-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

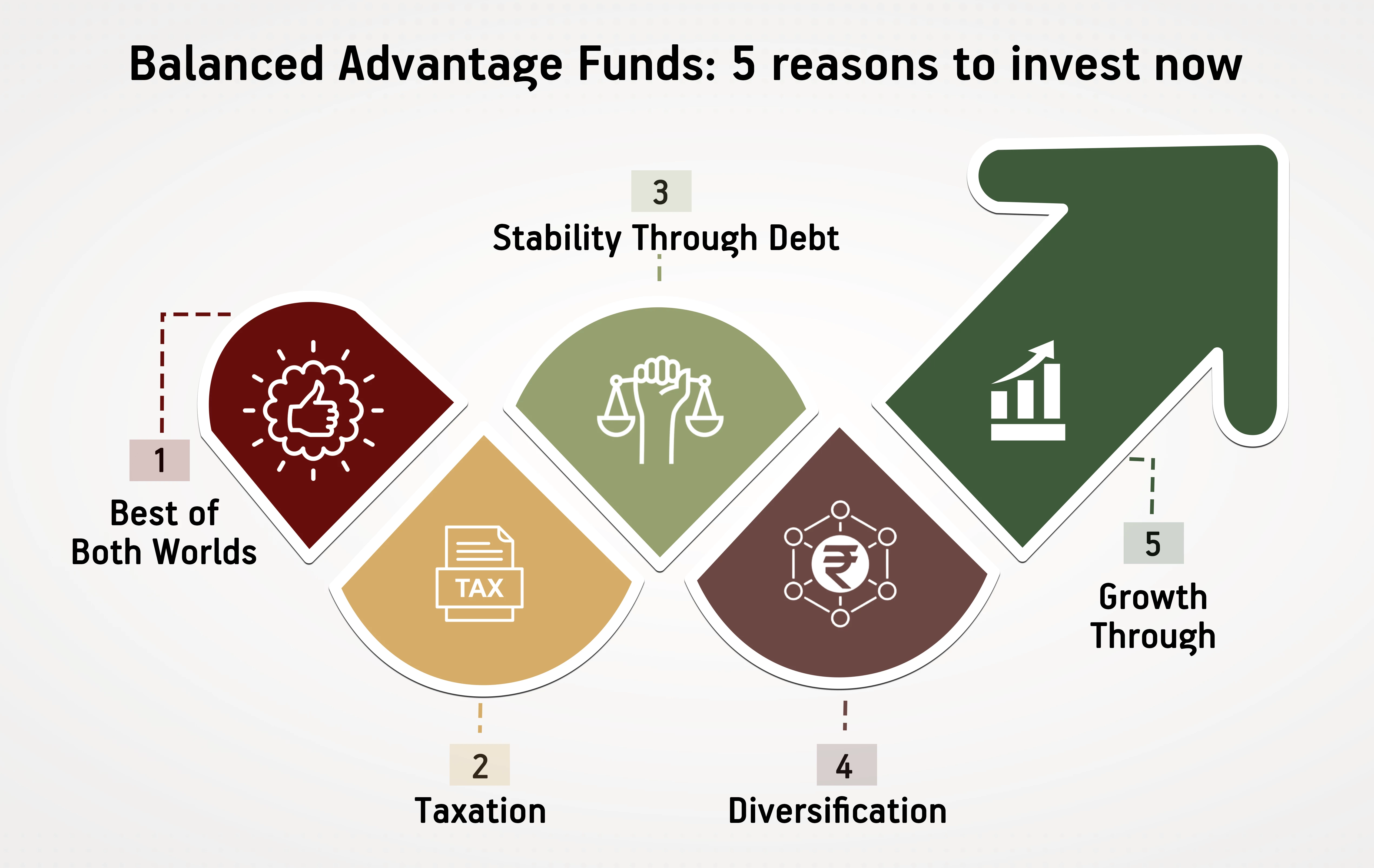

Balanced Advantage Funds- 5 reasons to invest now!

Sep 19, 2022

4 min

4 Rating

What is the secret to ‘good’ or ‘successful’ investing? Answer: Perspective.

For a newbie investor, the scariest thing about the market is volatility. The ever-changing moods of the market can make or break one’s fortunes. At the same time, experienced investors would tell you that one of the most useful features of the market is its volatility!

It’s true. Volatility breeds opportunity. Those who learn to observe and study the tides of the mar-ket can also learn to ride the waves and use them to their advantage. Balancing yourself on the risk-return surfboard can actually help you sail towards goal fulfilment and wealth creation.

One such investing surfboard is the Balanced Advantage Fund (BAF). As the name suggests, this hybrid fund aims to take advantage of the market volatility through dynamic asset allocation be-tween equity and debt instruments. By doing so, it attempts to strike a healthy risk-return balance that can not only keep your portfolio afloat during difficult times but can also give you better re-turns over time.

Also Read - What are Hybrid Funds?

So, can your portfolio also benefit from investing in a Balanced Advantage Fund? Why not! Here’s how:

Best of Both Worlds:

BAFs have the unique distinction of being able to allocate your money to both equity as well as debt markets. As you are aware, equity investments are growth-oriented while debt investments aim for stability through fixed income assets. BAFs give your portfolio the combined power of both, growth and stability. Thanks to its ability to allocate and real-locate resources within the fund from one market to another, the BAF can help give risk-adjusted returns depending on the market scenario.

Growth Through Equity:

A major portion of a Balanced Advantage Fund, almost 65-80%, is invested in equities. Eq-uity markets can give higher returns on investments during a bullish run. Since the invest-ment is not restricted to certain market caps or sectors, the Fund Manager can make opti-mum use of the favourable market to tap growth opportunities.

Stability Through Debt:

Just as it can help reap equity returns in a bull run, BAF can also help reduce the risks asso-ciated with equities during a market downturn. At such times, the fund manager reallo-cates the funds to fixed income assets that generate stable returns. Thus, it acts as a hedge and saves your portfolio from losing heavily while it waits for the downturn to pass.

Diversification:

By being a part of both equity as well as debt markets, the BAF gives you exposure to dif-ferent asset classes. Diversification is one strategy all successful investors have advocated time and again. Through careful study and monitoring, the Fund Manager can effectively spread your investments such that you can have a balanced mix of stable large caps, growth-oriented mid and small caps, as well as conventional debt instruments that have relatively lower risk. This dynamic asset allocation is done at the fund level, thereby reduc-ing brokerage and other costs. If you reallocate funds individually, it will cost you way more.

Taxation:

Balanced Advantage Funds are generally classified as equity-oriented funds as a large por-tion is invested in equities. Hence, equity taxation applies.

With its balanced risk-return ratio, a Balanced Advantage Fund makes for a strong and sound in-vesting strategy for the long term. Just like a balanced diet is the way to good, strong health, BAF can help strengthen your core portfolio. And a strong core is the secret to a better portfolio.

So don’t let market volatility discourage you; turn it into your ally by investing in a Balanced Ad-vantage Fund right away!

Also read about : Types of Mutual Funds

Also Read:

What is Mutual Fund

What is SIP

Types of Equity Funds

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000