-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

5 investing mistakes that prove you need a financial advisor

Aug 30, 2019

5 mins

4 Rating

To err is human. But not seeking help for these mistakes (especially when there are specialists available) is plain stupidity. This rationale is true for financial planning as well. Read on to know the top five mistakes that indicate that you should seek professional help from financial advisors.

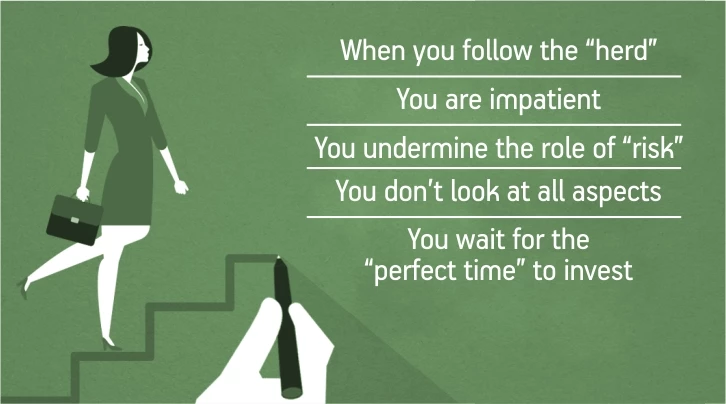

• When you follow the “herd”

The saying “one size fits all” does not apply to financial decisions. A stock or investment which may have worked for your colleague, friend or relative may not necessarily bear the desired results for you. Before making any investment decision, one needs to take into account a wide range of factors such as risk appetite, financial goals, time horizon of such goals, etc.

If you make your financial decisions basis popular opinion or general market sentiments, you need to seek the help from professional experts. They will analyze your needs, risk profile and long-term goals and suggest the most appropriate investment avenues.

• You are impatient

When you think of financial planning, think of test matches and not T20. One of the most common mistake made by investors is that they are impatient. They invest in equities thinking that they will have a windfall in a short span of time. So, whenever there is a market fluctuation, they quickly sell the stocks so that they can save themselves from a possible loss.

If you follow the same approach, it is time for a financial advisor to enter your life. A good financial advisor will ensure that you do not lose focus from your long-term financial goal and help you stay put through fluctuating market cycles.

• You undermine the role of “risk”

Many investors get so blinded by the “returns” that they overlook the associated risk. They assume much higher risk that they can absorb, which in the long-term proves a costly mistake. Never forget that higher the returns, higher the risk. Financial experts help strike the perfect balance between risk and return, after taking into account the financial and liquidity profile of the investors.

• You don’t look at all aspects

Do you decide to invest on the basis of only past returns? Or only sector performance? If you are making your investment decisions without considering all important factors, then you are not putting your money to the best use. Financial advisors have in-depth understanding of the market, trends and domain expertise. They can help to create a well-thought out investment plan.

• You wait for the “perfect time” to invest

Every financial guru will tell you that there is no perfect time to invest. If you keep on waiting for the right time, you will only delay investing and lose out on precious returns in the long run. The power of compounding takes care of market fluctuations and cycles in the long term. Rather than focusing on timing your investment decisions, one should focus on the investment horizon.

Final Words

Are you guilty of any of the above mistakes? If you find nodding your head, do not waste any more time and seek the help of a good financial advisor. Remember time is money. And an expert can help you make the most out of both these precious commodities.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000