-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

5 ways Yoga can guide your Investments

Jun 21, 2018

3 mins

4 Rating

Yoga is uniquely an Indian philosophy and way of life. It seeks the well-being of our physical, mental and spiritual self. Its unique ability to connect any individual with the world and divinity with simple breathing and meditation makes it popular across the world. People are continuously discovering its health and mental-focus benefits in a world that is increasingly lonely, stressful and fast. Yoga helps us to reconnect with ourselves, goals and inner peace.

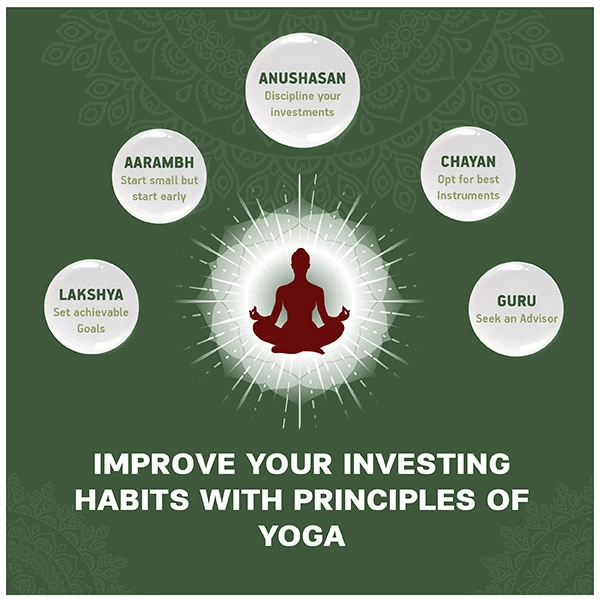

It’s easy to replicate principles of yoga in day to day life including our investing habits. 5 principles of yoga that can be applied to better investing are:

- Goal: Yes, Yoga has a goal – achieving stillness of mind and senses. When one achieves this, then all his actions are satvick and without greed. At a simpler level, all yogic asanas have specific goals and benefits. Similarly, all investment decisions should have a goal. It can be for financial freedom, child future, wealth creation or any other. Ultimately financial freedom helps us do what we love, pursue our dreams and happiness.

- Anytime anywhere: One can do meditation anywhere. The simple practice of observing your breath is the first step to meditation. You don’t need any costly membership to start. Similarly, you can start investing online with almost zero documentation. Many online platforms enable anyone to start investing with as low as Rs. 1000.

- Discipline: For attaining real benefit, one needs to make Yoga a part of daily life. A mix of breathing, stretching andexercise poses can bring a holistic healing for current lifestyle challenges. Similarly discipline of investing before spending every month or week through Systematic Investment Plans can provide a surer path to achieving financial goals and freedom.

- Different schools of yoga: There are various schools or types of yoga likeJnana Yoga, Bhakti Yoga, Karma Yoga, Kundalini Yoga, Hatha Yoga etc. Each type has a distinct philosophy and attracts different people. E.g. Hatha Yoga is a bit more for the advanced practitioners who can do more challenging poses and physical exercises. Similarly, investments are varied asset classes debt, equity, gold etc. Each has its own merits and suitable for people for different risk types and needs. You may take help of a financial advisor to know which fund best suits your investment needs.

- Guide or Master: Any discipline is best started with a guide, coach, mentor or master. It’s always recommended to have a mentor who will help you with dos & don’ts, right methods of meditation / poses and generally help you with staying on course. Likewise, financial advisors or coaches are essential to remain invested with right goals in right investments mix.

|

In Bhagwat Gita, Yoga is called out as an essential stage to be reached for all. Financial freedom too is essential to enjoy the joys of life.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000