-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

ABSL MSCI India ETF: Investing in India's Growth via a Global Index

Feb 12, 2026

5 min

0 Rating

The ABSL MSCI India ETF offers diversified exposure to India’s large and mid-cap companies through a globally recognised index, helping investors participate in India’s growth story.

India’s economic growth continues to stand out globally, with the International Monetary Fund (IMF) forecasting the country’s GDP to 6.6% in the 2025-26 fiscal year. The MSCI India Index covers approximately 85% of the Indian equity universe[ME3.1], offering broad exposure to large and mid-cap companies.

For investors seeking to participate in this growth through listed instruments, the ABSL MSCI India ETF aims to track the global benchmark. The sections that follow will cover how this ETF works, its benefits, risks, and how it may fit into a diversified investment strategy.

What Is the MSCI India Index?

The MSCI India Index is a globally recognised benchmark that tracks the performance of India’s large and mid-cap companies. It is built using a transparent methodology that considers factors like market size, liquidity, free float, and foreign ownership limits.

Since the index follows a dynamic structure, its list of stocks can change over time, helping it stay aligned with India’s evolving economy. It is widely used by global investors seeking diversified exposure to Indian equities, depending on market conditions.

What Is the ABSL MSCI India ETF?

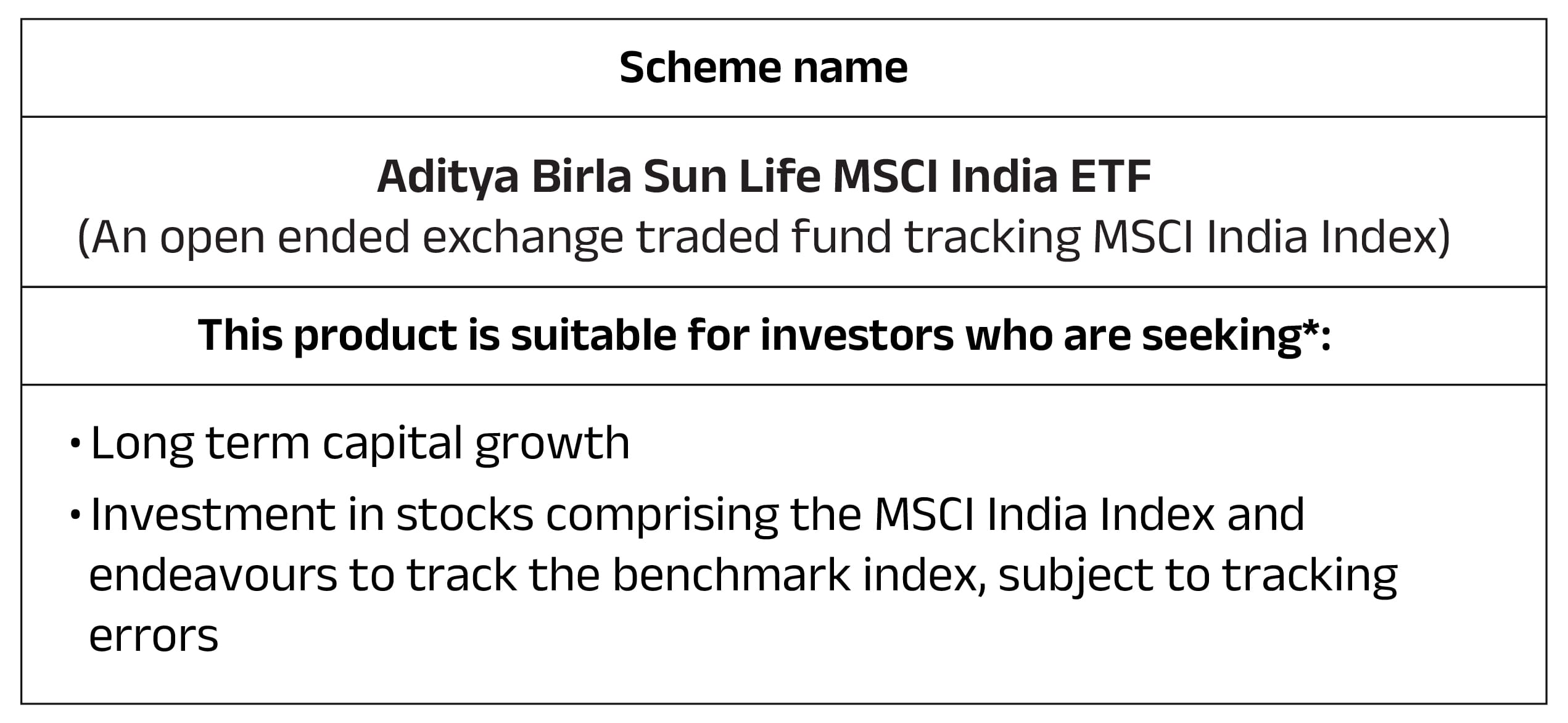

The ABSL MSCI India ETF is an open-ended exchange-traded fund that aims to track the MSCI India Index, subject to tracking error. It seeks to deliver returns in line with the index before expenses, depending on market conditions.

The scheme does not guarantee returns, and the investment objective may not be achieved. The MSCI India ETF price can also fluctuate on the exchange based on demand, supply, and the underlying portfolio value.

How the ABSL MSCI India ETF Works

The ABSL MSCI India ETF follows a passive strategy by investing in the same stocks as the MSCI India Index, in similar proportions, with the aim of tracking its performance (subject to tracking error and expenses).

Key points:

The ETF holds securities in the MSCI India Index.

Units can be bought and sold during market hours at the prevailing MSCI India ETF price.

The market price can be slightly higher or lower than the net asset value, depending on demand, supply, and market conditions.

It does not try to beat the index. Instead, it aims to replicate index returns before expenses.

Sector and Stock Composition of the Index

The MSCI India Index provides diversified exposure across sectors that represent India’s evolving economy. It includes companies from financial services, information technology, consumer-oriented businesses, manufacturing, and infrastructure-related segments.

As the economy transforms, sector weights and index constituents may change. This dynamic approach helps ensure that the index reflects shifts in growth drivers over time. For example, as digitalisation or manufacturing gains importance, the representation within the index may adjust accordingly.

The index primarily covers large and mid-cap companies. It does not restrict itself only to the very largest firms. This broader exposure can provide participation in different parts of the market, depending on overall market performance.

What are the Benefits of Investing in ABSL MSCI India ETF

Exposure to India’s Long-Term Growth Potential

India is widely viewed as one of the fastest-growing major economies. A young demographic profile, rising incomes, resilient domestic demand, and policy reforms support its growth trajectory. By investing in the ABSL MSCI India ETF, investors can gain exposure to this evolving equity story, depending on market performance.

Globally Recognised and Diversified Benchmark

The MSCI India Index follows a globally accepted methodology. Its diversified mix of large and mid-cap companies and evolving sector representation makes it a comprehensive way to access India’s equity markets.

Portfolio Diversification

The MSCI India Index has shown relatively low correlation with several global and emerging market indices. As a result, adding exposure through an ETF India MSCI product may help diversify a global portfolio, depending on broader market dynamics.

Earnings Growth Potential

Historically, the index has experienced periods of strong earnings growth compared with certain other emerging market benchmarks. However, future earnings and returns are subject to market risks and economic conditions.

Simple and Transparent Structure

The ABSL MSCI India ETF offers liquidity, transparency, and ease of access. Investors can track the MSCI India ETF price and monitor index movements, making it a convenient option for those who prefer passive investing.

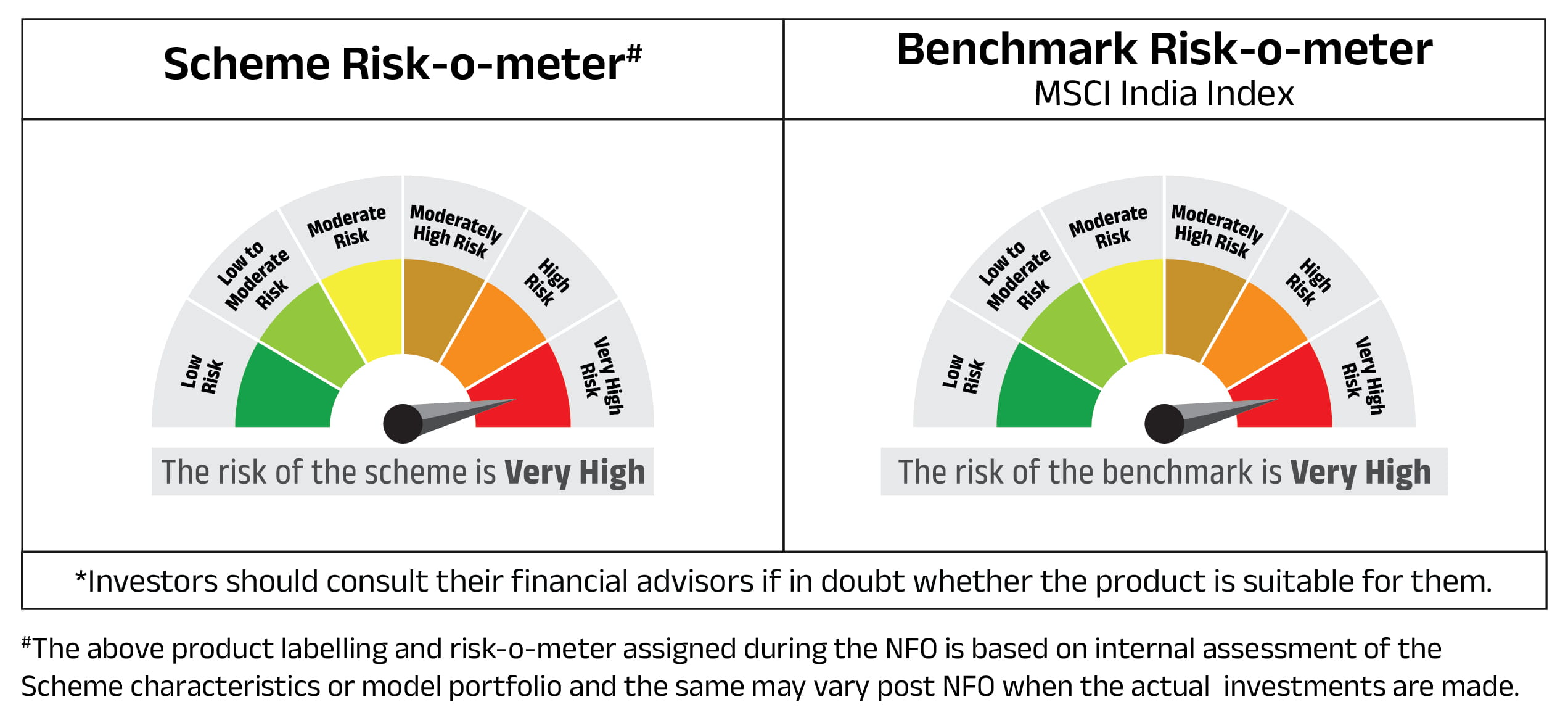

What are the Risks Associated with ABSL MSCI India ETF

Investing in the ABSL MSCI India ETF involves certain risks that investors should carefully consider before making a decision.

Key risks include:

Market Risk: Since the fund tracks an equity index, its value can fluctuate due to changes in stock prices, economic developments, policy decisions, and global events.

Tracking Error Risk: The fund aims to replicate the MSCI India Index; however, its returns may not exactly match the index returns due to expenses and other factors.

Liquidity Risk: The trading price of the ETF on the exchange may be affected by demand and supply conditions, which can influence the price at which investors buy or sell units.

Volatility Risk: Equity markets can experience periods of high volatility, which may impact the MSCI India ETF price in the short term.

Investors should assess their risk appetite, financial goals, and investment horizon before investing.

How ABSL MSCI India ETF Fits in a Portfolio

For investors building a diversified portfolio, the ABSL MSCI India ETF can serve as a strategic allocation to Indian equities through a global benchmark. It may complement other domestic or international investments by providing targeted exposure to India’s large and mid-cap segments.

Those already invested in domestic index funds may find that the MSCI-based approach offers a different composition due to its methodology and dynamic structure. As part of a broader asset allocation strategy, it can be considered for long-term participation in India’s growth story, depending on market conditions and individual financial goals.

Investors should review their overall portfolio mix, risk tolerance, and time horizon before making investment decisions.

Disclaimers:

The information herein is meant only for general reading purposes, and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data, and other sources believed to be reliable. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision.

Source:

https://thelogicalindian.com/imf-raises-indias-economic-growth-forecast-to-6-6-projects-fastest-growth-among-major-economies/#:~:text=IMF%20Raises%20India%E2%80%99s%20Economic%20Growth%20Forecast%20to%206.6%25

https://www.msci.com/indexes/index/935600#:~:text=85%25%20of%20the%20Indian%20equity%20universe

https://mutualfund.adityabirlacapital.com/campaign/nfo/aditya-birla-sun-life-msci-india-etf

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

The fund is designed to provide exposure to India’s equity markets through the MSCI India Index. Investors with a long-term horizon and the ability to withstand market volatility may consider it, depending on their financial goals and risk profile.

The ABSL MSCI India ETF tracks the MSCI India Index, which follows a global methodology and includes a dynamic set of large and mid-cap stocks. Nifty-based ETFs track domestic indices with a fixed structure. The composition and sector weights may therefore differ.

No. The MSCI India Index includes both large and mid-cap companies, offering broader market exposure.

The fund aims to generate returns corresponding to the total returns of the MSCI India Index before expenses, subject to tracking error. Actual returns depend on market performance and may vary over time.

1800-270-7000

1800-270-7000