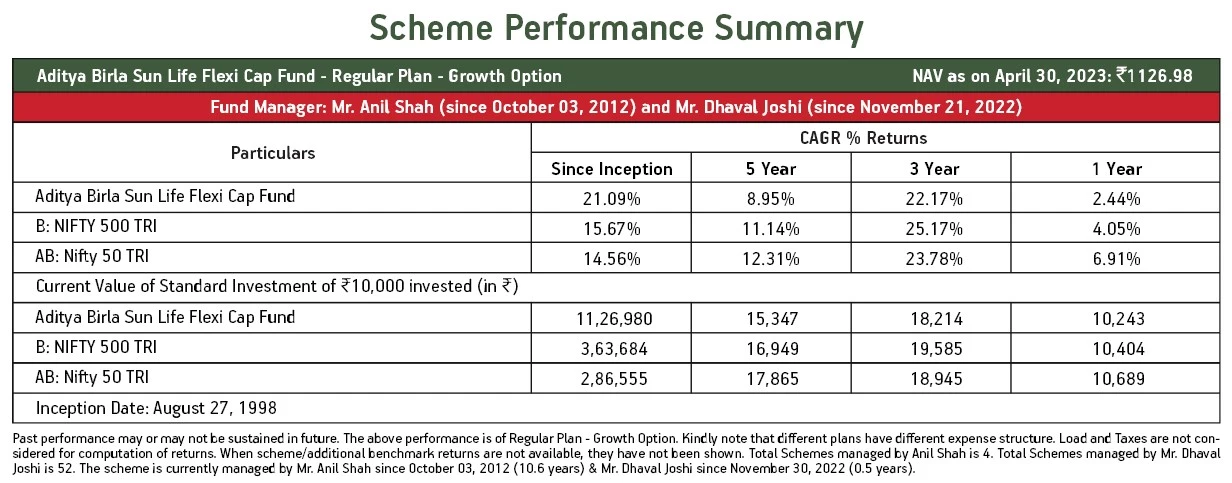

Let’s take a look at one of Aditya Birla Sun Life Mutual Fund’s schemes. If someone had an SIP in Aditya Birla Sun Life Flexi Cap Fund of Rs.10,000, since January 2005 and the investor didn’t budge from doing her monthly SIPs, this is what her return pattern would have been. Think about it, this period saw the global financial crisis in 2008, taper tantrum in 2013, Demonetisation in 2016, and Covid in 2020. Click here for performance details of the fund.

Source: ABSLAMC Internal Research

Bottomline, stay focused on your goals, keep an eye on the market and don’t panic.

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

You May Also Like

Loading...

1800-270-7000

1800-270-7000