-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Can the returns of the last decade sustain anymore?

Jul 19, 2019

5 mins

5 Rating

India is currently one of the fastest growing economies in the world. Having posted an average growth rate close to 7% over the last decade, India is now poised to be the 5th largest economy in the world.1

The Indian stock market has also earned returns over the last decade, growing by almost 150%* over the last decade.

Typically, advanced and developing economies’ growth rates stagnate around the 2 to 3% mark. In fact, most other developing and emerging economies have seen an average growth of around 4 to 5% against India’s growth rate average of around 7%.2

The question is: Can these high growth rates still continue in the years to come? Can the stock market success of the past decade continue in the years to come?

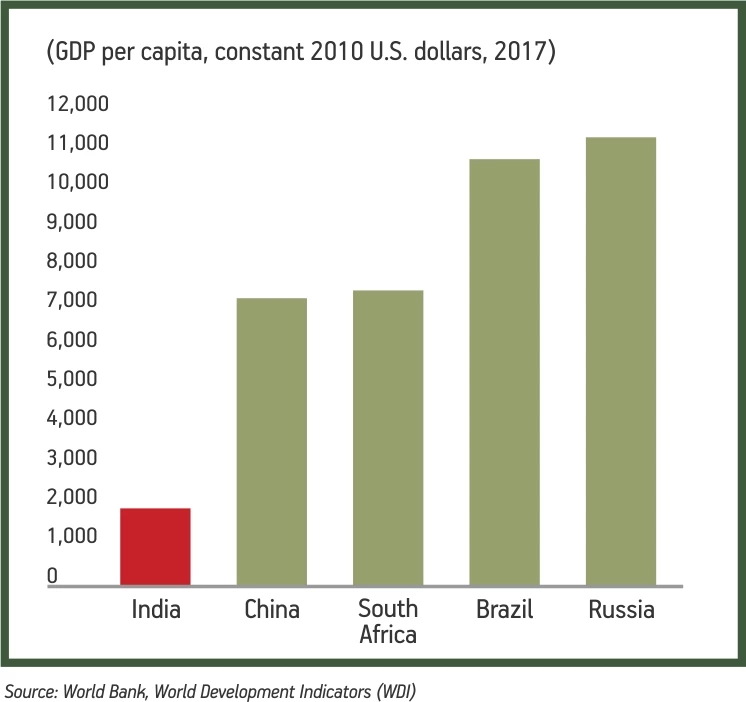

Even though India is one of the fastest growing economies, its per capita income numbers are still significantly lower than those of its peer countries. This, in itself, can indicate the potential that the Indian economy holds for higher growth.

India’s growth story – sectoral focus

The key to India’s growth story is its growing youth population and growing middle class population which accelerates domestic consumption and propels growth in the economy. With almost 65% of its population being younger than 35years3, India has the opportunity to propel its growth further, on the back of its increasing working age population.

There are several booming sectors in India’s economy which can have significant potential for growth. A different roadmap of growth is emerging in India with focus on several emerging sectors. Let’s look at a few:

Digital India

The government’s ‘Digital India’ movement has given a boost to expansion of technology services across the length and breadth of India. The number of rural Internet users is growing by 58% annually.4 The number of Internet users is expected to increase from the current 450 million to 850 million by 20225, with the use of mobiles expected to extend from 65% to 90% of the population.5

The digital payments market is also growing by leaps and bounds with total payments via digital instruments expected to hit $500 billion by 2020.6

This provides an expansive avenue of business and economic growth for technology companies.

Automobile sector

India is expected to emerge as the world’s third-largest passenger-vehicle market by 2021.7

Currently, the automotive sector contributes more than 7 percent to India’s GDP.7 The Automotive Mission Plan 2016–26 set out by the government seeks to increase this contribution to 12 percent.

Increasing urbanisation, expanding consumer class and clear policy intent can set the automobile sector on a positive growth path in the years to come.

How to gain from this as an investor?

The key to how you can gain from stock market is to identify and understand which sectors have positive growth outlook and to have an effective strategy of entry and exit from the stock market.

Balance your portfolio with investments across diverse sectors

Maintain portfolio balance – not heavily concentrated in few stocks at the top

Study the market movements across different sectors – with research into the market to gauge which stocks are peaking, and which have peaked. For eg: Investors who invested in infra sector companies saw significant profit with NIFTY INFRA crossing 6000 points in late 2007 – investors who exited and booked this profit gained as this was followed by a significant crash thereafter falling to around 2500 points within a year’s time. The key is to identify sunrise and sunset sectors in the stock market.

If you do not have adequate time and knowledge to undertake this research, you can choose to invest through mutual funds managed by experienced fund managers.

India continues to remain a fast-emerging economy its GDP expected to touch USD 5 trillion by 20251- this paints a positive future picture for investors in the Indian stock market.

Sources:

- International Monetary Fund (IMF) and World Bank data

- http://statisticstimes.com/economy/gdp-growth-of-india.php & World Bank data

- United Nations Development Programme

- PwC report

- Report by IBM and Kalaari Capital

- Report by Google and Boston Consulting Group

- Mckinsey Report, July 2018

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000