-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

How to Make Peace with Stock Market Turbulence

Sep 28, 2018

6 mins

5 Rating

Yes, you read it right. It’s possible to stay calm and be a Zen master during turmoil in the stock markets.

The past couple of weeks have been a nightmare for many investors as the indices and large cap stocks fell along with the Net Asset Values (NAVs) of several mutual funds. Driven by negative economic news globally and market dips worldwide, the current market is highly volatile. But that’s the nature of the beast. Peaks and troughs are a part of the life of an investor and any seasoned investor would have weathered many such storms. If you are new to this field though, a falling stock market can cause heartburn and many sleepless nights. Even long time individual investors are not immune to this. And it’s a perfectly understandable response to seeing your wealth falling in value. Who likes to see their money reduce? Panic is an investor’s worst enemy and causes many hasty and wrong decisions. So the first rule of investment - always remain calm and here’s how you can do it.

Look at the Big Picture

There’s always going to be some bad news. That’s a sad fact of life but not one that decisions can be based upon. Currently, the news is flooded with articles on the trade war initiated by the President of the U.S.A., the falling rupee and the rising fuel prices. Tomorrow, there will be something else. And all of it is out of your hands or control. The only things you can control are your decisions and investments. So what do you do? At this point, NOTHING

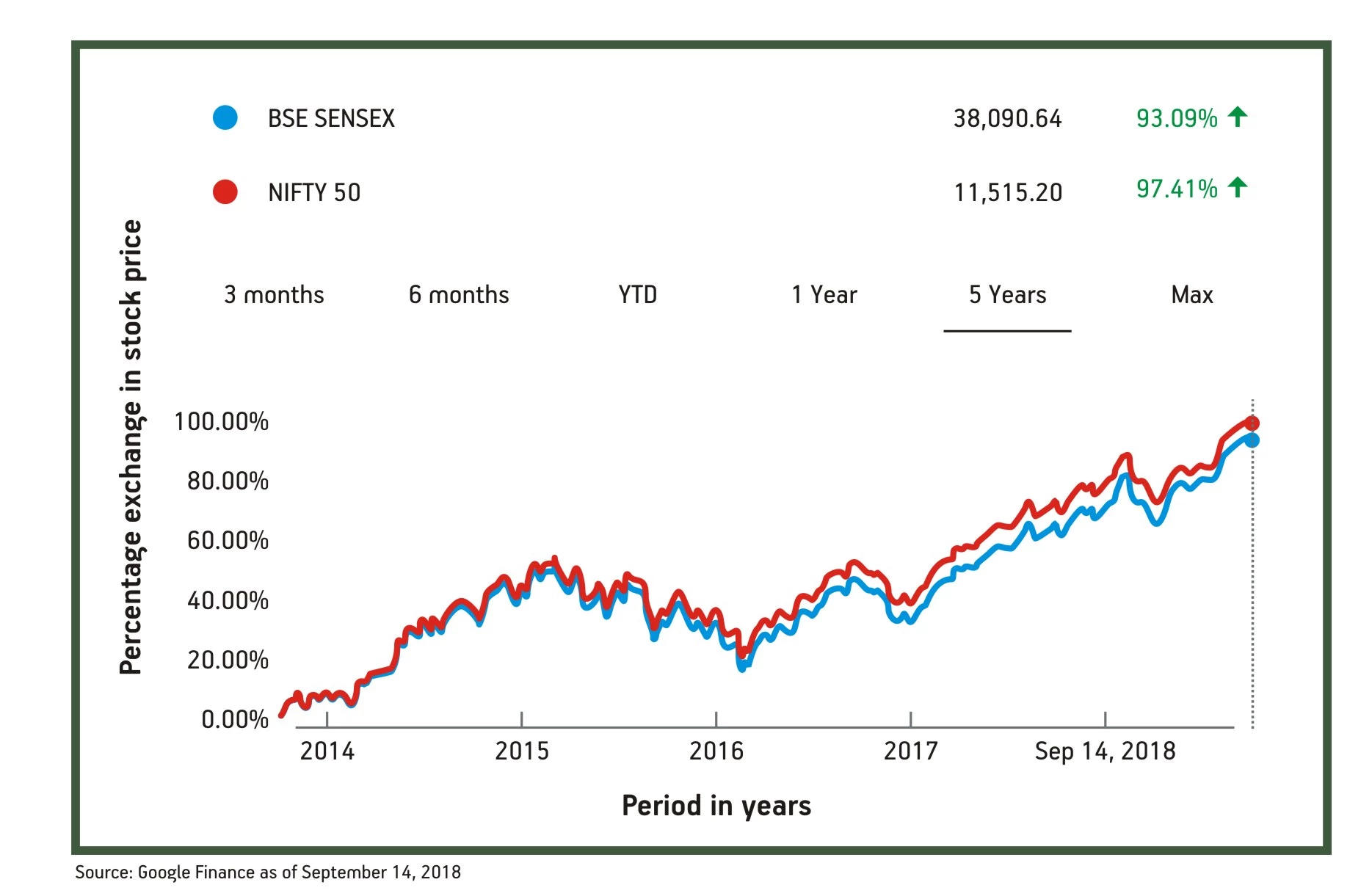

Take a look at the index charts over the past few years.

Over the last 5 years, both the benchmark indices have nearly doubled in value. The strong India growth story was the catalyst for this meteoric rise and this story is still going strong. The International Monetary Fund expects the economy to grow at 7.3% in the current and 7.5% in the next fiscal year^. The World Bank said that the country’s growth will revert to the trend growth rate of 7.5 percent in the coming years~. In fact, in a recent interview, the Finance Minister, Mr. Arun Jaitley, said that they might surpass the projected 7-7.5 percent GDP growth target*. This is on the back of buoyant tax revenues, expectations of surpassing the disinvestment targets and a resultant reduction in the fiscal deficit. All of these signs could point to a strong market

*Source: https://www.livemint.com/Opinion/0VUq4sdt8UvXFbvhOVAtPL/Opinion--The-sobering-reality-of-the-India-growth-story.html

*Source: http://www.worldbank.org/en/news/press-release/2018/03/14/india-growth-story-since-1990s-remarkably-stable-resilient

*Source: https://www.indiatoday.in/india/story/world-bank-endorses-india-s-growth-story-but-concerns-about-inflation-remain-1251596-2018-06-06Crisis is an Opportunity

Even bad news has a different facet to it if you look closely. The falling currency has a positive impact on certain export-oriented sectors like software and consultancy. Take a look at the USD/ INR chart over a month.

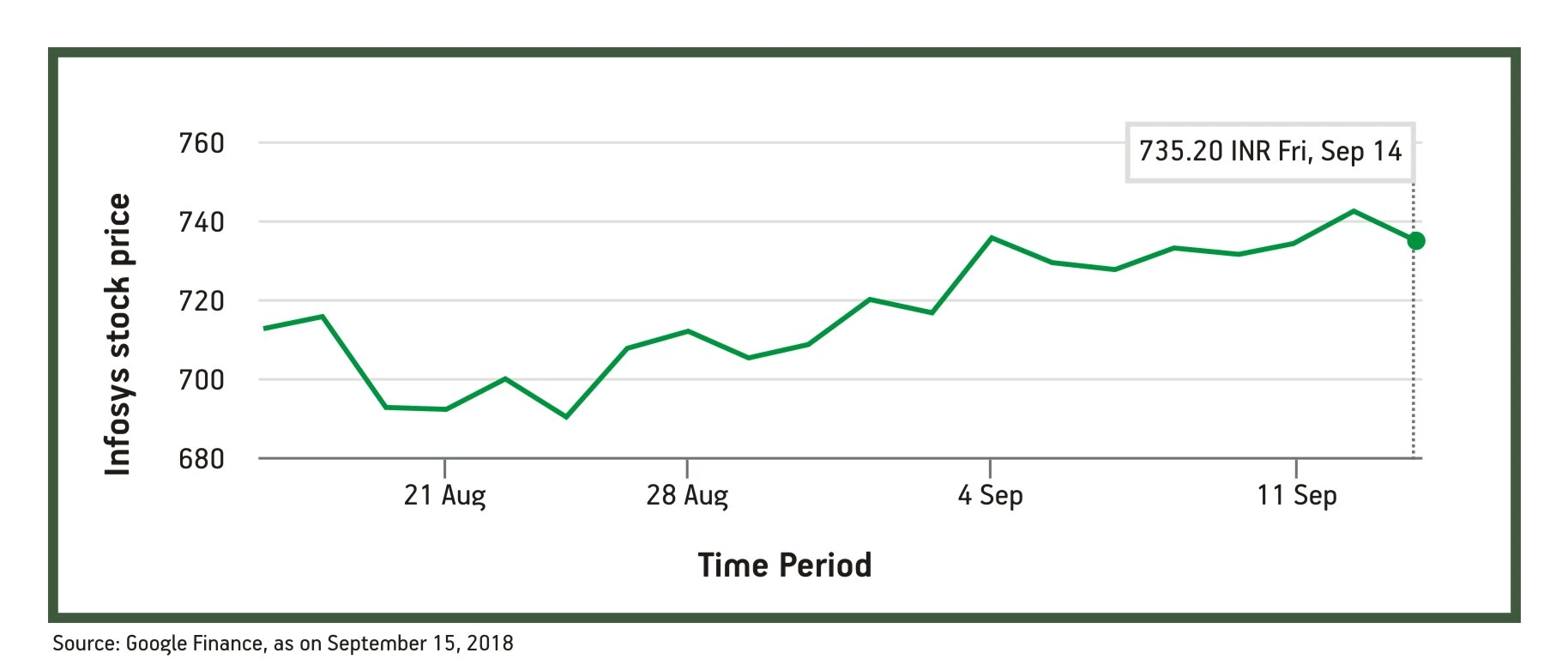

Compare the falling rupee (from a low of 69.6 to a high of 72.9) to the share market price of Infosys for the same period.

That’s nearly a 4% value rise in just a month. This is the case with most of the other companies too in this sector like TCS, Wipro etc. This phenomenon is not limited only to blue chip large cap stocks but even mid cap and small cap stocks like Mindtree Ltd., Accel Large Cap etc. are showing similar charts. Going on a tangent into mid cap and small cap stocks here, they are outpacing the main Sensex index according to an article in Economic Times#. Instead of panicking, if one looks at the data calmly, they will always find an opportunity in a turbulent market.

Stick To Your Goals

Volatility is an undeniable fact of the stock market. As an investor, ignore the fickle short-term nature of the market and focus on your goals. You may have started investing to build up a nest egg or fund your child’s education or any other long-term goal. Over the long-term, stock market has the potential to deliver good returns. Historically, it has been doing fairly well for the past so many years and the fundamentals backing these returns are still the same. Look at the time horizon and decide if your goals will be met. That might be the only criteria you need to judge the market on and take your decisions.

Trust the Experts

A smart investor is also usually a seasoned investor. The experience of the chief investment officers and fund managers is at the service of the investor. They all have decades of experience dealing with the market and in the course of their careers have seen all ups and downs it can take. They have teams of expert professionals researching and analysing the minutiae of the investing world to determine the best possible avenues to create wealth, generate income or further the fund and investor financial objectives. These teams have a wealth of information available, much more than an individual investor can hope to gather, and also the required expertise to make sense of it and decide on a course of action. Unlike an individual investor, this is what they breathe and live. They are your financial specialist doctors. You could trust them like you trust a surgeon.

As a long-term investor, you need not worry about short-term turbulence. Volatility is a need of the market and a mechanism for price corrections. Focus on the long-term, look at the big picture and just #KeepCalmStayInvested.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000