-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

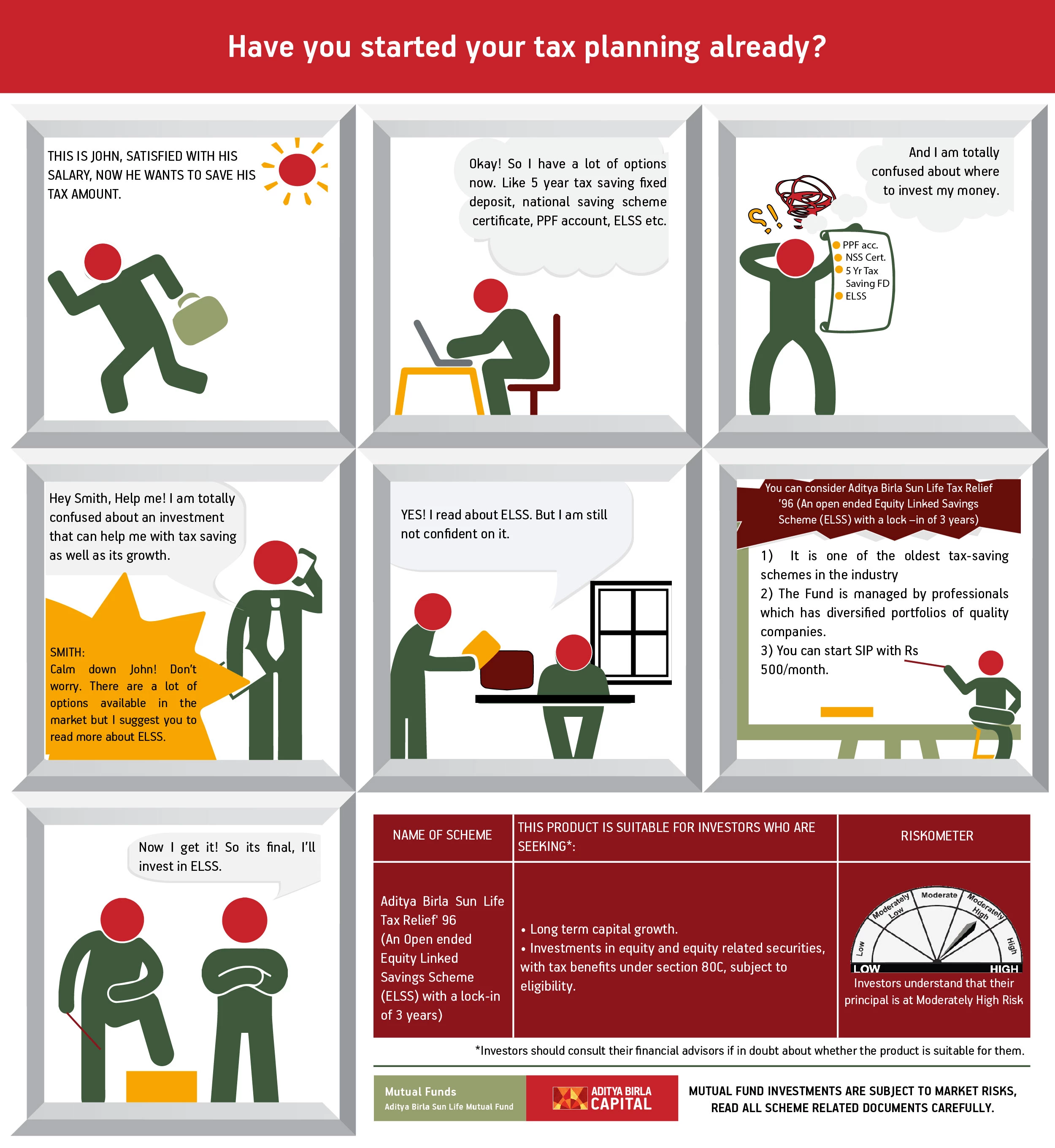

Have you started your tax planning already

Feb 28, 2018

5 mins

5 Rating

This is John, satisfied with his salary, he wants to save his tax amount now.

John: Okay! So I have a lot of options now. Like 5 year tax saving fixed deposit, national saving scheme certificate, PPF account, Equity Linked Saving Scheme (ELSS) etc. And I am totally confused about where to invest my money.

John: Hey Smith, Help me! I am totally confused about an investment that can help me with tax saving as well as its growth.

Smith: Calm Down John! Don’t worry. There are a lot of options available in the market but I suggest you to read more about ELSS.

John: YES! I read about ELSS. But I am not confident on it

Smith: You may consider Aditya Birla Sun life Tax Relief fund ’96 (An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit):

- It is one of the oldest tax-saving schemes in the industry with a consistent track record of generating superior risk-adjusted returns.

- The Fund is managed by professionals which has diversified portfolios of quality companies.

- You can start by investing in SIP with as little as Rs 500 per month.

John: Now I get it! So its final, I’ll invest in ELSS.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000