-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Drawing up your short-term and long-term goals!

May 26, 2022

4 min

4 Rating

Investment planning is a very intricate task, you will have to conduct financial planning for short term and long-term goals. Short term goals are those which have a timeline of 6 months to 3 years. Long term goals are goals that have a timeline ranging between 3 – years and beyond.

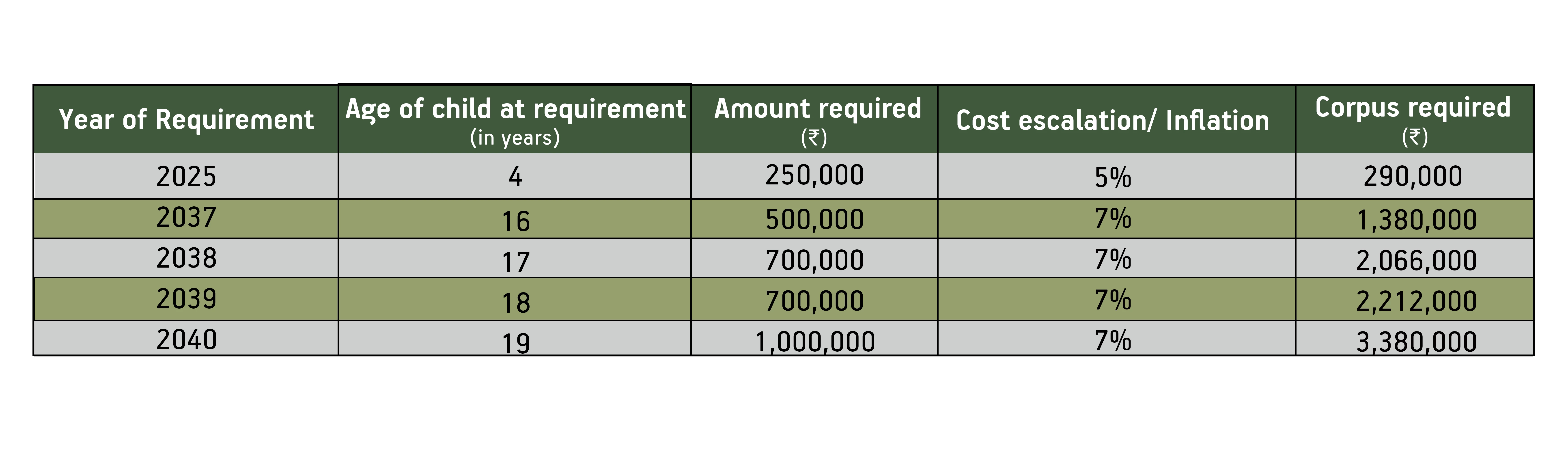

Often, many of the long-term plans could have intermediate short-term plans, for example, if you plan to build a corpus for your children's education. If your child is 1 year old, then you may need to plan for an intermediate corpus around 4 years (school admission), 16 years - 18 years (under-graduation) and 20 years (post–graduation).

Calculate the amount required for using Children’s Education Planner

Here is how it would look:

Past performance may or may not be sustained in future. Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing /offering /communicating any indicative yield /returns on investments. This calculation is based on assumed rate of returns, and it is meant for illustration purposes only. The calculations are not based on any judgments of the future return of the debt and equity markets / sectors or of any individual security and should not be construed as promise on minimum returns and/or safeguard of capital. This calculation alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy.

By breaking down the long term goals into smaller milestones, you have better visibility and the monitoring of the goals and their achievements will be easier. It is easier to zero in on the investment avenues based on the tenure available for the corpus.

Short-term and long-term goals – Key features

Irrespective of whether your goals are short term or long term, these are important aspects to keep note of:

Precise:

The goals have to be precise and not vague, they should be aligned to your life goals and should be in line with the stage of life you are at.Assessable:

The goals should be measurable and should be enumerated appropriately. This should be the blueprint against which you will monitor your achievement. The goals, however, should be assessed periodically, to ensure that they continue to make senseRealisable:

Both short term and long-term goals should be achievable if you were to chalk out a plan where within a short term (3 years) you intend to build a corpus of Rs. 10 lakh. It is not realisable over a short timeframe. Goals being practical is of prime importance to ensure that they are achievable.Relevant:

The goals should be aligned to your life stage, it should reflect the quality of life that you intend to achieve over the long haul. The goals should be related to your financial planning requirement. For example, retirement planning often does not become a part of your investment planning. Many individuals realise this fatal mistake much later in life.

Plan your retirement using Retirement CalculatorTime-based:

Every need has to be enumerated with a relevant timeline. The timeline should be associated with the need under consideration. This is particularly important as it would determine the rate of inflation or cost escalation that we would be looking at.

Importance of inflation or cost escalation:

To arrive at the corpus required at the time of the need, one must consider inflation rate or cost escalation as applicable. Some of the points to note whilst you consider the rates are:

For short term goals, the prevalent inflation rate may be considered

For long term goals, you should consider the projected inflation rate

The cost escalation rate should align with the average rate at which the expense has grown over the years.

Read more about How low duration funds helps to achieve short term goals

For example, medical expenses escalated at around 7.5% per annum* (taking an average of cost escalation at pre-pandemic and post-pandemic levels) over the last few years. Hence, it may be impractical to assume a rate of inflation that is much lower than this rate. Similarly, the cost of education grows at a faster pace as compared to education.

Financial planning should be a well-calibrated approach, the choice of investment avenues and risk appetite would depend on whether they are short term goals or long term in nature. Hope this brief note helps you get started on your journey towards efficient investment planning.

*Source

Livemint - 7.76% as of April 2021 - post pandemic;

Milliman White Paper - 7.14% as of March 2019 - pre-pandemic

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000