How does one go about fulfilling one’s goals in life?

The first thing to do is set a goal for yourself. Then put a deadline for yourself, so that you stay focused and don’t lose your zeal mid-way. And thirdly, you work out the best possible strategy that can be followed to achieve the goal by the decided deadline. In order to achieve the desired financial outcome, you need to diversify your portfolio and have a flexible approach to investing across different asset classes so that you can grab opportunities as and when they arise.

That, in a nutshell, is what Multi Asset Allocation Funds aim to do too.

Presenting Multi-Asset Allocation Fund

As the name goes, a multi-asset allocation fund allocates your investment across multiple asset classes that are uncorrelated, which means they perform differently in different market conditions. As per SEBI categorization, multi-asset allocation funds need to invest in at least 3 asset classes with a minimum allocation of at least 10% in each asset class. These asset classes could be equity, fixed income and commodities like gold, silver, REIT etc.

Where do Multi-Asset Allocation Funds Invest?

Equity portion: Equity investments are inherently high-risk, high-return investments. Investors with a high-risk appetite and the desire to make the utmost use of the market volatility to earn high returns prefer investing in equity instruments.

As per SEBI rules, multi-asset allocation funds are required to invest a minimum of 65% of the investment amount into equity and equity-related instruments. This gives investors a better chance of making the most of a market upturn. The fund manager has the flexibility to invest across market caps, sectors, and industries to give you well-diversified exposure to the equity market and help generate wealth.

Debt portion: Conservative investors with a relatively lower risk tolerance prefer investing in debt instruments. The multi-asset allocation fund gives conservative investors the benefit of the equity and commodity classes, without investing outside their comfort zone.

The rule of investing a minimum of 10% in every asset class in the multi-asset allocation fund makes sure that your invested money has at least 10% allocated in debt instruments which are less volatile than equity instruments, thereby bringing stability to the investment portfolio.

Commodities and REITs portion: Going by SEBI’s rule, a multi-asset allocation fund invests a minimum of 10% in other asset classes like gold/silver ETFs and REITs. They act as a hedge against economic uncertainty and inflation.

While the above-mentioned points stand true for multi asset allocation funds in principle, every multi-asset allocation fund is unique. The fund manager determines the actual asset classes it will invest in and the percentage allocation to each of these asset classes. He/she also determines the threshold that will trigger the reallocation of funds from one asset class to another.

Benefits of Multi-Asset Allocation Funds:

1. Diversification with a capital D:

Diversifying your money across various stocks is one way. But multi-asset allocation fund takes diversification to the next level. It diversifies your money into three distinct asset classes. Each class has its advantages, and each is important in order to have a well-balanced portfolio. Let’s see how.

In a dynamic market like India, volatility is a boon as well as a bane. When the market is doing well, equity can reap the benefits. But during a bleak period, debt might be the better option as they are considered to be more stable and can help curtail losses. Commodities such as gold and silver have been known to be good as a hedge against uncertainty and inflation. Thus, by investing in a multi-asset allocation fund, you can fulfil two of the cardinal rules of “good investing” as experts call it – diversification, and balancing your portfolio as per the market movements.

2. Generating reasonable returns while managing risks:

By giving your portfolio exposure across asset classes with lower correlation, as well as across sectors, caps and investing strategies, multi asset allocation funds extend a certain amount of flexibility to your investments. By investing across different market caps and sectors, they provide a better opportunity for growth. At the same time, diversifying into both traditional and non-traditional asset classes such as real estate helps in managing risks while generating reasonable returns..

3. Managed by Experts:

Gathering information and doing thorough research about three different asset classes is a time-consuming effort for an individual investor. Fund Managers, on the other hand, are professional experts. They have a team of analysts and are well-equipped with data and tools to track market movements and identify opportunities for growth.

Multi-asset allocation funds are actively managed funds, where fund managers do all the research and strategically allocate funds based on their observations. The fund manager’s expertise and experience give your investments a better chance of generating returns while side-stepping potential risks and bringing you closer to your desired goal.

Conclusion

Long story short, a multi-asset allocation fund can be said to be a wholesome fund that is flexible and can be moulded to any investing style, without losing out on other strategies.

Presenting Aditya Birla Sun Life Multi Asset Allocation Fund - an open-ended scheme investing in Equity, Debt and Commodities. It aims to help you achieve your financial goals by combining the benefits of three asset classes under one fund. Give your goals the boost they require with Aditya Birla Sun Life Multi Asset Allocation Fund.

Must Read - Tips for Portfolio diversification with Multi Asset Allocation Fund

Aditya Birla Sun Life Multi Asset Allocation Fund

(An open ended scheme investing in Equity, Debt and Commodities.)

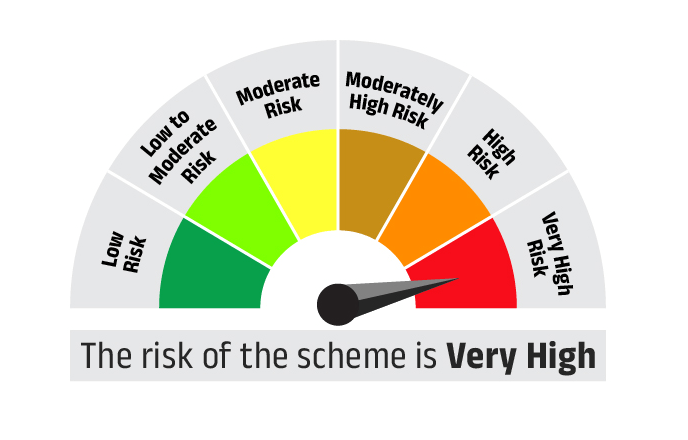

This product is specially designed for investors seeking

- Long term capital appreciation

- Investment in equity and equity related securities, debt & money market instruments and Commodities.

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

The product labelling assigned during the NFO is based on internal assessment of the Scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

For more information on the scheme, please refer to SID/KIM of the scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000