-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Covid 19 - A Watershed event for World Economy & Economics

Aug 28, 2020

6 mins

5 Rating

Bhupesh Bameta

Bhupesh Bameta

By Mr Bhupesh Bameta

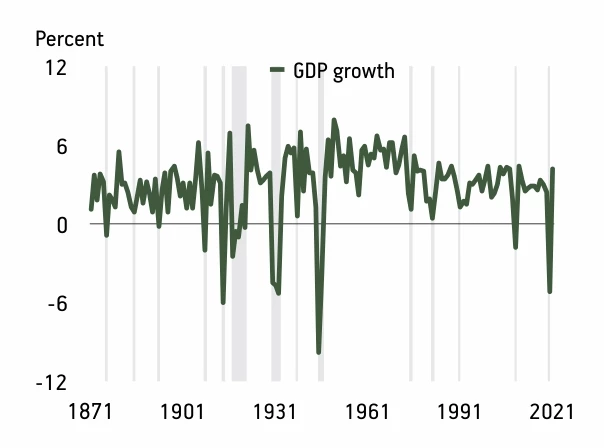

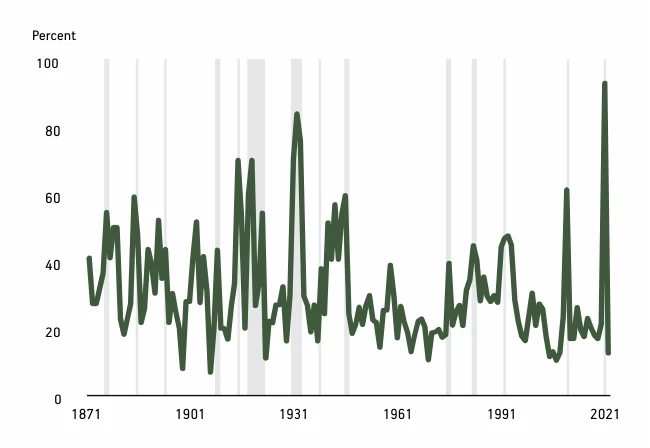

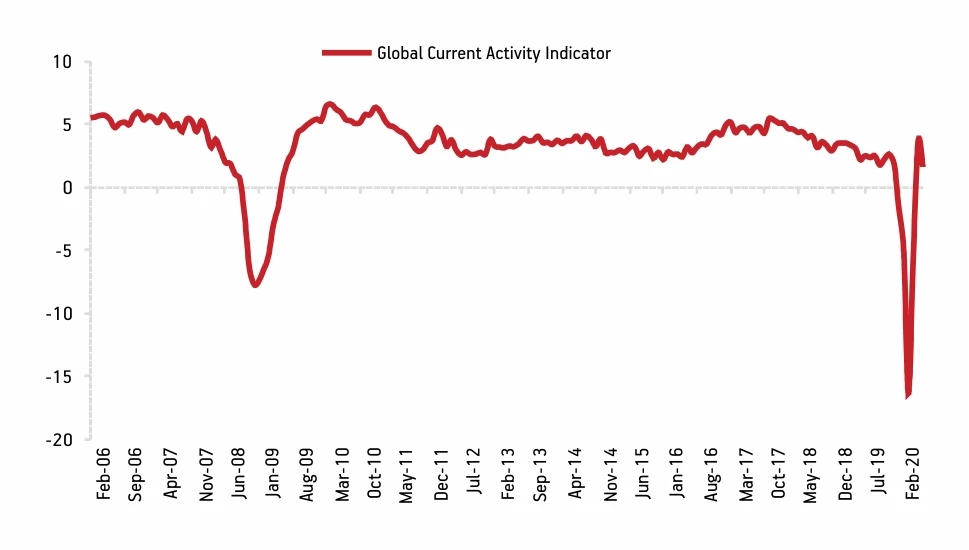

Covid-19 and what IMF calls the “Great Lockdown” has given acute shock to world economy with lowest growth since World War II and the most widespread recession till date( Fig 1 and 2). However, after sharp decline in economic activity that we witnessed in March-April, global economic momentum gained steam in May-June, with a sharp and broad-based improvement in high frequency growth indicators around the world. Currently, the global recovery is transiting from the sharp jump in monthly indicators in May-June (Fig 3) to a natural moderation in the pace of improvement since July.

Fig.1: 2020 is likely to see the biggest contraction since World War-2.

Fig.2: Percentage of economies in recession: 2020 will have the most widespread recession on record

Fig.3: Global current activity indicator has turned to positive territory after record downtick

Unprecedented policy response in the pandemic

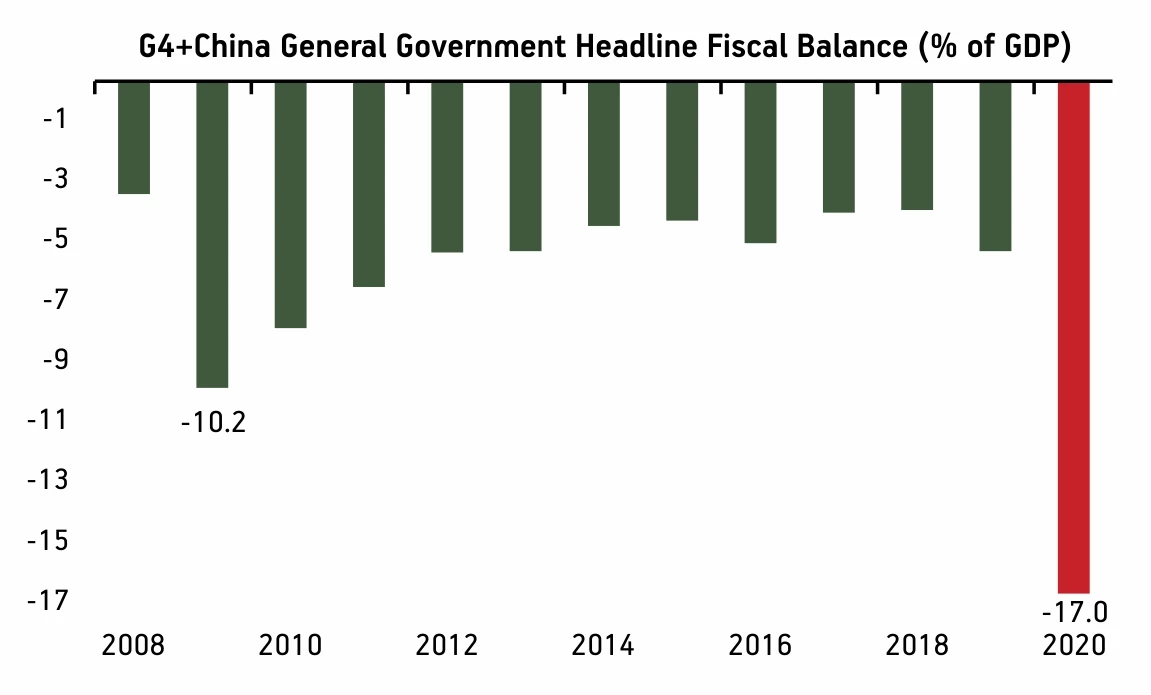

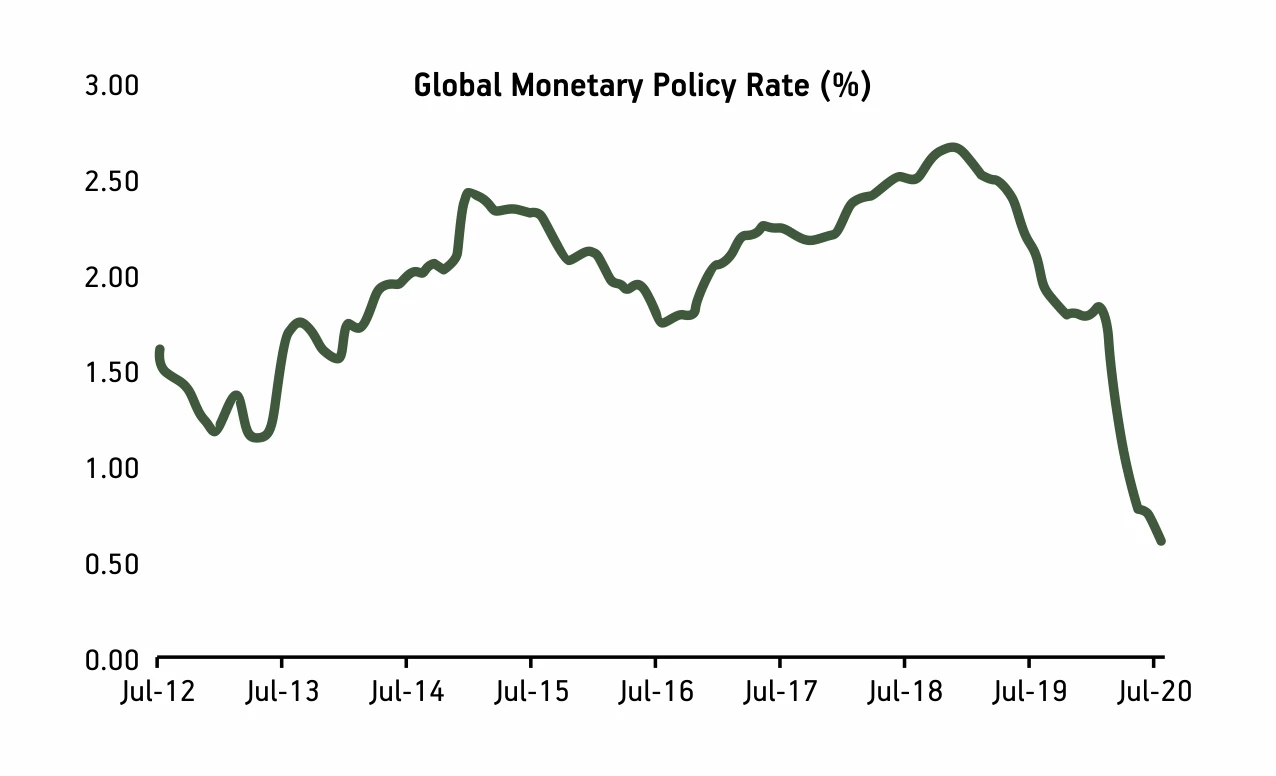

Policy-response to the crisis has been truly unprecedented, in alacrity, quantum and scope, with strong coordination between monetary and fiscal authorities. Global fiscal stimulus announced so far has been much bigger in scale and scope compared to the Global Financial Crisis (GFC) of 2007-2008. Monetary stimulus has also been very aggressive. Global rates are at their lowest levels with aggressive cuts both in DMs and EMs. Global fiscal support announced so far has exceeded US$11 tn and rising, with a combination of above the line spending, grants, loans and guarantees. With monetary policy reaching near conventional limit in many DM economies, the template is shifting towards a benign version of Modern Monetary Theory (MMT), with greater monetary fiscal coordination in response. Aggressive and unlimited QEs (Quantitative Easing) have kept bond yields near record lows despite significantly high fiscal deficits.

Fig.4: Unprecendented fiscal stimulus

Fig.5: Complemented by aggressive monetary easing

Global markets have rallied strongly on the back of this strong policy response as well as opening up of the economies. Notably, market senses that even when the pandemic is past us, much of the stimulus is expected to stay till the economic recovery gains sufficient strength, underpinning widespread market optimism.

What makes Covid-19 a watershed event for economics

Besides impact on world economy, Covid-19 crisis would also be remembered as a watershed event in global economics and policy-making. The policy makers have used significantly expanded list of policy-tools and some may call the response close to what heterodox economic schools like Modern Monetary Theory has been espousing.

Economics have already been in a state of churn since the GFC and the (then considered) unorthodox policy response, which it entailed. A rethink on the cost-benefits of pursuing ultra-expansionary policies had already been underway. It is instructive to note that even before the Covid-19 crisis, economic research and particularly monetary policy in DMs was grappling with the absence of inflation and unusually flat Philips curve despite unprecedented easy monetary policy along with massive rise in Central Bank balance sheet, prolonged economic expansion cycle and apparently tight labour markets. Fed has already conducted a broad review of the strategy, tools, and communication practices it uses to pursue the monetary policy goals and is switching to average inflation targeting.

A key reason for the unparalleled alacrity of the post-Covid response has been the evolving economic thought and learnings in the wake of experiences of post-GFC stimulus and the last economic cycle. The policy response to the Covid-19 shock was putting to practice the post-GFC learning.

Monetary policy response was along the lines of what we saw post GFC, only much bigger, quicker and wider in scope. Global policy rates are at the lowest level and rapid growth in CB balance sheets clearly dwarfed GFC response. However, the key difference from GFC has been the massive fiscal response across the world, particularly in DMs in coordination with Central Banks working as enablers of the fiscal response. The response has taken form of significant rise in unemployment allowances, employment backstops to prevent firing of workers and unprecedented sovereign credit and liquidity guarantees. The result is that unlike in post-GFC policy response, this time we are also witnessing sharp rise in broad money supply, and in countries like US, monthly income has actually increased for a large number of people.

The combined monetary-fiscal policy response has succeeded in containing the most negative fallout of the pandemic, thereby putting a floor to economic fallout of the pandemic. Moreover, given that the pandemic was no one’s fault, the policy response had also enjoyed widespread support amongst policy-makers and general public, resulting in broad-based political support, which explains the unprecedented nature of the response.

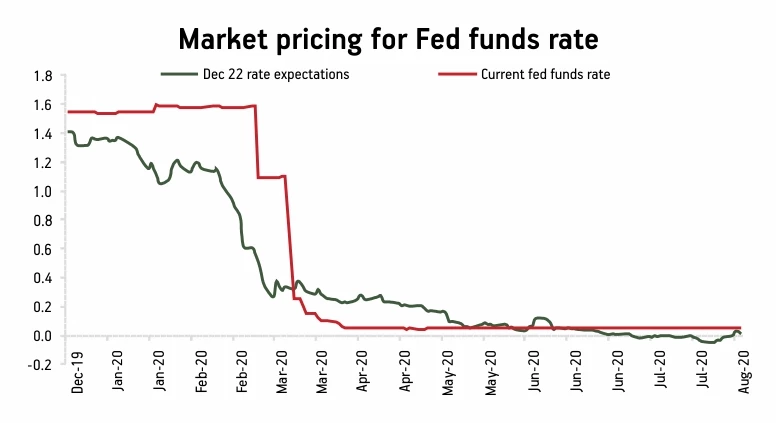

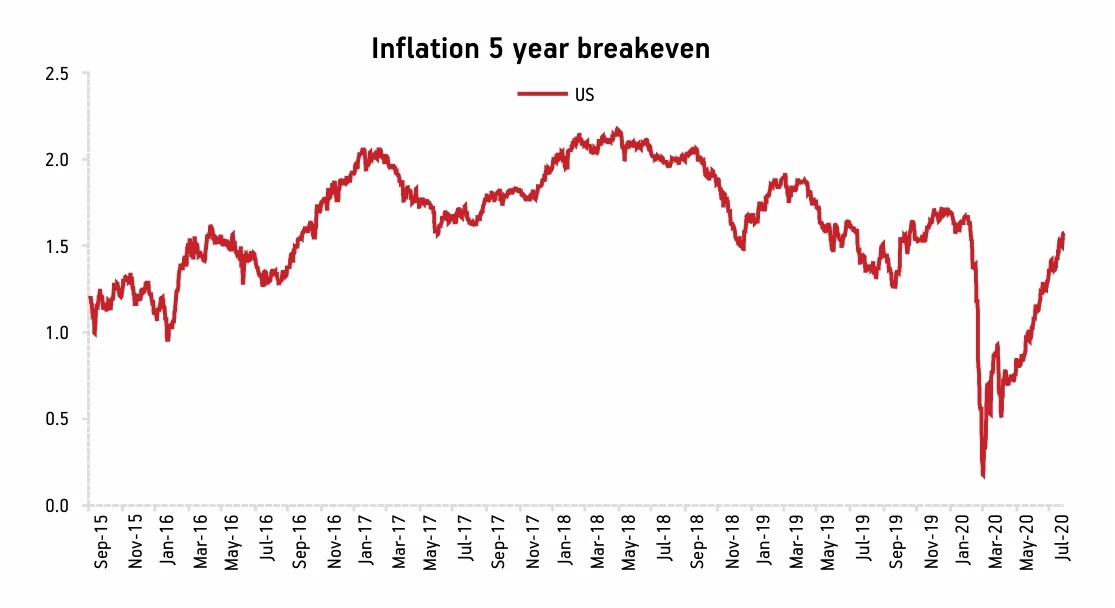

We believe that much of the coordinated policy support (both monetary and fiscal) will stay till recovery is well underway or whites of inflation’s eyes are clearly visible. Market expectation of zero Fed Funds rate till December 2022 amidst rising inflation expectations attests to the same (Fig 6 and Fig 7).

It shall bring to focus questions on what is the limit and cost-benefit of this kind of co-ordinated monetary-fiscal policy support? Is the policy space much larger than what was previously thought? How structural is the disinflation trend many DMs are fighting against and will this combination of fiscal-monetary finally tango end in inflation shock? What is the debt limit of a currency issuing sovereign? Will it create harmful financial bubbles?

While many of the dire projections that were made in the wake of post-GFC policy response has turned out (at least till now) to be largely unfounded, the long term implications of the post-Covid response, which pushes the policy envelope much further, would be keenly seen. The course of world economic growth, markets and inflation in the coming period will guide answers to the above questions and provide invaluable lessons and answer to economists and policy makers. It would act as a template for future crisis, and can potentially chart a new course for economics and policy-making for years to come.

Fig. 6: Markets continue to price zero rates till Dec 2022…

Fig.7: …amidst rising inflation expectations

Sources: Morgan Stanley (Fig 4 and Fig 5), IMF, World Bank, Bloomberg, CEIC

The author of the blog is the Fund Manager, Fixed Income Team, Aditya Birla Sun Life AMC Ltd

The views and opinions expressed are those of Bhupesh Bameta, Fund Manager and do not necessarily reflect the views of Aditya Birla Sun Life AMC Ltd (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”). ABSLAMC/ the Fund is not guaranteeing/offering/communicating any indicative yield on investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000