-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

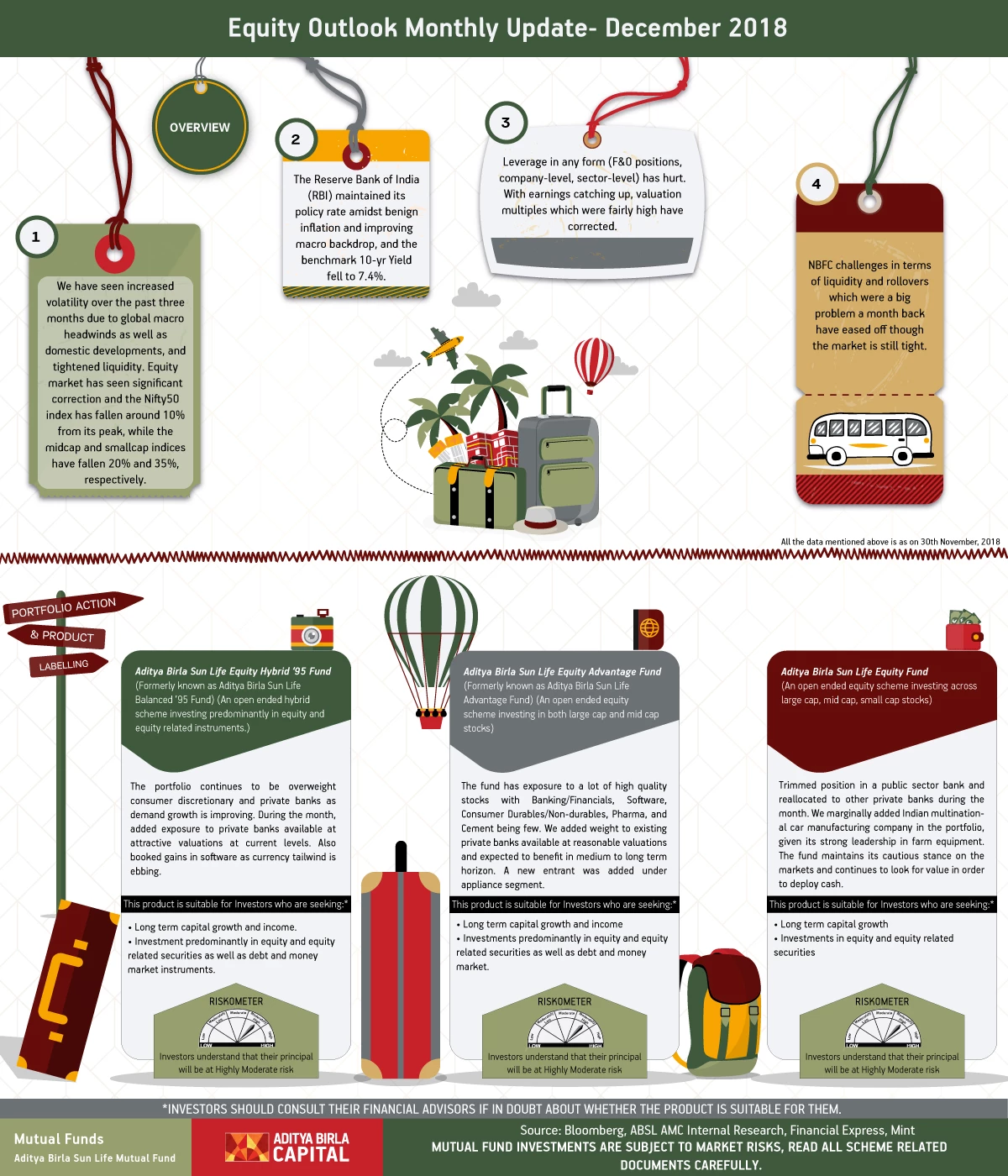

Equity Outlook Monthly Update - December 2018

Dec 28, 2018

5

4 Rating

We have seen increased volatility over the past three months due to global macro headwinds as well as domestic developments, and tightened liquidity.

The Reserve Bank of India (RBI) maintained its policy rate amidst benign inflation and improving macro backdrop, and the benchmark 10-yr Yield fell to 7.4%.

Equity market has seen significant correction and the Nifty50 index has fallen around 10% from its peak, while the midcap and smallcap indices have fallen 20% and 35%, respectively.

Leverage in any form (F&O positions, company-level, sector-level) has hurt. With earnings catching up, valuation multiples which were fairly high have corrected.

NBFC challenges in terms of liquidity and rollovers which were a big problem a month back have eased off though the market is still tight.

Source: ABSLAMC Research, Bloomberg, Financial Express, Mint

Portfolio Action

Aditya Birla Sun Life Equity Hybrid ‘95 Fund (formerly known as Aditya Birla Sun Life Balanced ’95 Fund) (An open ended hybrid scheme investing predominantly in equity and equity related instruments.):

The portfolio continues to be overweight consumer discretionary and private banks as demand growth is improving. During the month, added exposure to private banks available at attractive valuations at current levels. Also booked gains in software as currency tailwind is ebbing.

Aditya Birla Sun Life Equity Advantage Fund (formerly known as Aditya Birla Sun Life Advantage Fund) (An open ended equity scheme investing in both large cap and mid cap stocks):

The fund has exposure to a lot of high quality stocks with Banking/Financials, Software, Consumer Durables/Non-durables, Pharma, and Cement being few. We added weight to existing private banks available at reasonable valuations and expected to benefit in medium to long term horizon. A new entrant was added under appliance segment

Aditya Birla Sun Life Equity Fund (An open ended equity scheme investing across large cap, mid cap, small cap stocks):

Trimmed position in a public sector bank and reallocated to other private banks during the month. We marginally added Indian multinational car manufacturing company in the portfolio, given its strong leadership in farm equipment. The fund maintains its cautious stance on the markets and continues to look for value in order to deploy cash.

All the Data mentioned above is as on 30th November, 2018

The scheme(s) may or may not have any present or future positions in these sectors.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000