-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Investing in Technicolor: How Multi Asset Allocation Funds Bring a 3-in-1 Pop of Colour to Your Portfolio

Aug 10, 2023

5 min

4 Rating

Imagine what your investment portfolio would look like if it were an old monochrome movie…

There would be an optimistic beginning with you as a newbie ready to explore the world of investing. Then there would be a montage of your first few steps in this new world, learning the ropes of investing, the different asset classes, and their features, how much and when to invest in each asset class. And then there would come the struggles, ups and downs of bullish and bearish markets, some happy highs and some not-so-happy lows. But then having everything in just one colour kind of kills the thrill, doesn’t it?

Different occasions and different moods stand out better in technicolour, rather than monochrome. The market too is a dynamic, volatile place which has its many phases and moods. Then why not add a pop of colour to your portfolio with a multi-asset allocation fund which adjusts its script as per the market’s moods?

Click here to Visit – 3-in-1 Investment Option

The Technicolour world of Multi-Asset Allocation:

If single-asset investing is monochromatic, then a multi asset allocation fund is technicolour. This fund allocates your investment across multiple asset classes like equity, debt and commodities such as gold/silver ETFs that are uncorrelated. This means that each asset class performs differently in different market moods and conditions.

It invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes.

Each of these asset classes adds a different colour to your investment movie:

- Equity is an aggressive asset class that harnesses volatility to grab market opportunity. Its adventurous attitude makes for a bold and bright scene against the backdrop of a bullish market.

- Debt is another asset class which is lower in volatility than equity making for a subtle, soft colour. When the market mood is uncertain, debt helps generate reasonable with potential consistent returns in the short term.

· Commodities fill in the gaps left by the other two classes when the market mood turns bearish. Calm and indifferent, commodities act as a hedge against inflation by generating reasonable returns when equity and debt are volatile.

Together, these three classes give you the opportunity to transform your portfolio into a wholesome technicolour blockbuster.

Also Read – What is Multi-Asset Allocation Fund

How the Multi-Asset Allocation bring a 3-in-1 pop of colour to your portfolio

The outcome of a technicolour blockbuster is vibrant and eye-pleasing, but the process is tedious and needs technical skill and prowess. Behind the scenes, hundreds of technicians work round the clock to make sure the movie grabs the essence of the story and communicates each mood and emotion effectively. Similarly, a multi-asset allocation fund works round the clock, striving to make your investments create wealth for you even when you are on a break.

Diversifying across asset classes:

The entire storyline is in the name. The multi-asset allocation fund diversifies your funds across the above three asset classes. The fund adds the colour of each asset class to generate a well-balanced technicolour portfolio. Here’s how:

The markets are always in motion. In a bull market, equities are leading the race and in a bear market debt gives stability. A multi-asset allocation fund invests in all three asset classes at the same time and rebalances the portfolio timely. When the equity portion rises it shifts some funds to the other two asset classes, maintaining the balance across the portfolio. This way, the fund accumulates the high returns of each asset class and compounds them to generate wealth in the long term.Where there is a risk there is a reasonable return:

Everything has some degree of risk, investments too. The trick is to manage these risks efficiently to generate better returns. The multi-asset allocation fund has the power of three uncorrelated asset classes, and it uses each of their strengths to manage the other’s risk. For instance, equity’s strength is high returns, but it is also highly volatile. The fund reduces the high risk of equity by allocating some amount in debt whose strength is low volatility. It fills the gaps of debt and equity with commodities and real estate.Expertly managed:

Making sure the colours of a technicolour movie are just right, needs expertise and a trained eye. Fund managers are the colour-balancing experts of multi-asset allocation funds. They, along with the team of analysts, tirelessly map and monitor the market moods to blend the three asset class colours together in a balanced mix. The right mix helps bring reasonable returns in every market scenario.

No matter the market mood, the technicolour balance of a multi-asset allocation fund can act as one of the anchors of your portfolio. Optimising the opportunities offered by the volatile movements of the market go a long way in achieving your financial goals.

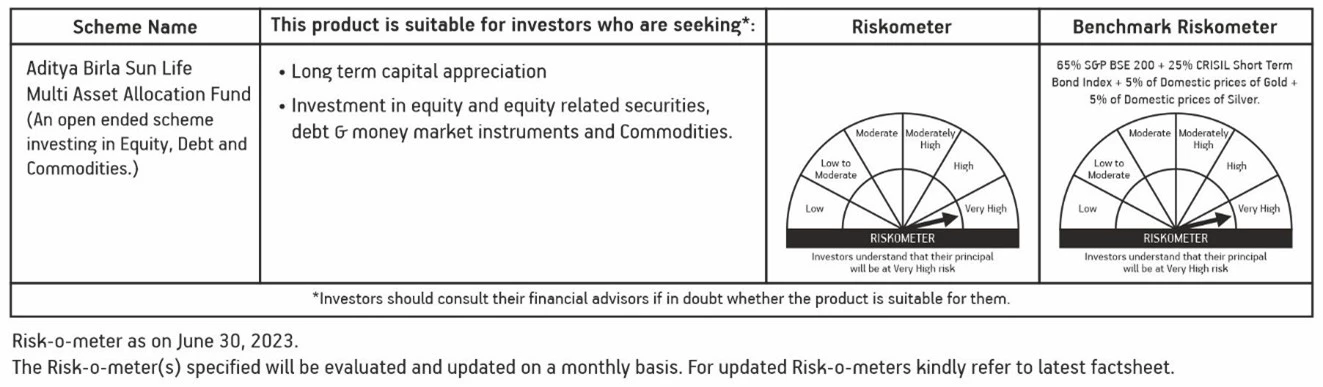

In conclusion, multi-asset allocation funds add a vibrant touch to your investment journey, bringing a 3-in-1 pop of colour to your portfolio. As you explore this strategy, you may consider the Aditya Birla Sun Life Multi Asset Allocation Fund as one of the potential options for investment. Remember to assess your financial goals and risk tolerance to make the best choice and optimize your investment experience. Happy investing!

Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000