-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

5 Clever Ways to Invest Your Surplus Cash and Put Your Savings to Work

Feb 09, 2023

4 Min

4 Rating

Tax season is already in full swing. Everyone is busy sorting out their finances and thinking of ways to save on taxes without compromising on the growth of their money. In a country like India, where the stock market is volatile, many people are uncertain about investing. They prefer keeping their money “safe” and handy using traditional saving methods which offer low risks, but also lower returns. Such people are faced with the dilemma of how to help their savings grow without losing out on liquidity, and also save on taxes.

Today, the Indian economy is steadily moving forward. The current atmosphere is optimistic, and opportunities for investments are plenty. In other words, this is the time to make most of the situation and put your money to work to get you more returns.

Why You Shouldn’t leave your Savings Idle:

As we all know, inflation is always at play in any economy around the world. With rising inflation come rising prices and cost of living. Your hard-earned money, despite saving it diligently, cannot grow at the same pace as inflation. Therefore, it is very important to not only save, but also invest the saved money to help it grow.

Many people let a significant surplus stay in their savings accounts, but it is not tax efficient as the interest income is not adjusted for inflation. Instead, you can put your idle money in appropriate mutual funds, and earn better after-tax returns without losing out on liquidity or taking on higher risk.

Checkout - What is Liquidity? Understanding the Role of Liquidity in Financial Planning

Here are 5 ways to optimise your idle savings:

1. Liquid Funds:

Liquid mutual funds invest primarily in debt and fixed income instruments and are known to be one of the safest short term investment vehicles. These funds are less volatile compared to other asset classes, thanks to their diversified allocation of funds. You can invest in these funds for as short a duration as 1 day* and earn reasonable returns. High liquidity makes liquid mutual fund suitable for emergencies. They also provide an opportunity to generate a stable income or cash flow. In case of the Aditya Birla Sun Life Liquid Fund, you can also invest and redeem your money 24/7 through the Active Account App.

*Exit load charges may be applicable for redemption within 7days. Please refer to the SID/KIM for further details.

Click Here to know more about exit load in mutual fund

2. Ultra Short Duration Funds:

These funds invest in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3-6months. These funds give investors an alternative to traditional investment options. You can park your surplus money in this fund for 3-6 six months.

Also read - What are Ultra Short-Term Mutual Funds?

3. Low Duration Funds:

As the name suggests, Low Duration Funds offer a short-term investment horizon, from 6 months to 12 months. These funds invest in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 6 months to 12 months. You can park your savings in these funds for any short-term goals that you have. They are positioned to give better returns than conventional saving products and can help you optimize your idle cash.

4. Arbitrage Funds:

Arbitrage funds are a kind of hybrid fund. They adopt a unique strategy to leverage the price differential between the cash and derivatives markets to earn returns. Thus, they use volatility between different asset classes to generate returns. These short-term funds aim to provide capital growth and stable income for investors with a moderate risk appetite.

5. Money Market Funds:

These funds invest in Money Market instruments having maturity up to 1 year with an objective to deliver reasonable returns. If you don’t need money for a year or so, you can park your money in a money market fund.

All these funds aim to offer reasonable returns in the duration that is convenient and suitable to your financial goals. Moreover, if you keep your surplus money invested for a reasonable period, you can get indexation benefit i.e. tax is applicable on inflation-adjusted returns instead of absolute returns.

The investment world have a range of options where you get paid for keeping your money invested for a few days, and not years. These options allow you to optimize your money and not let it stay idle even for 30 days. When you have an opportunity for better return at lower risk, why not put the money to use .

Also Read About - What is the Minimum Investment in Mutual Funds?

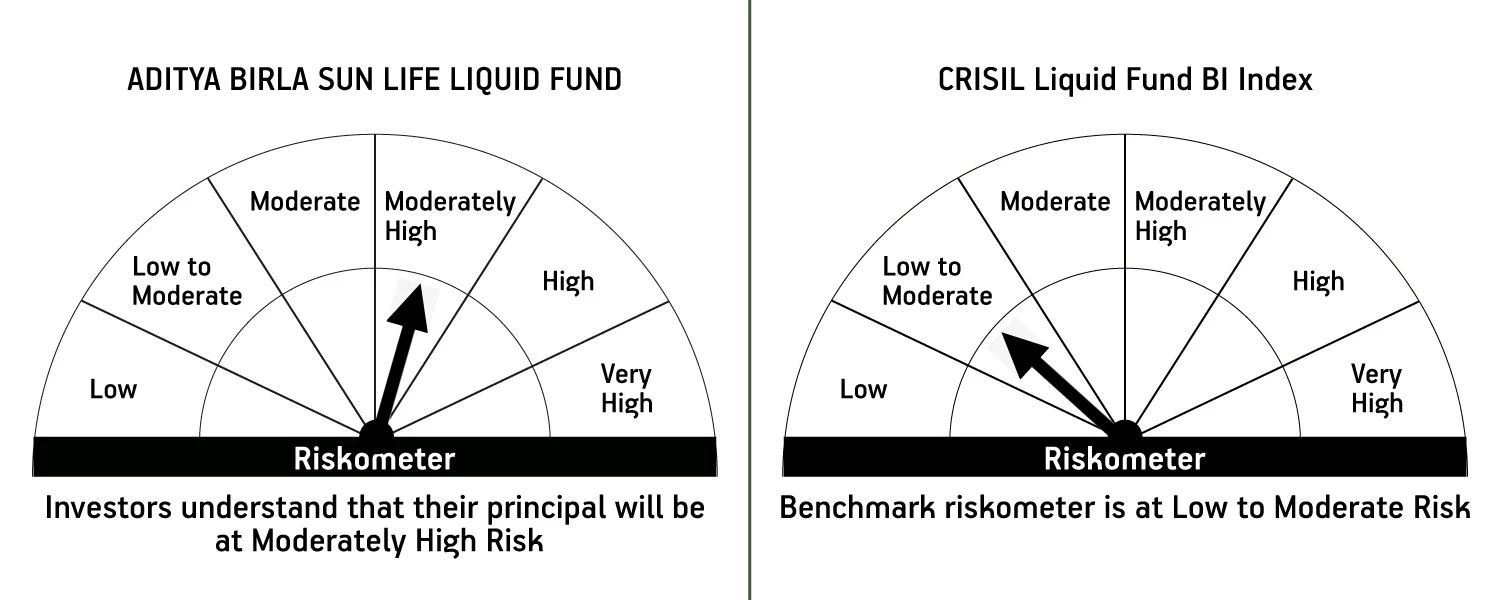

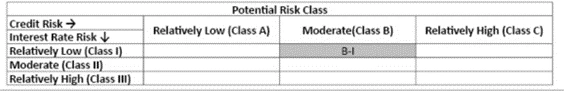

Aditya Birla Sun Life Liquid Fund

(An Open-ended Liquid Scheme)

This product is suitable for investors who are seeking*

- Investments that offer reasonable returns, high level of safety and convenience of liquidity over short-term.

- Investments in high-quality debt and liquid investments.

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000